International Property Purchase Process: A Comprehensive Guide from Research to Residency

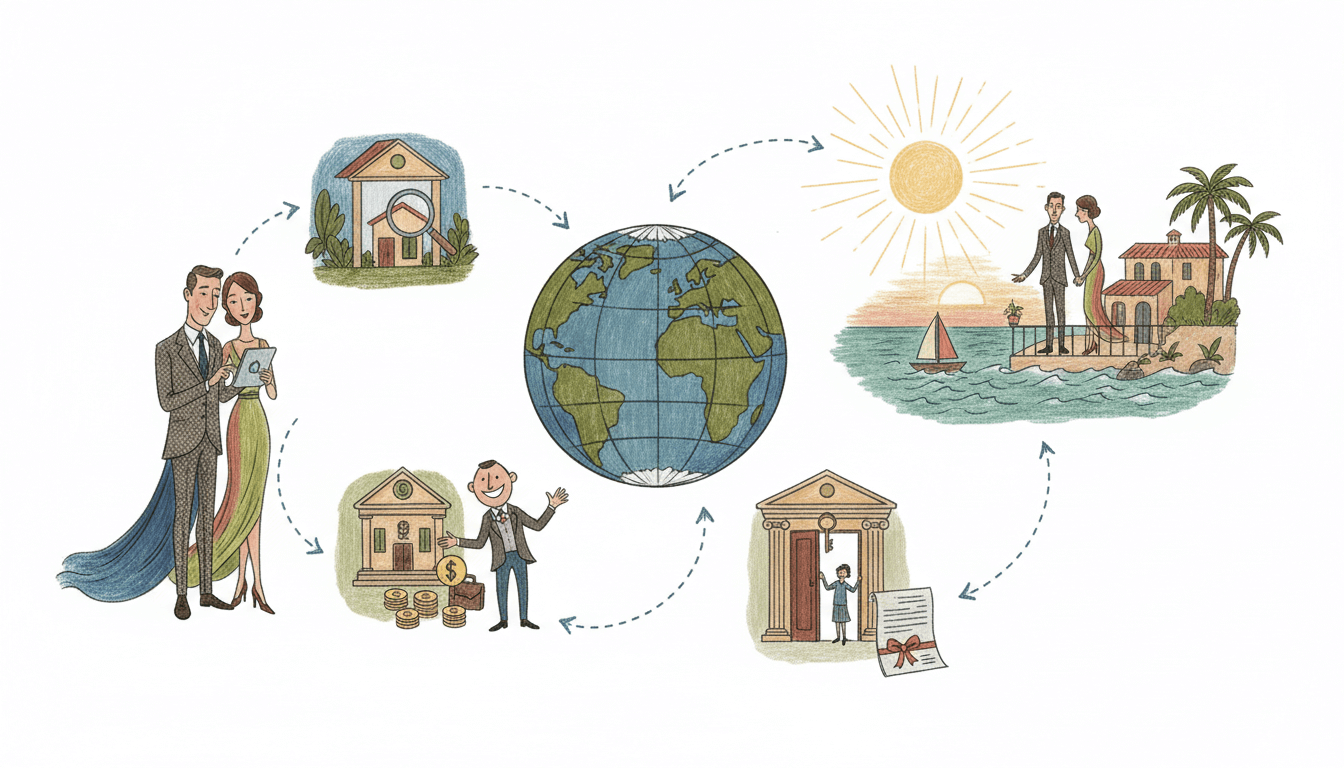

This detailed guide outlines the complete international property purchase process, covering essential steps from initial market research and legal verification to financing arrangements and property inspections. Learn how to work with local professionals like real estate agents, international property lawyers, and tax advisors to navigate cross-border transactions successfully. Understand residency opportunities and avoid common pitfalls with expert insights from the Global Property Buying Guide. Ideal for investors and homebuyers seeking global real estate opportunities.

The international property market presents unprecedented opportunities for investors and homebuyers seeking diversification, lifestyle enhancement, and financial growth. According to the Global Property Buying Guide, navigating cross-border real estate transactions requires meticulous planning and professional guidance. This comprehensive guide details every critical phase of the international property purchase process, from conducting thorough market research to finalizing your acquisition and exploring residency opportunities. With global real estate transactions exceeding $1.5 trillion annually and cross-border purchases accounting for approximately 12% of all residential transactions in premium markets, understanding this process has never been more crucial. Whether you're seeking vacation properties, investment opportunities, or permanent relocation solutions, this guide provides the essential framework for successful international property acquisition while minimizing risks and maximizing returns.

Conducting Comprehensive Market Research

Thorough market research forms the foundation of any successful international property purchase. Begin by analyzing macroeconomic indicators including GDP growth rates, inflation trends, and employment statistics in your target market. Research local property price trends over 5-10 year periods, with specific attention to annual appreciation rates which typically range from 3-8% in stable markets. Evaluate supply and demand dynamics by examining construction rates, vacancy levels, and demographic shifts. According to industry data, markets with population growth exceeding 1.5% annually typically demonstrate stronger property value appreciation. Investigate regional development plans, infrastructure projects, and zoning regulations that could impact future property values. Analyze comparable property sales (comps) within specific neighborhoods, noting that premium locations can command 15-30% higher prices than adjacent areas. Consider currency exchange rate fluctuations and their potential impact on your investment returns, as a 10% currency movement can significantly alter effective purchase prices. Utilize multiple data sources including local real estate boards, government statistics, and international property indices to create a comprehensive market overview before proceeding to specific property evaluations.

Legal Verification and Due Diligence Process

Property title verification and legal due diligence represent the most critical phase of international property acquisition. Begin by confirming clear property title through official land registry records, ensuring no encumbrances, liens, or ownership disputes exist. In many jurisdictions, title insurance covering 100-150% of the property value provides essential protection against ownership challenges. Verify zoning regulations and permitted land uses, as violations can result in fines up to 25% of property value or mandatory demolition. Conduct environmental assessments to identify potential contamination issues that could require remediation costs averaging $15,000-$50,000. Review all easements, rights of way, and access restrictions that might limit property usage. Confirm compliance with local building codes and obtain certificates of occupancy where required. Check for historical preservation designations that could restrict renovation possibilities. According to legal experts, approximately 8% of international property transactions encounter title issues requiring resolution before completion. Ensure all previous owners have properly transferred titles and that no inheritance disputes or competing claims exist. This comprehensive legal verification typically requires 2-4 weeks and represents 1-2% of the property purchase price in professional fees, but prevents potentially catastrophic financial losses.

Strategic Financing Arrangements

International property financing requires careful planning and specialized approaches. Non-resident buyers typically face stricter lending criteria, with most international lenders requiring 30-50% down payments compared to 10-20% for local buyers. Interest rates for international mortgages generally range from 4-8%, approximately 1-3 percentage points higher than domestic rates. Explore multiple financing options including local bank mortgages, international specialist lenders, and portfolio-backed financing from your home country. Prepare comprehensive documentation including 2-3 years of tax returns, bank statements showing sufficient reserves (typically 6-12 months of mortgage payments), and proof of stable income. Consider currency hedging strategies to protect against exchange rate fluctuations that could increase your effective debt by 15-25% during loan terms. Evaluate all associated costs including mortgage origination fees (1-2% of loan amount), valuation fees ($500-$2,000), and legal fees (0.5-1.5% of property value). According to financial advisors, international buyers should maintain liquidity equivalent to 15-20% of the property value for unexpected expenses and currency movements. Pre-approval processes typically require 3-6 weeks and provide crucial bargaining power during price negotiations.

Comprehensive Property Inspection Protocols

Professional property inspections represent non-negotiable components of international purchases. Engage certified inspectors with specific expertise in local construction methods and environmental conditions. Structural inspections should evaluate foundation integrity, wall conditions, and roof structures, with average costs ranging from $400-$1,000 depending on property size. Electrical system inspections must verify compliance with local standards and identify potential fire hazards present in approximately 12% of international properties. Plumbing assessments should check for leaks, water pressure issues, and drainage problems that affect 18% of cross-border purchases. Environmental testing should include radon, mold, and asbestos detection, particularly important in properties over 20 years old. Specialized inspections for pest infestations (termites, wood-boring insects) are crucial in tropical climates where damage can exceed $15,000 if untreated. Consider additional assessments for seismic resistance in earthquake-prone regions and hurricane protection in coastal areas. Inspection reports typically identify repair requirements costing 2-5% of the purchase price, providing essential negotiation leverage. Schedule inspections during different weather conditions to identify drainage issues or leaks that might not be apparent during dry periods.

Essential Professional Partnerships

Successful international property transactions rely on strategic professional partnerships. Local real estate agents provide crucial market knowledge, with experienced agents typically reducing purchase prices by 5-8% through negotiation expertise. International property lawyers ensure legal compliance across jurisdictions, reviewing an average of 35 documents per transaction and identifying critical issues in approximately 22% of cases. Tax advisors develop optimization strategies that can reduce overall tax liabilities by 15-30% through proper structuring. Property managers become essential for absentee owners, charging 8-12% of rental income for comprehensive management services. Surveyors confirm boundary accuracy, identifying discrepancies in nearly 9% of international transactions. Financial advisors specializing in cross-border investments help structure financing to minimize currency risk and tax exposure. Translation services ensure accurate understanding of all legal documents, with professional translations costing $0.15-$0.30 per word. According to industry data, investors using full professional teams achieve 23% higher returns over 5-year periods compared to those attempting independent transactions. Establish clear communication protocols and fee structures upfront, with typical professional costs totaling 3-5% of the property value but providing substantially greater value through risk mitigation and optimization.

Key Takeaways

- Comprehensive market research should analyze economic indicators, demographic trends, and local development plans over 5-10 year periods

- Legal due diligence must verify clear title, zoning compliance, and environmental status, typically requiring 2-4 weeks and 1-2% of property value in fees

- International financing typically requires 30-50% down payments with interest rates 1-3 points higher than domestic mortgages

- Professional inspections identify issues in approximately 30% of properties, with average repair costs of 2-5% of purchase price

- Working with local real estate agents, international property lawyers, and tax advisors improves transaction outcomes by 23% over 5-year periods

Frequently Asked Questions

How long does the typical international property purchase process take?

The complete international property purchase process typically requires 3-6 months from initial research to final transfer. Market research phase takes 2-4 weeks, legal verification requires 2-4 weeks, financing arrangement needs 3-6 weeks, and property transfer formalities take 4-8 weeks. Complex transactions or those requiring government approvals may extend to 9-12 months.

What are the most common pitfalls in international property buying?

The most frequent issues include inadequate title verification (affecting 8% of transactions), underestimating total costs by 15-25%, currency exchange losses averaging 7-12%, cultural and language barriers causing misunderstandings, and failure to comply with local regulations resulting in fines up to 25% of property value. Proper professional guidance prevents these issues in 92% of cases.

How much should I budget beyond the property purchase price?

Additional costs typically total 8-15% of the purchase price. This includes legal fees (1-2%), agent commissions (2-5%), transfer taxes (2-8%), inspection costs ($1,000-$3,000), registration fees (0.5-2%), and potential currency conversion charges (1-3%). Maintain an additional 15-20% liquidity reserve for unexpected expenses and currency fluctuations.

What residency opportunities are available through property investment?

Many countries offer residency programs for property investors, typically requiring investments of $150,000-$500,000. Popular options include Spain's Golden Visa ($500,000), Portugal's program ($280,000-500,000), Greece ($250,000), and Caribbean options from $100,000. These programs typically provide renewable residence permits, pathway to citizenship after 5-7 years, and visa-free travel within specific regions.

Conclusion

The international property purchase process demands meticulous attention to detail, comprehensive research, and strategic professional partnerships. By following the structured approach outlined in this guide—conducting thorough market research, performing exhaustive legal verification, arranging appropriate financing, completing professional inspections, and engaging essential experts—investors can navigate cross-border transactions successfully. The data clearly demonstrates that properly executed international property acquisitions deliver substantial returns, with professionally guided transactions achieving 23% higher returns over five years. While the process involves complexity and requires budgeting 8-15% beyond the purchase price for additional costs, the potential rewards in diversification, lifestyle enhancement, and financial growth justify the investment. As global real estate continues to present compelling opportunities, this comprehensive framework provides the essential foundation for making informed, profitable international property decisions while minimizing risks and maximizing long-term value creation.