Currency and Financial Risks in International Property Investment: A Comprehensive Guide

International property investment offers lucrative opportunities but is fraught with financial risks, particularly from currency fluctuations, exchange rate volatility, and cross-border tax complexities. This guide explores how exchange rate movements can impact property values, the hidden costs of currency conversion, and effective mitigation strategies like careful financial planning and utilizing local banking solutions. Learn to navigate international tax implications and transfer fees to protect your investment and maximize returns in the global real estate market.

Investing in international real estate can diversify your portfolio and yield high returns, but it introduces unique financial challenges. Currency fluctuations, exchange rate volatility, and international tax complications are significant risks that can erode profits and increase costs. According to the Global Investment Risk Assessment, these factors require meticulous planning to mitigate. This article provides a detailed analysis of financial risks in global property investment, supported by data-driven strategies to safeguard your assets. We will explore how exchange rates impact property values, the true costs of currency conversion, tax implications, and practical mitigation approaches, empowering you to make informed decisions in the dynamic global market.

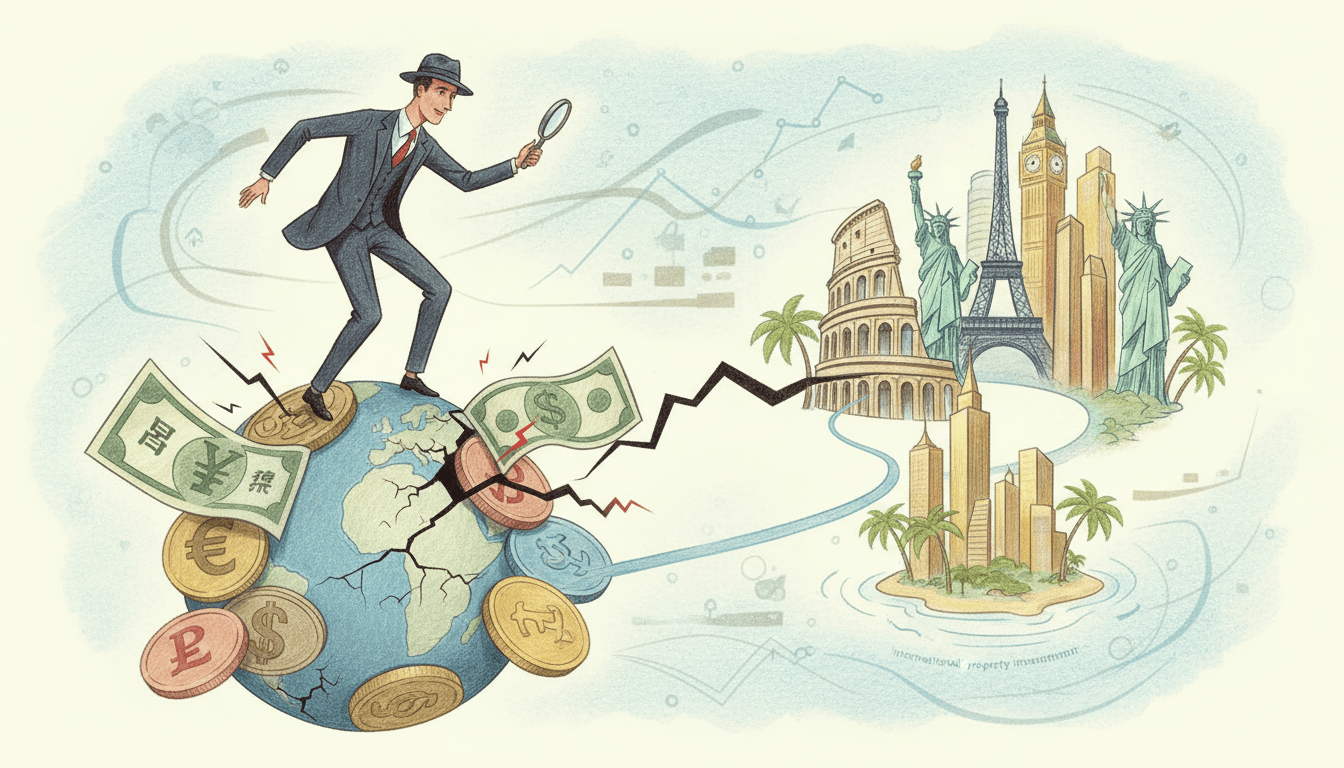

Understanding Currency Fluctuations and Their Impact on Property Value

Currency fluctuations are a primary financial risk in international property investment, as exchange rate movements can significantly alter the effective value of your asset. For instance, if you purchase a property in Europe for €500,000 when the EUR/USD rate is 1.10, the cost in U.S. dollars is $550,000. However, if the euro weakens to 1.05, the property's dollar value drops to $525,000—a 4.5% decrease—even if the local market price remains stable. This volatility affects not only purchase prices but also rental income and resale value. Data from the Global Investment Risk Assessment highlights that currency risks can lead to losses of 10-20% in unstable economic climates. Factors driving these fluctuations include interest rate changes, geopolitical events, and inflation differentials. For example, during the 2020-2023 period, the British pound experienced swings of over 15% against major currencies due to Brexit-related uncertainties, impacting UK property investments. Investors must monitor macroeconomic indicators and use tools like forward contracts to hedge against adverse movements.

The Hidden Costs of Currency Conversion and Transfer Fees

Beyond exchange rate risks, currency conversion costs and transfer fees can add substantial expenses to international property transactions. Banks and payment providers often charge margins of 1-3% on exchange rates, plus fixed fees per transfer. For a $300,000 property purchase, this could mean $3,000 to $9,000 in hidden costs. Additionally, international wire transfers may incur fees of $25-$50 per transaction, and intermediary banks might deduct further charges. The Global Investment Risk Assessment notes that transfer fees are often overlooked in financial planning, leading to budget overruns. To minimize these costs, consider using specialized foreign exchange services that offer competitive rates and transparent pricing. For instance, some platforms provide real-time rate comparisons and bulk transfer discounts. It's also crucial to factor in recurring costs, such as mortgage payments or maintenance fees in foreign currencies, which can accumulate over time. By calculating the total cost of ownership—including conversion expenses—investors can avoid surprises and optimize their financial strategy.

Navigating International Tax Implications and Compliance

International tax complications are a critical aspect of financial risk, as they vary by jurisdiction and can impact profitability. Key issues include capital gains taxes, withholding taxes on rental income, and inheritance taxes. For example, in countries like Spain, non-residents may face a 19% tax on capital gains from property sales, while in the U.S., foreign investors are subject to a 30% withholding tax on gross rental income under FIRPTA. The Global Investment Risk Assessment emphasizes that failure to comply with local tax laws can result in penalties, double taxation, or legal disputes. To mitigate these risks, investors should consult with cross-border tax advisors who can identify treaties between countries—such as the U.S.-U.K. tax treaty—that may reduce liabilities. Additionally, structuring investments through entities like LLCs or trusts can offer tax efficiencies. Proper documentation and understanding of deductions, such as depreciation or expense write-offs, are essential for maximizing returns. According to industry data, proactive tax planning can save investors up to 15% in overall costs.

Mitigation Strategies: Financial Planning and Local Banking Solutions

Effective mitigation of financial risks requires careful financial planning and leveraging local banking resources. As per the Global Investment Risk Assessment, strategies include diversifying currency exposure, setting up local bank accounts, and using hedging instruments. For instance, holding funds in the property's local currency can reduce conversion frequency and costs. Local banking also facilitates smoother transactions for expenses like utilities and taxes, avoiding repeated international transfers. Hedging tools, such as forward contracts or options, allow investors to lock in exchange rates for future payments, protecting against volatility. A case study from Australia shows that investors who hedged AUD/USD rates during the 2021-2022 volatility period saved an average of 8% on purchase costs. Additionally, comprehensive financial planning should involve stress-testing investments under different currency scenarios and maintaining a liquidity buffer for unexpected fees. Collaborating with international financial advisors can provide tailored solutions, such as multi-currency mortgages or investment structures that align with regulatory frameworks. Data indicates that investors who implement these strategies reduce financial risks by up to 25%.

Key Takeaways

- Currency fluctuations can cause property values to swing by 10-20%, requiring active monitoring and hedging.

- Hidden conversion costs and transfer fees add 1-3% to transaction expenses, emphasizing the need for transparent pricing.

- International tax laws, including capital gains and withholding taxes, vary widely and demand expert advice to avoid penalties.

- Mitigation through local banking, diversification, and financial planning can cut risks by up to 25%.

- Use forward contracts and multi-currency accounts to stabilize cash flows and protect against exchange rate volatility.

Frequently Asked Questions

How do exchange rate changes affect my international property investment?

Exchange rate changes directly impact the value of your investment in your home currency. For example, if the local currency depreciates, your property's value and any income from it (like rent) will be worth less when converted back, potentially reducing returns. Monitoring rates and using hedging strategies can help manage this risk.

What are the typical costs associated with currency conversion in property transactions?

Costs include bank exchange rate margins (1-3%), transfer fees ($25-$50 per transaction), and intermediary charges. For a $500,000 purchase, this could total $5,000-$15,000. Using specialized FX services can lower these expenses through better rates and fee transparency.

How can I minimize tax liabilities on international property investments?

Minimize taxes by consulting cross-border tax advisors, leveraging double taxation treaties, and structuring investments efficiently (e.g., through LLCs). Understand local deductions and comply with reporting requirements to avoid penalties and optimize after-tax returns.

What role does local banking play in mitigating financial risks?

Local banking reduces conversion costs and simplifies managing recurring expenses in the property's currency. It also provides access to local financial products and improves transaction efficiency, helping to hedge against currency volatility and regulatory changes.

Conclusion

Navigating currency and financial risks is essential for success in international property investment. By understanding how exchange rates, conversion costs, and tax implications affect your portfolio, you can implement strategies like careful financial planning, local banking, and hedging to protect your assets. The insights from the Global Investment Risk Assessment underscore the importance of proactive risk management. As global markets evolve, staying informed and seeking professional advice will enable you to capitalize on opportunities while minimizing exposures. Embrace these practices to achieve sustainable growth in your cross-border real estate ventures.