Comprehensive International Real Estate Buying Guide: Navigating Global Property Markets

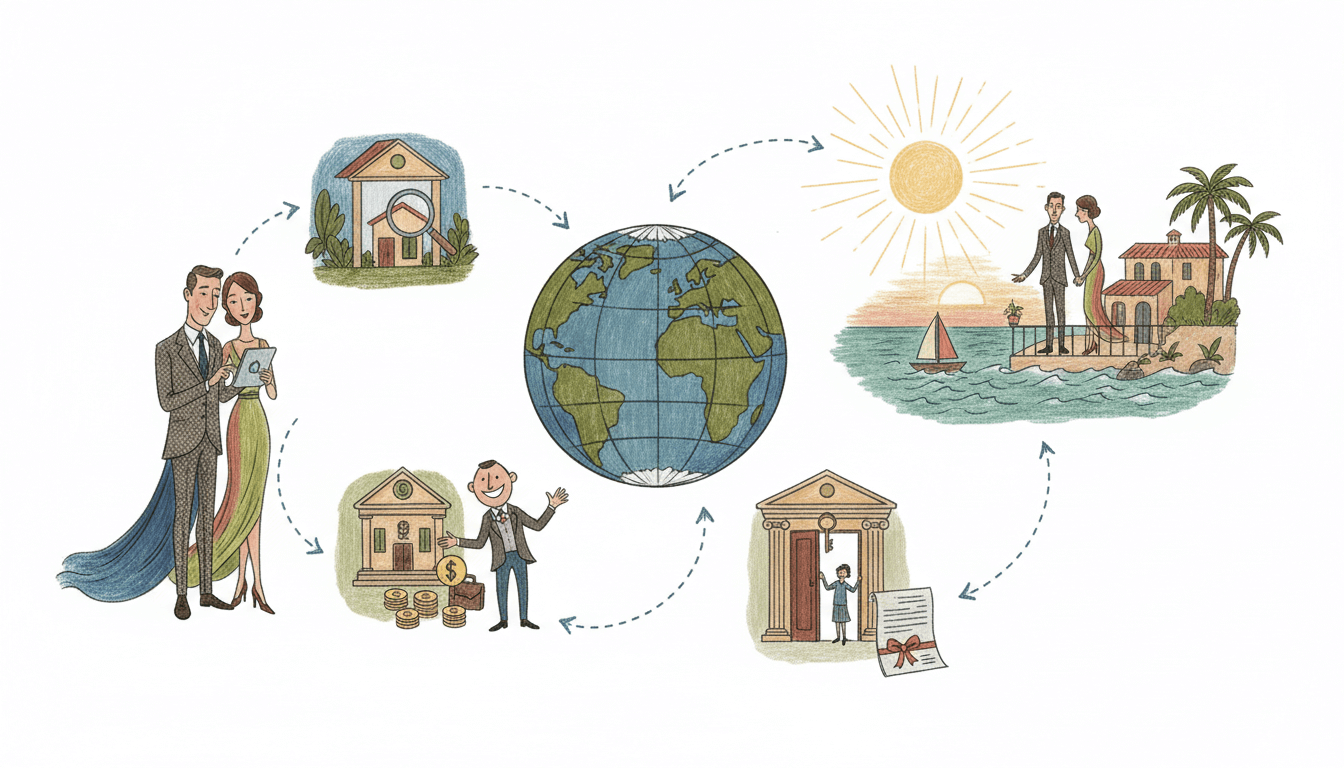

This definitive guide provides a comprehensive roadmap for purchasing international real estate, covering essential aspects from market research to legal compliance. Learn about four primary financing options including local bank mortgages and international loans, understand critical considerations like currency exchange risks and cultural barriers, and discover proven strategies for successful overseas property investment. The guide emphasizes working with local professionals and thorough due diligence to mitigate risks in international real estate transactions across different markets and jurisdictions.

The global real estate market presents unprecedented opportunities for investors and homebuyers seeking diversification, lifestyle enhancement, and portfolio growth. However, purchasing property internationally involves navigating complex legal frameworks, financial considerations, and cultural nuances that differ significantly from domestic transactions. According to comprehensive analysis of international real estate purchasing trends, successful cross-border property acquisition requires meticulous planning, professional guidance, and deep understanding of local market dynamics. This guide synthesizes expert insights and data-driven strategies to help you confidently navigate the international real estate landscape, whether you're seeking vacation properties, permanent relocation, or pure investment opportunities across global markets.

Comprehensive Market Research and Due Diligence

Thorough market research forms the foundation of any successful international real estate purchase. Begin by analyzing macroeconomic indicators including GDP growth rates, population trends, and political stability in your target country. Property market data should encompass price trends over 5-10 year periods, rental yield averages (typically ranging from 3-8% depending on location), and vacancy rates. Infrastructure development plans, transportation networks, and urban regeneration projects significantly impact property values. Digital platforms provide valuable insights, but nothing replaces on-ground reconnaissance. Engage local real estate agents who understand neighborhood dynamics and can provide access to off-market opportunities. Verify property titles through official land registries and conduct environmental assessments where applicable. Market research should also include analysis of comparable properties, understanding seasonal fluctuations in tourist areas, and evaluating long-term development potential of the region.

Legal Framework and Regulatory Compliance

Navigating international legal systems requires expert local guidance to ensure compliance and protect your investment. Property ownership laws vary dramatically - some countries restrict foreign ownership to specific property types or locations, while others impose additional taxes or approval processes. Legal due diligence must include verification of clear title, zoning regulations, building permits, and any existing encumbrances or easements. Tax implications span multiple jurisdictions: capital gains taxes (typically 15-30%), property taxes (0.1-2% of assessed value annually), inheritance taxes, and potential double taxation issues. Engage qualified legal counsel specializing in international real estate transactions to review all contracts, understand disclosure requirements, and ensure proper registration. Many countries mandate specific purchase procedures - for example, Spain requires notarization of deeds, while Thailand requires specific documentation for foreign condominium ownership. Understanding these legal intricacies prevents costly mistakes and ensures your investment remains secure.

Financial Planning and Funding Strategies

International real estate financing requires sophisticated planning across multiple dimensions. The four primary financing options identified in comprehensive market analysis include local bank mortgages (typically requiring 30-50% down payment for non-residents), international loans from global banks with cross-border lending programs, developer financing (often with lower initial deposits but potentially higher interest rates), and equity release from existing properties through refinancing or home equity lines of credit. Currency risk management is critical - fluctuations of just 10% can significantly impact affordability and returns. Consider currency hedging strategies and maintain reserves for exchange rate volatility. Budget comprehensively for additional costs including legal fees (1-2% of property value), registration taxes (3-10% depending on jurisdiction), agent commissions (3-6%), and ongoing maintenance costs. Financial planning should also account for different payment structures common in international transactions, such as stage payments during construction or retention amounts held until completion.

Cultural Integration and Local Market Dynamics

Cultural competence significantly impacts international real estate success. Language barriers can complicate negotiations and legal processes - professional translation services are essential for all official documents. Business customs vary widely; while some cultures expect aggressive negotiation, others value relationship-building and gradual trust development. Understanding local lifestyle patterns, community norms, and neighborhood dynamics informs better property selection and integration. Local professionals provide invaluable cultural insights about preferred locations, architectural styles, and community amenities that align with your lifestyle needs. Property management considerations differ internationally - some markets have well-developed rental management ecosystems, while others require more hands-on involvement. Cultural due diligence extends to understanding local construction quality standards, maintenance expectations, and community regulations that might differ from your home country's practices.

Risk Mitigation and Investment Protection

International real estate carries unique risks requiring sophisticated mitigation strategies. Political and economic instability can dramatically impact property values and ownership rights - diversify across stable jurisdictions with strong legal protections for foreign investors. Currency exchange risks necessitate hedging strategies and multi-currency banking relationships. Physical property risks require comprehensive inspections by qualified local professionals to identify structural issues, environmental hazards, or regulatory non-compliance. Legal risks are mitigated through title insurance (available in many international markets), escrow arrangements for purchase funds, and proper due diligence on all contractual obligations. Insurance coverage must address local risks including natural disasters common to the region, liability requirements, and adequate property protection. Develop contingency plans for management challenges, unexpected costs, and exit strategies should your circumstances change. Regular portfolio reviews and professional management ensure your international investments remain aligned with your financial objectives.

Key Takeaways

- Comprehensive market research should analyze economic indicators, property trends, and local development plans across 5-10 year horizons

- Legal due diligence must verify ownership restrictions, tax implications, and compliance with local registration requirements through qualified counsel

- Financial planning should incorporate multiple funding options while managing currency risks and budgeting for 10-15% in additional acquisition costs

- Cultural competence and local professional networks are essential for successful integration and property management

- Risk mitigation requires diversification, proper insurance, contingency planning, and regular portfolio review

Frequently Asked Questions

What are the most common financing options for international real estate purchases?

The four primary financing options identified in comprehensive market analysis include local bank mortgages (typically requiring 30-50% down payment for non-residents), international loans from global banking institutions, developer financing arrangements, and equity release from existing domestic properties. Each option carries different requirements, interest rates, and risk profiles that must be evaluated based on your financial situation and the specific jurisdiction's regulations.

How do I manage currency exchange risks in international property investment?

Currency risk management involves multiple strategies including forward contracts to lock in exchange rates, multi-currency accounts to hold funds in the local currency, maintaining cash reserves to cover exchange rate fluctuations, and potentially structuring financing in local currency to create natural hedging. Professional currency specialists can develop customized hedging strategies based on your transaction timeline and risk tolerance.

What legal documents are essential for international property transactions?

Essential documents include verified title deeds, zoning compliance certificates, building permits, tax clearance certificates, identification documents authenticated for international use, purchase contracts reviewed by local legal counsel, and proper registration with the local land registry. Additional documents may include foreign investment approvals, power of attorney if purchasing remotely, and compliance certificates for any renovation or construction plans.

How important are property inspections for international purchases?

Professional property inspections are critical for international purchases where buyers may lack familiarity with local construction standards, common issues, and environmental factors. Inspections should assess structural integrity, electrical and plumbing systems, pest infestations common to the region, and compliance with local building codes. Many international buyers engage multiple specialists including structural engineers, environmental assessors, and local architects to provide comprehensive evaluation before purchase.

Conclusion

International real estate investment offers significant opportunities but requires sophisticated approach combining thorough research, professional guidance, and strategic planning. Success hinges on understanding local market dynamics, navigating complex legal and financial landscapes, and developing cultural competence in your target markets. By implementing the comprehensive strategies outlined in this guide - from meticulous due diligence to risk mitigation - investors can confidently expand their portfolios across global markets. The evolving nature of international real estate demands continuous learning and adaptation, but for those willing to invest the necessary time and resources, the rewards of global property ownership can be substantial and transformative for long-term wealth building and lifestyle enhancement.