Global Residency and Citizenship Programs: Property Investment Pathways

This comprehensive guide explores property investment routes to residency and citizenship through Golden Visa programs and investment-based immigration. Covering Portugal's Golden Visa with minimum investments from €280,000, Spain's real estate pathway requiring €500,000, and Caribbean citizenship options like St. Kitts & Nevis starting at $150,000, we detail eligibility, benefits, and processes. These programs offer residency rights, visa-free travel, and potential citizenship, making them attractive for global investors seeking mobility and security. Based on the Global Citizenship Investment Report, this analysis provides essential insights for property investors worldwide.

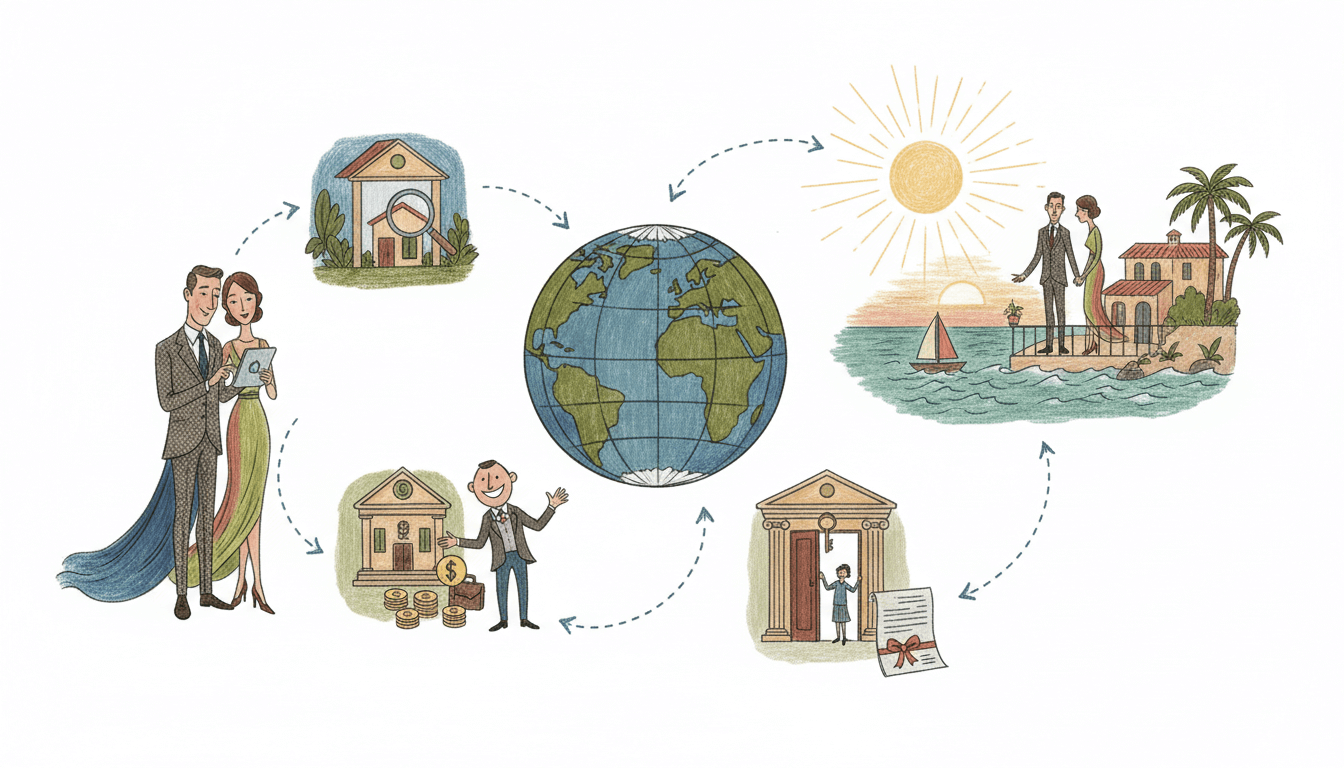

In today's globalized economy, property investment has evolved beyond traditional returns to become a strategic pathway to residency rights and citizenship. According to the Global Citizenship Investment Report, investment-based immigration programs have seen unprecedented growth, with property routes offering dual benefits of real estate appreciation and enhanced global mobility. These programs, commonly known as Golden Visas or citizenship by investment schemes, allow investors and their families to obtain residency rights and potential citizenship through qualified real estate investments. The convergence of property markets and immigration policy creates unique opportunities for high-net-worth individuals seeking geographic diversification, visa-free travel access, and enhanced lifestyle options. This comprehensive analysis examines the leading property investment pathways, detailing specific requirements, benefits, and strategic considerations for investors navigating this complex landscape.

Portugal Golden Visa Program: European Gateway

The Portugal Golden Visa Program represents one of Europe's most attractive residency-by-investment schemes, having processed over 12,000 main applicants since its 2012 inception. The program offers multiple investment routes, with real estate options including: minimum €500,000 in conventional properties, €350,000 for properties over 30 years old in urban regeneration areas, or €280,000 in low-density regions. Additional requirements include maintaining the investment for at least five years, minimum stay requirements of just 7 days annually during the first year and 14 days in subsequent two-year periods, and clean criminal records. Successful applicants gain residency rights extending to spouses, dependent children, and parents, access to Schengen Area travel, and eligibility for Portuguese citizenship after five years—including dual citizenship permission. The program's popularity stems from its relatively low physical presence requirements, attractive tax benefits including NHR tax regime for ten years, and pathway to EU citizenship. Recent legislative changes have restricted investments in coastal metropolitan areas, directing capital toward interior regions and urban regeneration projects.

Spain Real Estate Investment Residency

Spain's real estate investment visa program requires a minimum property investment of €500,000, which can be spread across multiple properties. The program grants initial residency for one year, renewable subsequently for two-year periods, with no minimum stay requirements—making it ideal for investors seeking flexibility. Applicants must demonstrate clean criminal records, comprehensive health insurance coverage, and sufficient financial means. The investment must be free of encumbrances and properly registered. While this program provides residency rights rather than direct citizenship, it serves as a pathway to long-term residence and potential citizenship after ten years of legal residence (reduced to two years for citizens of Latin American countries, Andorra, Philippines, Equatorial Guinea, and Portugal). Key advantages include access to Spain's high-quality healthcare and education systems, visa-free travel within Schengen Area, and the ability to include spouses, minor children, and dependent adult children in the application. The program has attracted significant investment in coastal regions like Costa del Sol and urban centers including Madrid and Barcelona, with average processing times of 20-30 days for initial approval.

Caribbean Citizenship by Investment Programs

Caribbean citizenship by investment programs offer the most direct route to second citizenship through real estate investments, with five countries providing established options. St. Kitts & Nevis pioneered the concept in 1984 and requires minimum real estate investments of $200,000 (resalable after seven years) or $400,000 (resalable after five years), plus government fees starting at $35,000 for single applicants. Dominica offers investments from $200,000 in approved real estate projects with government fees starting at $25,000. Grenada's program requires $220,000 in approved projects plus $50,000 government fees, with the unique advantage of E-2 treaty investor visa eligibility for the United States. St. Lucia's program starts at $300,000 real estate investment with $30,000 government fees, while Antigua and Barbuda requires $200,000 in approved real estate plus $30,000 in fees. These programs typically process applications within 3-6 months, require no residence requirements, and provide visa-free or visa-on-arrival access to 130-160 countries including the UK, Schengen Area, and Singapore. Due diligence fees range from $7,500-$15,000 depending on family size, and all programs include spouses, dependent children, and in some cases parents and siblings.

Comparative Analysis and Investment Considerations

When evaluating property investment pathways, investors must consider multiple factors beyond minimum investment thresholds. European Golden Visa programs typically offer residency rights with pathways to citizenship, while Caribbean programs provide immediate citizenship. Investment security varies significantly—European properties offer stable markets with appreciation potential, while Caribbean investments often involve government-approved tourism projects with guaranteed buy-back options. Processing times range from 2-4 months for Caribbean citizenship to 6-12 months for European residency permits. Tax implications represent crucial considerations: Portugal's NHR regime offers favorable tax treatment for ten years, Spain taxes worldwide income for residents, while Caribbean jurisdictions typically impose no wealth, inheritance, or capital gains taxes. Due diligence requirements have intensified across all programs, with enhanced background checks and source of wealth verification. Successful applications require comprehensive documentation including property purchase agreements, proof of funds, medical certificates, police clearance certificates, and professional reference letters. Investors should also consider geopolitical stability, currency risks, and exit strategies when selecting appropriate programs.

Strategic Implementation and Future Trends

Implementing a successful residency or citizenship strategy requires careful planning and professional guidance. Engaging specialized immigration lawyers, real estate agents familiar with program requirements, and financial advisors is essential for navigating complex regulatory frameworks. Market trends indicate increasing program sophistication, with rising investment thresholds in European programs and enhanced due diligence procedures across all jurisdictions. The European Union has proposed stricter regulations for Golden Visa programs, potentially leading to higher investment requirements and more rigorous compliance standards. Simultaneously, new programs are emerging in developing markets seeking foreign investment. Successful applicants typically maintain detailed investment records, comply with all reporting requirements, and understand the long-term commitment involved—particularly for citizenship pathways requiring sustained residency. The convergence of digital nomadism with investment immigration represents an emerging trend, with several countries developing hybrid programs combining remote work provisions with investment requirements. As global mobility becomes increasingly valuable, property-based residency and citizenship programs continue evolving to balance economic development objectives with security considerations.

Key Takeaways

- Portugal Golden Visa offers multiple real estate options starting at €280,000 with pathway to EU citizenship after 5 years

- Spain's €500,000 real estate investment provides flexible residency with minimal stay requirements

- Caribbean citizenship programs deliver second passports within 3-6 months through investments from $150,000-$400,000

- All programs require thorough due diligence, clean criminal records, and legitimate source of funds

- Tax implications, processing times, and family inclusion policies vary significantly between programs

- Professional guidance is essential for navigating complex application processes and regulatory requirements

Frequently Asked Questions

What is the main difference between Golden Visa programs and citizenship by investment?

Golden Visa programs typically provide temporary or permanent residency rights with a pathway to citizenship after meeting specific requirements (such as physical presence and language tests), while citizenship by investment programs grant immediate citizenship without residency requirements. Golden Visas are common in European countries like Portugal and Spain, while direct citizenship is offered primarily by Caribbean nations.

Can family members be included in these investment applications?

Yes, most programs allow inclusion of immediate family members. Typically, spouses, dependent children under 18 (sometimes up to 26-30 if studying), and in some cases dependent parents can be included. Additional government fees and due diligence costs apply for each family member, usually ranging from $10,000-$50,000 depending on the program and relationship.

How long does the application process typically take?

Processing times vary significantly by program. Caribbean citizenship applications typically take 3-6 months from submission to passport issuance. European Golden Visa programs generally require 6-12 months for residency permit approval, with citizenship pathways taking 5-10 additional years including physical residence requirements. Accelerated processing options are available in some programs at additional cost.

What are the main risks associated with these investment programs?

Key risks include program changes or termination, real estate market fluctuations, due diligence failures resulting in application rejection, political instability in host countries, and currency exchange risks. Mitigation strategies include working with reputable agents, diversifying investments, understanding exit options, and maintaining compliance with all program requirements throughout the investment period.

Are there minimum stay requirements for maintaining residency status?

Requirements vary significantly. Caribbean citizenship programs typically have no stay requirements. Portugal's Golden Visa requires 7 days in the first year and 14 days in subsequent two-year periods. Spain's program has no minimum stay requirements for maintaining residency. Other European programs may require more substantial physical presence, particularly for citizenship eligibility pathways.

Conclusion

Property investment pathways to residency and citizenship represent sophisticated strategies for global mobility and wealth preservation. As documented in the Global Citizenship Investment Report, these programs continue evolving to balance economic development objectives with security concerns. Successful navigation requires understanding specific program requirements, investment structures, and long-term implications. European Golden Visa programs offer residency rights with citizenship pathways, while Caribbean options provide immediate second citizenship—each serving different investor profiles and objectives. With increasing global competition for investment migration, programs are becoming more specialized while maintaining rigorous due diligence standards. Investors should approach these opportunities as long-term strategic decisions rather than transactional arrangements, recognizing that the ultimate value extends beyond the property investment itself to encompass enhanced global access, security, and lifestyle opportunities for entire families. As regulatory landscapes continue shifting, professional guidance remains essential for maximizing success in this dynamic investment category.