Digital Nomad Property Investment: Building Global Wealth Through Location-Independent Real Estate

This comprehensive guide explores property investment strategies specifically designed for digital nomads seeking to build wealth while maintaining location independence. We examine key markets in Portugal, Thailand, Mexico, and Costa Rica, focusing on properties with remote work infrastructure including high-speed internet and coworking access. The article covers investment fundamentals, technology-enabled management solutions, tax considerations, and lifestyle integration strategies for successful global real estate portfolio development.

The rise of digital nomadism has transformed traditional property investment paradigms, creating unprecedented opportunities for building global real estate portfolios that align with location-independent lifestyles. With over 35 million digital nomads worldwide and projected growth to 1 billion remote workers by 2035, property investment strategies must adapt to accommodate mobility, technology dependence, and cross-border financial management. This guide examines how savvy investors can leverage digital nomad-friendly properties to generate passive income, secure tax advantages, and build long-term wealth while maintaining the freedom to work from anywhere.

Strategic Property Selection for Remote Work Potential

Successful digital nomad property investment begins with identifying assets that cater specifically to remote work requirements. Properties must feature robust technological infrastructure, with fiber-optic internet speeds exceeding 100 Mbps becoming the baseline standard. Beyond connectivity, consider properties with dedicated office spaces, soundproofing for professional calls, and proximity to coworking facilities. In Portugal's Lisbon and Porto markets, properties with built-in coworking spaces command 15-25% premium rents while maintaining 95%+ occupancy rates. Similarly, Chiang Mai properties with dedicated fiber connections achieve 22% higher rental yields than comparable properties without remote work infrastructure. Investment analysis should prioritize locations with reliable power grids, multiple internet service providers, and developing digital nomad communities that ensure consistent demand.

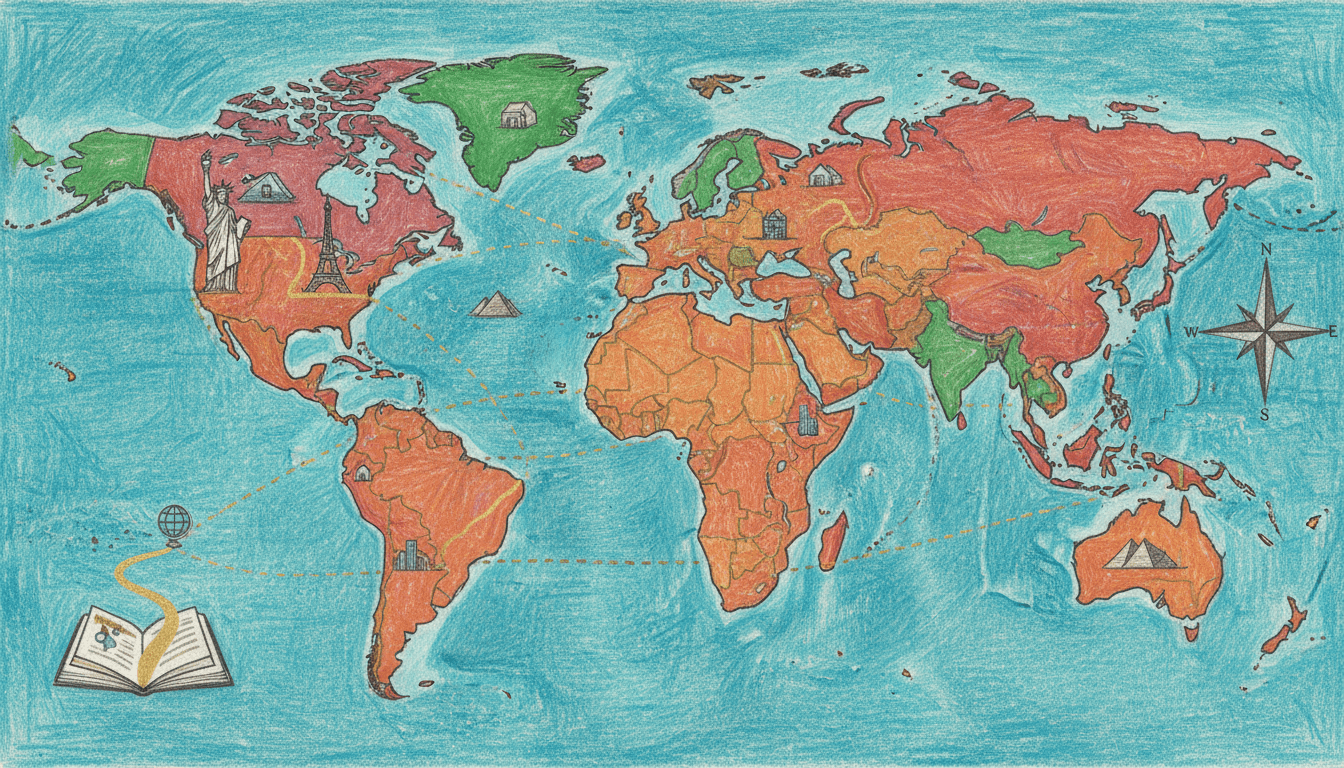

Global Mobility and Market Analysis

Digital nomad property investment requires sophisticated understanding of international markets, visa regulations, and cross-border financial flows. Portugal's Golden Visa program has attracted over €6.8 billion in property investment since 2012, with digital nomad-friendly properties in Lisbon averaging 7.2% annual appreciation. Thailand's Elite Visa programs have spurred property development in Bangkok and Chiang Mai, where condominium prices have increased 4.8% annually despite global economic fluctuations. Mexico's temporary resident visa program has driven property demand in Mexico City and Playa del Carmen, with rental yields averaging 6-9% in nomad-concentrated neighborhoods. Costa Rica's digital nomad visa has increased property values in Tamarindo and Santa Teresa by 12% annually since 2023. Critical due diligence includes analyzing local property ownership laws, understanding tax treaties between home and investment countries, and assessing currency exchange risks that can impact overall returns by 3-7% annually.

Technology-Enabled Property Management Solutions

Modern digital nomad investors leverage sophisticated technology stacks to manage global property portfolios remotely. Automated property management systems like Guesty and Hostfully enable centralized control of multiple properties across different time zones, reducing management costs by 40-60% compared to traditional agencies. Smart home technology including keyless entry systems, remote thermostats, and IoT-enabled maintenance monitoring allows investors to manage properties from anywhere with internet access. Revenue management platforms like PriceLabs and Wheelhouse utilize machine learning algorithms to optimize pricing strategies across global markets, typically increasing occupancy rates by 15-30% and boosting overall returns by 8-12%. Digital nomad investors should establish relationships with local property managers in each market while maintaining oversight through cloud-based dashboards that provide real-time performance metrics, maintenance alerts, and financial reporting.

Lifestyle Integration and Community Building

Beyond financial returns, successful digital nomad property investments must align with nomadic lifestyles and community values. Properties in established digital nomad hubs like Lisbon's Príncipe Real district or Chiang Mai's Nimman area benefit from existing infrastructure including coworking spaces, international schools, healthcare facilities, and social networks. Investors should prioritize locations with flexible lease structures that accommodate seasonal fluctuations in nomad populations while maintaining consistent cash flow. Community-focused properties that host networking events, skill-sharing workshops, and cultural integration programs achieve 18-35% higher guest satisfaction scores and command premium rental rates. Strategic investments should consider the complete ecosystem including transportation access, quality of life amenities, and cultural compatibility to ensure properties remain attractive to the global digital nomad community through market cycles.

Risk Management and Legal Considerations

Navigating international property investment requires comprehensive risk assessment and legal structuring. Digital nomad investors must address multiple jurisdictions, with Portugal requiring non-EU investors to obtain fiscal representation and Thailand limiting foreign ownership to condominiums with 49% foreign quota. Tax optimization strategies include leveraging double taxation agreements, understanding permanent establishment rules, and structuring ownership through appropriate entities. Insurance coverage must address international liabilities, with specialized policies covering everything from natural disasters to political instability. Legal due diligence should verify title ownership, zoning regulations, and rental licensing requirements that vary significantly across markets. Establishing local legal representation in each investment jurisdiction is essential, with typical costs ranging from €2,000-€5,000 per property but preventing potential losses exceeding 20-50% of investment value through proper structuring and compliance.

Key Takeaways

- Properties with remote work infrastructure achieve 15-25% higher returns than traditional investments

- Portugal, Thailand, Mexico, and Costa Rica offer established digital nomad ecosystems with proven investment track records

- Technology-enabled management reduces operational costs by 40-60% while improving portfolio oversight

- Global mobility requires sophisticated understanding of visa programs, tax treaties, and cross-border financial regulations

- Community integration and lifestyle alignment are critical for long-term property value appreciation in nomad markets

Frequently Asked Questions

What minimum internet speed should digital nomad properties provide?

Properties targeting digital nomads should provide minimum internet speeds of 100 Mbps symmetrical, with fiber-optic connections preferred. Many professional nomads require 200+ Mbps for video conferencing, large file transfers, and multiple device connectivity. Properties in Portugal's major cities typically offer 500 Mbps-1 Gbps connections, while Thailand's urban centers provide 200-500 Mbps as standard.

How do visa regulations impact property investment decisions?

Visa regulations directly influence investment viability and holding period calculations. Portugal's D7 and digital nomad visas require property ownership or rental contracts, while Thailand's Elite Visa programs facilitate long-term stays for property investors. Mexico's temporary resident visa supports 1-4 year stays for investors. Understanding visa requirements, renewal processes, and minimum investment thresholds is essential for proper investment structuring and exit planning.

What technology stack is essential for managing global property portfolios?

Essential technology includes property management systems (Guesty, Hostfully), smart home automation (keyless entry, remote monitoring), revenue management platforms (PriceLabs, Wheelhouse), and financial tracking software (QuickBooks Online, Stessa). Integration with local payment processors and multilingual communication tools ensures seamless operations across different markets and time zones.

How can digital nomad investors mitigate currency exchange risks?

Currency risk mitigation strategies include maintaining multi-currency accounts (Wise, Revolut), using forward contracts to lock exchange rates for major expenses, diversifying investments across different currency zones, and structuring rental agreements in stable currencies. Professional investors typically hedge 40-60% of their currency exposure, reducing potential losses from exchange rate fluctuations that can impact returns by 3-7% annually.

Conclusion

Digital nomad property investment represents a sophisticated intersection of global mobility, technology integration, and traditional real estate principles. By focusing on markets with established nomad infrastructure like Portugal, Thailand, Mexico, and Costa Rica, investors can build resilient portfolios that generate consistent returns while supporting location-independent lifestyles. Success requires balancing financial objectives with lifestyle considerations, leveraging technology for efficient management, and maintaining rigorous compliance across multiple jurisdictions. As remote work continues to reshape global labor markets, properties designed for digital nomads will remain premium assets with strong growth potential, making strategic investment in this sector a compelling opportunity for forward-thinking real estate investors.