Emerging Markets for Property Investment: High-Growth Opportunities in Global Real Estate

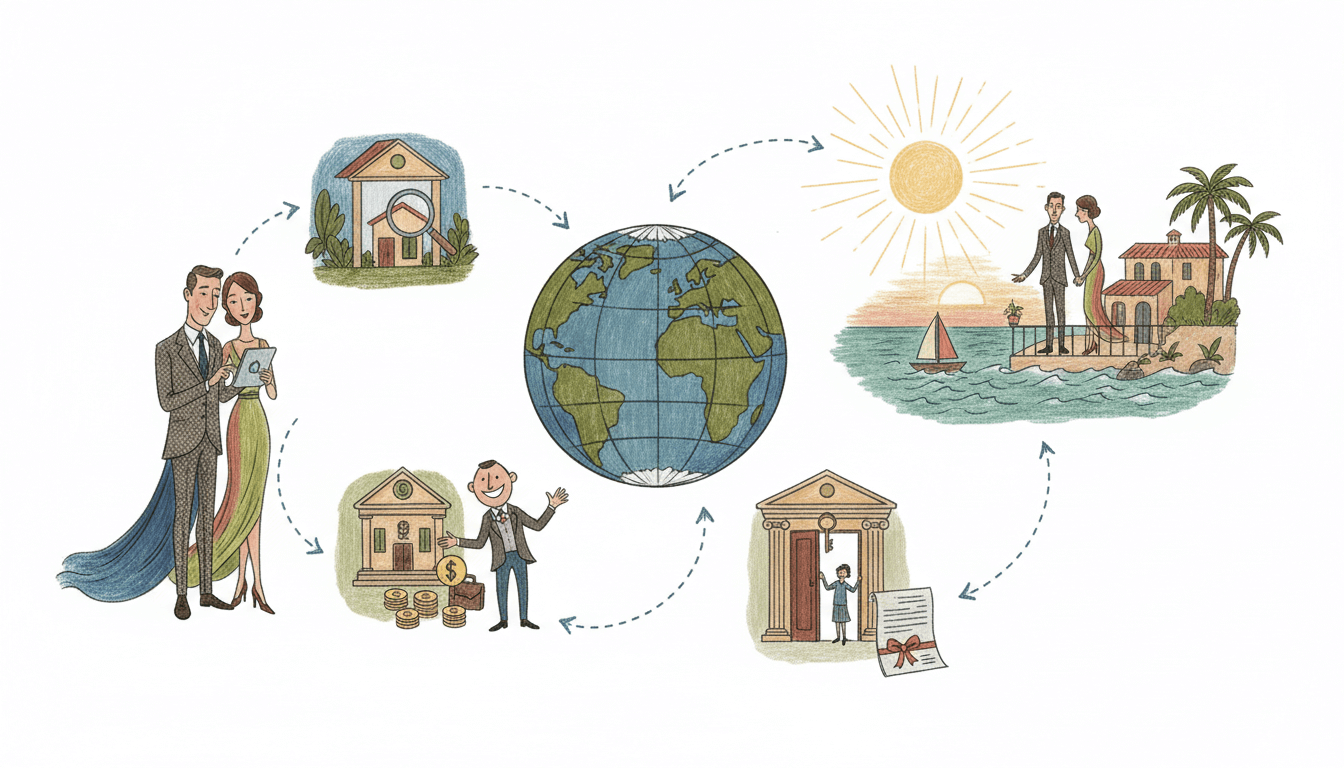

This comprehensive analysis examines emerging international real estate markets with exceptional growth potential and investment returns. Based on the Global Emerging Markets Investment Report, we explore Eastern European countries, Southeast Asian emerging economies, and select Latin American markets. The article provides detailed insights into economic growth indicators, political stability factors, and foreign investment regulations. With specific investment criteria and market dynamics, this guide helps investors identify high-potential opportunities while navigating local market conditions and maximizing returns through strategic property acquisitions.

The global real estate landscape continues to evolve, with emerging markets presenting unprecedented opportunities for savvy investors seeking diversification and superior returns. According to the Global Emerging Markets Investment Report, these markets offer unique advantages including lower entry points, rapid appreciation potential, and growing rental demand. This comprehensive analysis examines three primary emerging market categories: Eastern European countries demonstrating robust economic transformation, Southeast Asian emerging economies experiencing rapid urbanization, and select Latin American markets benefiting from economic reforms and demographic shifts. Understanding the intricate dynamics of these regions requires careful evaluation of economic growth trajectories, political stability indicators, and regulatory frameworks governing foreign ownership. With property values in many developed markets reaching peak levels, emerging markets provide the next frontier for international real estate investment, offering potential annual returns of 8-15% in prime locations.

Eastern European Property Markets: Post-Transition Growth Stories

Eastern European countries have emerged as compelling investment destinations following their economic transitions and EU integration processes. Poland stands out with GDP growth averaging 4.2% annually over the past five years and commercial property yields reaching 6-8% in major cities like Warsaw and Krakow. The Romanian real estate market has demonstrated remarkable resilience, with Bucharest apartment prices increasing by 9.3% year-over-year and office space demand exceeding supply in key business districts. Hungary's pro-business policies have attracted significant foreign direct investment, particularly in Budapest's luxury residential sector where prices have appreciated by 7.8% annually. Bulgaria's coastal properties along the Black Sea offer tourism-driven returns, with rental yields averaging 5-7% during peak seasons. Czech Republic's industrial real estate market has flourished due to its strategic position in European supply chains, with warehouse rents increasing by 4.5% annually. These markets benefit from EU structural funds, improving infrastructure, and growing middle-class populations driving housing demand. Foreign investors should note that while EU membership provides regulatory stability, local property registration processes and tax structures vary significantly across jurisdictions.

Southeast Asian Emerging Economies: Urbanization and Demographic Dividends

Southeast Asian emerging economies represent some of the world's most dynamic property markets, driven by rapid urbanization, demographic advantages, and increasing foreign investment. Vietnam leads the region with Ho Chi Minh City and Hanoi experiencing annual property price growth of 6-9%, supported by GDP expansion averaging 6.5% and a young, urbanizing population. The Philippine real estate market continues its strong performance, with Manila office vacancies below 3% and residential condominium prices increasing by 7.2% annually. Indonesia's property sector benefits from economic reforms and infrastructure development, particularly in Jakarta where commercial property yields range between 7-9%. Thailand remains a stable investment destination with Bangkok condominium markets showing consistent 5-6% annual appreciation and tourism-driven rental markets in Phuket and Pattaya delivering 6-8% net yields. Malaysia's Iskandar development region offers strategic opportunities with properties priced 40-60% below Singapore across the border. These markets present unique considerations including foreign ownership restrictions (typically limited to condominiums in many countries), currency volatility management, and navigating local partnership requirements for landed property investments. The region's growing middle class, increasing urbanization rates (projected to reach 65% by 2030), and infrastructure investments create favorable long-term fundamentals for property appreciation.

Select Latin American Markets: Reform-Driven Opportunities

Select Latin American markets offer compelling property investment prospects driven by economic reforms, commodity cycles, and demographic trends. Colombia has emerged as a regional standout with Bogotá office yields reaching 7.5% and Medellín's transformation into an innovation hub driving residential demand and 6.2% annual price growth. Mexico benefits from nearshoring trends and manufacturing growth, particularly in northern border cities where industrial property demand has increased rental rates by 8.3% annually. Brazil's post-pandemic recovery has revitalized property markets, with São Paulo luxury apartments showing 5.8% appreciation and commercial properties in prime locations offering 9-11% gross yields. Peru's mining-driven economy supports steady property demand in Lima, where middle-income housing developments generate 6-7% annual returns. Chile remains the region's most stable market with Santiago commercial properties delivering consistent 6.5-7.5% yields and regulatory transparency attracting institutional investors. These markets require careful assessment of political cycles, currency stability mechanisms, and local partnership structures. Successful investing in Latin America often involves navigating complex title registration systems, understanding local tax implications, and developing relationships with reputable local brokers and legal advisors. The region's growing middle class and infrastructure development create sustained demand for residential, commercial, and industrial properties.

Investment Criteria Framework: Evaluating Market Potential

A systematic approach to evaluating emerging market property investments requires rigorous assessment across multiple dimensions. Economic growth remains the primary indicator, with markets demonstrating consistent GDP expansion above 4% typically showing stronger property appreciation. Political stability assessment should include analysis of regulatory consistency, property rights protection, and transparency in legal systems. Foreign investment friendliness encompasses ownership restrictions, repatriation policies, and tax treatment of international investors. Additional critical factors include demographic trends (urbanization rates, middle-class growth), infrastructure development (transportation, utilities), and market liquidity (transaction volumes, time-on-market metrics). Due diligence should extend to local market dynamics including supply-demand imbalances, construction quality standards, and environmental regulations. Financial analysis must account for currency risk management strategies, financing availability for foreign buyers, and total cost of ownership calculations including property taxes, maintenance fees, and management expenses. Successful investors typically employ a diversified approach across markets and property types, maintain longer investment horizons to weather market cycles, and develop local expertise through partnerships with established real estate firms and legal advisors. The most promising opportunities often exist in markets where economic growth outpaces property price appreciation, creating valuation gaps that can deliver superior risk-adjusted returns over 5-10 year holding periods.

Key Takeaways

- Eastern European markets offer EU-integration benefits with property yields of 6-9% in prime locations

- Southeast Asian economies provide demographic-driven growth with annual appreciation of 5-9% in major cities

- Latin American markets present reform-driven opportunities with commercial yields reaching 7-11%

- Economic growth above 4% GDP expansion correlates strongly with property market performance

- Foreign ownership restrictions vary significantly by country and property type

- Currency risk management is critical for international property investments

- Local partnership development enhances due diligence and operational efficiency

- Infrastructure development timelines impact property value appreciation trajectories

Frequently Asked Questions

What are the main risks when investing in emerging market real estate?

Primary risks include currency volatility, political instability, regulatory changes affecting foreign ownership, liquidity constraints during market downturns, title verification challenges, and construction quality variability. Mitigation strategies include diversification across markets, thorough legal due diligence, local partnership development, currency hedging instruments, and maintaining adequate cash reserves for unexpected expenses.

How do foreign ownership restrictions typically work in these markets?

Restrictions vary significantly by country. Common limitations include prohibitions on owning land (requiring leasehold arrangements), quotas on foreign ownership in certain developments, minimum investment thresholds, restrictions on specific property types (often allowing condominium but not landed property ownership), and requirements for local partnership structures. Countries like Thailand and Indonesia typically allow foreign condominium ownership with restrictions, while Mexico requires specific trust structures for border and coastal properties.

What due diligence is essential before purchasing property in emerging markets?

Comprehensive due diligence should include legal title verification, zoning regulation compliance checks, environmental impact assessments, construction quality evaluations, market comparables analysis, tax implication reviews, financing availability assessment, and exit strategy planning. Engaging local legal counsel, property surveyors, and tax advisors is essential. Additional considerations include understanding property management options, rental market dynamics, and potential regulatory changes affecting foreign investors.

How can investors manage properties remotely in these markets?

Effective remote management requires establishing relationships with reputable local property management companies, implementing clear service level agreements, utilizing technology for monitoring and communication, conducting regular physical inspections, maintaining local banking relationships for expense payments, and developing contingency plans for emergency situations. Many investors benefit from building relationships with multiple service providers to ensure competitive pricing and service quality.

Conclusion

Emerging markets for property investment present compelling opportunities for investors seeking diversification and superior returns in the global real estate landscape. The analysis of Eastern European, Southeast Asian, and select Latin American markets reveals distinct growth drivers and investment characteristics that align with different risk profiles and investment horizons. Successful navigation of these opportunities requires thorough understanding of local market dynamics, regulatory frameworks, and economic fundamentals. While these markets offer attractive yields and appreciation potential, they demand sophisticated risk management approaches including currency hedging, political risk assessment, and local partnership development. As global economic patterns continue to evolve, emerging market real estate provides strategic diversification benefits and exposure to the world's fastest-growing economies. Investors who conduct meticulous due diligence, maintain appropriate investment horizons, and develop local expertise stand to benefit from the significant growth potential these markets offer in the coming decade.