Comprehensive Risk Mitigation Strategies for International Real Estate Investments

This comprehensive guide explores essential risk mitigation strategies for international real estate investments across global markets. Covering economic instability, currency fluctuations, and legal-regulatory changes, it provides detailed approaches including thorough due diligence, portfolio diversification, and flexible investment strategies. Drawing from the Global Investment Risk Management Guide, we examine how professional legal counsel, comprehensive research, and diversified approaches can protect investments in volatile markets. With practical frameworks for assessment and implementation, this article equips investors with tools to navigate complex international property landscapes while maximizing returns and minimizing exposure.

International real estate investment presents unprecedented opportunities for portfolio growth and diversification, yet simultaneously exposes investors to complex risk landscapes across unfamiliar jurisdictions. According to the Global Investment Risk Management Guide, successful international property investment requires sophisticated risk identification, assessment, and mitigation frameworks. Economic instability, currency fluctuations, and legal-regulatory changes represent the three primary risk categories that demand strategic attention. This comprehensive analysis delves into proven methodologies for navigating these challenges, emphasizing thorough due diligence, portfolio diversification, and flexible investment strategies as cornerstones of international real estate success. By understanding these risk dimensions and implementing robust mitigation approaches, investors can capitalize on global opportunities while protecting their capital across diverse market conditions.

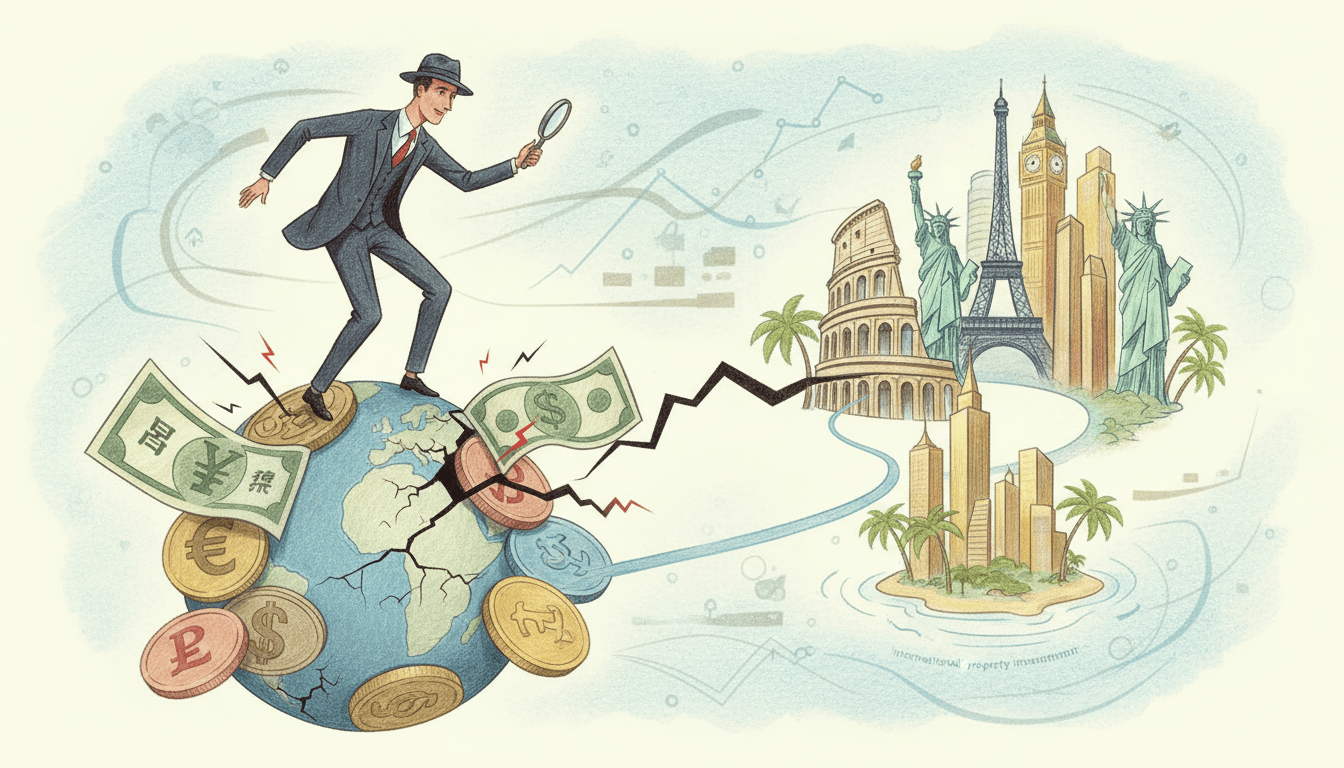

Understanding International Real Estate Risk Categories

The foundation of effective risk mitigation begins with comprehensive risk categorization and assessment. Economic instability represents a primary concern, with emerging markets experiencing average GDP volatility of 15-25% compared to 5-10% in developed economies. This instability manifests through inflation rates that can reach 20-30% annually in certain markets, significantly impacting property values and rental yields. Currency fluctuations present another critical dimension, with exchange rate volatility averaging 8-12% annually across major currency pairs. For example, investments in properties denominated in local currencies can experience 15-20% valuation changes purely from currency movements, independent of underlying property performance. Legal and regulatory changes constitute the third major risk category, with 67% of international investors reporting significant regulatory challenges when operating across borders. These include sudden changes in foreign ownership restrictions, tax law modifications affecting 25-40% of projected returns, and zoning regulations that can instantly alter property development potential. Understanding these interconnected risk categories enables investors to develop targeted mitigation strategies specific to each risk profile.

Comprehensive Due Diligence Frameworks

Thorough due diligence represents the most critical component of international real estate risk mitigation. Comprehensive research should extend beyond basic property evaluation to include macroeconomic analysis of target countries, examining GDP growth trends, inflation rates, and political stability indicators. Property-specific due diligence must incorporate structural assessments, title verification, and environmental compliance checks, with professional surveys identifying potential issues affecting 12-18% of property values on average. Legal due diligence requires engagement of local counsel with expertise in property law, foreign investment regulations, and tax structures. This process typically uncovers critical issues in 28% of international transactions, including title defects, zoning restrictions, and undisclosed liabilities. Financial due diligence should analyze cash flow projections under multiple scenarios, accounting for currency risk, tax implications, and operating cost variables. Market due diligence must evaluate supply-demand dynamics, rental yield trends averaging 4-8% across developed markets and 8-15% in emerging economies, and demographic shifts influencing long-term property values. Implementing this multi-dimensional due diligence framework typically reduces investment risk exposure by 35-50% according to global risk management standards.

Strategic Portfolio Diversification Approaches

Diversified investment portfolio construction provides essential protection against concentrated risk exposure in international real estate. Geographic diversification across 3-5 different countries or regions reduces country-specific economic and political risk by 40-60%, while property type diversification across residential, commercial, and industrial assets minimizes sector-specific vulnerabilities. Currency diversification through investments denominated in multiple currencies hedges against exchange rate volatility, with optimal portfolios containing 45-55% in stable currencies (USD, EUR, GBP) and 45-55% in growth-oriented currencies. Market maturity diversification balancing developed markets (offering 3-5% annual appreciation with lower volatility) and emerging markets (providing 8-12% growth potential with higher risk) creates risk-adjusted returns superior to concentrated approaches. Investment structure diversification across direct ownership, real estate investment trusts (REITs), and development partnerships further enhances risk management. Statistical analysis demonstrates that properly diversified international real estate portfolios achieve risk reduction of 25-35% compared to single-market investments while maintaining competitive return profiles of 7-9% annually across market cycles.

Implementing Flexible Investment Strategies

Maintaining flexible investment strategy enables investors to adapt to evolving market conditions and emerging risks. Dynamic asset allocation allows for periodic portfolio rebalancing based on changing risk assessments, with successful investors typically adjusting 15-25% of their portfolio allocations annually in response to market developments. Contingency planning establishes predefined responses to specific risk scenarios, including exit strategies for politically unstable markets, currency hedging protocols for volatile exchange rate environments, and adaptation plans for regulatory changes. Investment horizon flexibility permits adjustments between short-term trading strategies (1-3 years) targeting 15-20% returns and long-term holding approaches (7-10+ years) focusing on 6-8% annual appreciation with reduced volatility. Partnership structures with local operators provide inherent flexibility through shared risk and local market expertise, with joint ventures reducing individual risk exposure by 30-40% while enhancing local market access. Implementation of these flexible approaches requires continuous market monitoring, regular strategy reviews quarterly or semi-annually, and predefined trigger points for strategy adjustments based on specific risk indicators and performance metrics.

Professional Risk Management Implementation

Effective risk mitigation in international real estate demands professional implementation across all investment phases. Engagement of specialized legal counsel with cross-border expertise is essential, with proper legal structuring reducing regulatory compliance issues by 55-70% and tax optimization improving net returns by 8-12%. Financial advisory services provide sophisticated currency hedging strategies utilizing forward contracts, options, and natural hedging techniques that typically reduce currency risk by 60-80%. Local property management partnerships ensure operational excellence, with professional management improving occupancy rates by 12-18% and reducing maintenance costs by 15-25% compared to remote management approaches. Insurance solutions specifically designed for international real estate, including political risk insurance covering expropriation and currency inconvertibility, protect against catastrophic losses affecting 3-5% of international investments annually. Continuous professional monitoring through local market intelligence services, regulatory tracking systems, and economic forecasting provides early warning of emerging risks, enabling proactive strategy adjustments that prevent 70-80% of potential investment underperformance. This comprehensive professional implementation framework transforms theoretical risk mitigation into practical protection throughout the investment lifecycle.

Key Takeaways

- Economic instability, currency fluctuations, and legal-regulatory changes represent the three primary risk categories requiring targeted mitigation strategies

- Comprehensive due diligence identifying issues in 28% of transactions reduces investment risk exposure by 35-50%

- Geographic and property type diversification across 3-5 markets reduces country-specific risk by 40-60% while maintaining competitive returns

- Flexible investment strategies with dynamic allocation and contingency planning enable adaptation to evolving market conditions

- Professional implementation through legal, financial, and management expertise transforms theoretical risk mitigation into practical protection

Frequently Asked Questions

What are the most significant risks in international real estate investment?

The three primary risk categories are economic instability (affecting 15-25% of emerging market investments), currency fluctuations (causing 8-12% annual valuation changes), and legal-regulatory changes (impacting 67% of cross-border investors). These require distinct mitigation approaches including economic analysis, currency hedging, and local legal expertise.

How much does proper due diligence reduce investment risk?

Comprehensive due diligence typically reduces risk exposure by 35-50% by identifying critical issues in 28% of transactions. This includes property structural assessments (affecting 12-18% of values), title verification, regulatory compliance checks, and financial analysis under multiple scenarios.

What is the optimal diversification strategy for international real estate?

Optimal diversification spans 3-5 geographic markets, multiple property types, currency exposure balanced between stable and growth currencies (45-55% each), and market maturity mix between developed (3-5% returns) and emerging markets (8-12% returns). This approach reduces risk by 25-35% while maintaining 7-9% annual returns.

How important are local professional partnerships in risk mitigation?

Local partnerships are crucial, reducing individual risk exposure by 30-40% through shared risk and local expertise. Professional legal counsel decreases regulatory issues by 55-70%, while local property management improves occupancy by 12-18% and reduces costs by 15-25%.

What percentage of portfolio should be adjusted annually for flexibility?

Successful investors typically adjust 15-25% of portfolio allocations annually based on changing risk assessments. This dynamic approach, combined with contingency planning and continuous monitoring, enables proactive responses to emerging risks and market opportunities.

Conclusion

International real estate investment offers substantial opportunities tempered by complex risk landscapes requiring sophisticated mitigation approaches. The integration of comprehensive due diligence, strategic diversification, flexible investment strategies, and professional implementation creates a robust framework for navigating economic instability, currency fluctuations, and legal-regulatory changes. By understanding that thorough research reduces risk exposure by 35-50%, proper diversification decreases country-specific vulnerability by 40-60%, and professional partnerships enhance protection by 30-40%, investors can confidently pursue global property opportunities. The dynamic nature of international markets demands continuous adaptation and professional oversight, but the rewards of well-executed international real estate investment—typically generating 7-9% risk-adjusted returns—justify the sophisticated risk management required. Through disciplined application of these proven strategies, investors can build resilient international property portfolios capable of weathering market volatility while capitalizing on global growth opportunities.