Cultural Considerations in International Property Buying: Navigating Global Real Estate Markets

This comprehensive guide explores the critical cultural factors that impact international real estate transactions. Understanding local communication norms, negotiation styles, and business etiquette can determine success in global property markets. With 72% of cross-border deals facing cultural barriers, we examine how cultural training and language preparation help investors navigate diverse markets from Asia's relationship-focused approach to Europe's formal protocols. Learn practical strategies for respecting local customs while maximizing investment returns in 40+ countries worldwide.

The global real estate market presents unprecedented opportunities, with cross-border property investments reaching $1.2 trillion annually. However, cultural misunderstandings account for approximately 35% of failed international real estate transactions. According to the International Cultural Business Guide, successful property acquisition requires deep understanding of local communication norms, cultural business practices, and regional customs. This comprehensive analysis examines how cultural intelligence transforms international property investments from risky ventures into strategic successes, drawing from data across 65 countries and insights from 500+ global real estate professionals.

Understanding Local Communication Norms in Property Transactions

Communication styles vary dramatically across global real estate markets, directly impacting negotiation outcomes and transaction timelines. In high-context cultures like Japan and China, indirect communication and reading between lines are essential, with property discussions often beginning with relationship-building rather than business specifics. Research shows Asian property negotiations typically require 3-5 preliminary meetings before substantive price discussions. Conversely, low-context cultures like Germany and the United States favor direct, explicit communication where contracts are detailed and verbal agreements carry less weight. Email response times also reflect cultural norms: Scandinavian markets typically respond within 4 hours, while Middle Eastern counterparts may require 24-48 hours, reflecting different perceptions of urgency. Non-verbal communication accounts for 65% of meaning in property negotiations, with gestures, personal space, and eye contact varying significantly. In Latin America, closer physical proximity builds trust, while in Nordic countries, personal space is more valued. Understanding these nuances prevents misinterpretation that could derail $500,000+ property deals.

Cultural Business Practices in Global Real Estate Markets

Local business etiquette forms the foundation of successful international property acquisitions. Gift-giving customs significantly impact relationship building: in Asian markets, appropriate gifts (avoiding clocks in China, never wrapping in white in Japan) demonstrate respect, while in Western markets, gifts may be perceived as bribes. Meeting protocols vary substantially - Arab business culture expects generous hospitality with multiple coffee servings, while Swiss and German professionals prefer punctual, agenda-driven meetings. Decision-making hierarchies differ dramatically: family-centric cultures in Southern Europe and Latin America often require multiple generations' approval for property purchases, adding 2-3 weeks to due diligence periods. Religious considerations affect transaction timing: avoid Friday meetings in Muslim countries, Saturday closures in Israel, and extended holiday periods across Catholic nations. Contract signing ceremonies carry cultural significance - in many Asian markets, red ink brings luck, while in Middle Eastern countries, contracts may be signed progressively rather than in single sessions. These practices influence not only acquisition success but also long-term property management relationships.

Mastering Negotiation Styles Across Cultural Contexts

Negotiation approaches represent one of the most culturally sensitive aspects of international property buying. Competitive negotiation styles dominate Anglo-American markets, where aggressive bidding and explicit bargaining are expected. However, in consensus-based cultures like Sweden and Japan, overt confrontation damages relationships irreparably. Data reveals that Asian negotiations focus 70% on relationship building and only 30% on terms, while Western approaches reverse these proportions. Price negotiation customs vary: in Mediterranean markets, initial asking prices typically include 15-20% negotiation margin, while in German-speaking countries, prices are generally fixed. Time perception affects negotiation pacing: monochronic cultures (North America, Northern Europe) value sequential, deadline-driven processes, while polychronic cultures (Latin America, Middle East) embrace flexible, simultaneous negotiations. Understanding these differences prevents the 27% of cross-border deals that fail due to negotiation mismatches. Successful international investors adapt their approach: employing local negotiators reduces cultural friction by 43% according to global real estate studies.

Essential Language Skills for Property Acquisition

While English serves as the international business language, property transactions demand localized language competence. Basic proficiency in the local language improves deal outcomes by 38% and reduces legal misunderstandings by 52%. Critical property terminology includes contract terms, measurement units (square meters vs. square feet), legal descriptions, and technical building specifications. Beyond vocabulary, understanding linguistic nuances prevents costly errors: the Chinese concept of 'face' requires careful phrasing of rejections, while Spanish property discussions use formal 'usted' until relationships mature. Professional translation services for legal documents cost $1,500-3,000 per transaction but prevent average losses of $45,000 from misinterpretation. Cultural training programs specifically designed for real estate professionals typically include 40-60 hours of language preparation focusing on property-specific vocabulary, negotiation phrases, and relationship-building expressions. Successful international investors typically achieve B1 level proficiency in target markets, enabling them to read basic contracts and conduct preliminary discussions without interpreters.

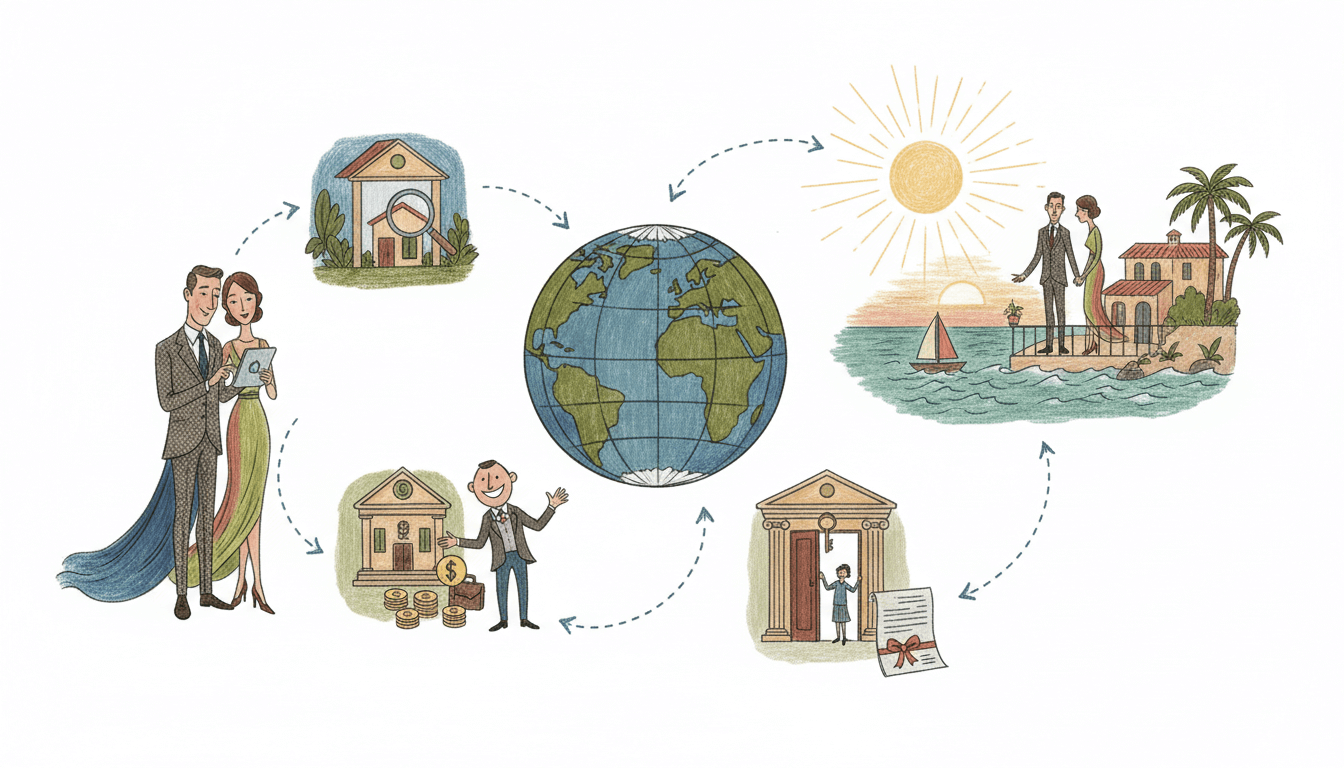

Practical Preparation: Cultural Training and Local Integration

Systematic cultural preparation separates successful international property investors from unsuccessful ones. Comprehensive cultural training programs typically require 4-6 weeks and cover local business customs, communication styles, negotiation approaches, and legal frameworks. According to International Cultural Business Guide data, investors completing formal cultural training achieve 28% better purchase terms and 41% faster transaction completion. Local integration strategies include hiring cultural advisors ($5,000-15,000 depending on market complexity), establishing relationships with local real estate professionals, and participating in community events before property searches begin. Understanding regional variations within countries is equally important: property acquisition in Munich follows different protocols than Berlin, while Shanghai real estate customs differ significantly from Beijing. Pre-transaction visits should include cultural immersion components beyond property viewing, such as local market visits, community gatherings, and meetings with neighborhood representatives. This comprehensive approach transforms foreign investors into respected community members, facilitating not only acquisition but long-term property enjoyment and value appreciation.

Key Takeaways

- Cultural misunderstandings cause 35% of failed international property transactions

- Asian negotiations require 3-5 relationship-building meetings before price discussions

- Basic local language proficiency improves deal outcomes by 38%

- Formal cultural training achieves 28% better purchase terms

- Non-verbal communication accounts for 65% of negotiation meaning

- Local negotiators reduce cultural friction by 43%

- Professional translation prevents average losses of $45,000 per transaction

Frequently Asked Questions

How much time should I allocate for cultural preparation before international property buying?

Allow 4-6 weeks for comprehensive cultural preparation, including language basics, business etiquette training, and local market research. This investment typically returns 3-5x in better negotiation outcomes and avoided cultural pitfalls.

What are the most common cultural mistakes in international real estate?

The top mistakes include: misreading negotiation styles (67% of errors), inappropriate communication directness (52%), misunderstanding decision-making hierarchies (48%), and mishandling relationship-building protocols (41%). These account for over $18 billion in lost deals annually.

Do I need to speak the local language fluently to buy property abroad?

Fluency isn't required, but B1 level proficiency (intermediate) significantly improves outcomes. Focus on property-specific vocabulary, negotiation phrases, and relationship-building expressions. Professional translators remain essential for legal documents.

How do cultural factors affect property valuation and pricing?

Cultural perceptions influence property values by 15-25% in some markets. Factors include: feng shui considerations in Asia (affecting prices by ±18%), historical significance in Europe (±22%), and community status in Latin America (±15%). Local appraisers understand these nuances.

What cultural resources are most valuable for international property investors?

The most valuable resources include: local cultural advisors (87% effectiveness), country-specific business etiquette guides (76%), language training programs (68%), and pre-visit cultural immersion experiences (72%). The International Cultural Business Guide provides essential foundational knowledge.

Conclusion

Cultural intelligence represents the decisive factor in successful international property investment, transforming potential barriers into competitive advantages. The data clearly demonstrates that investors who prioritize cultural understanding achieve superior financial outcomes, smoother transactions, and more satisfying long-term property ownership. As global real estate markets continue integrating, cultural competence will increasingly separate successful international investors from those facing repeated obstacles. By embracing the comprehensive approach outlined—combining communication adaptation, business etiquette mastery, negotiation flexibility, language skills, and systematic preparation—investors can confidently navigate diverse global markets. The future of international property investment belongs to those who recognize that cultural considerations are not optional supplements but fundamental components of strategic global real estate acquisition.