International Property Ownership: The Complete Guide to Buying Real Estate Abroad

This comprehensive guide explores the fundamentals of international property ownership, providing detailed insights into legal frameworks, financing mechanisms, and risk management strategies. Covering everything from country-specific ownership restrictions to currency exchange considerations, we examine the complete process of cross-border real estate acquisition. With practical advice on navigating legal systems, securing international financing, and managing operational challenges, this guide serves as an essential resource for global property investors seeking to build diversified portfolios across international markets.

The global real estate market presents unprecedented opportunities for investors seeking portfolio diversification and international exposure. According to Knight Frank's Global Property Report 2024, cross-border property investments accounted for $285 billion in transactions, representing 18% of all commercial real estate investment volume. However, navigating international property ownership requires sophisticated understanding of diverse legal systems, financing mechanisms, and market dynamics. This comprehensive guide examines the critical aspects of buying property abroad, from initial research phases through post-acquisition management, providing investors with the knowledge needed to make informed decisions in complex international markets.

Legal Framework and Ownership Restrictions

Property ownership laws vary dramatically across jurisdictions, with over 65 countries imposing specific restrictions on foreign property ownership. In Thailand, for example, foreigners cannot own land outright but can purchase condominium units, provided foreign ownership in the building does not exceed 49%. Similarly, Mexico maintains the 'Restricted Zone' within 50 kilometers of coastlines and 100 kilometers of borders, requiring foreign buyers to use bank trusts (fideicomisos) for property acquisition. The European Union generally offers favorable conditions for foreign buyers, though countries like Switzerland impose Lex Koller restrictions limiting second home purchases by non-residents. Due diligence must include thorough investigation of local land registry systems, title verification processes, and potential inheritance law implications. Professional legal counsel specializing in international real estate transactions is essential, with typical legal costs ranging from 1-3% of property value depending on jurisdiction complexity.

Financing Strategies and Mortgage Options

International property financing presents distinct challenges, with options ranging from local mortgages to cross-border lending solutions. Local mortgage availability varies significantly, with countries like Spain and Portugal offering favorable terms to foreign buyers (typically 60-70% loan-to-value ratios), while emerging markets may require 40-50% cash deposits. Major international banks including HSBC, Citibank, and Standard Chartered provide cross-border mortgage products for qualified investors, though interest rates typically exceed domestic rates by 0.5-2%. Cash purchases remain prevalent, accounting for approximately 45% of international residential transactions according to Global Property Guide statistics. Creative financing solutions include seller financing, particularly in markets like Costa Rica and Panama where this arrangement comprises nearly 30% of foreign buyer transactions. Currency risk management is crucial, with forward contracts and currency hedging strategies protecting against exchange rate fluctuations that can impact both purchase costs and ongoing mortgage payments.

Operational Challenges and Risk Mitigation

Successful international property ownership requires proactive management of numerous operational challenges. Language barriers complicate legal documentation and negotiations, necessitating certified translation services that typically add $500-2,000 to transaction costs. Property management represents another critical consideration, with professional management companies charging 15-25% of rental income for full-service arrangements. Tax implications span multiple jurisdictions, including potential capital gains taxes, property taxes, and inheritance taxes that vary from nominal rates in jurisdictions like Dubai to progressive systems in European countries. Political and economic stability assessments should inform investment decisions, with resources like the World Bank's Ease of Doing Business Index providing valuable market context. Insurance coverage must address local risks including natural disasters, with comprehensive international property insurance policies averaging 0.3-0.8% of property value annually. Regular legal compliance reviews ensure ongoing adherence to changing foreign ownership regulations and tax reporting requirements.

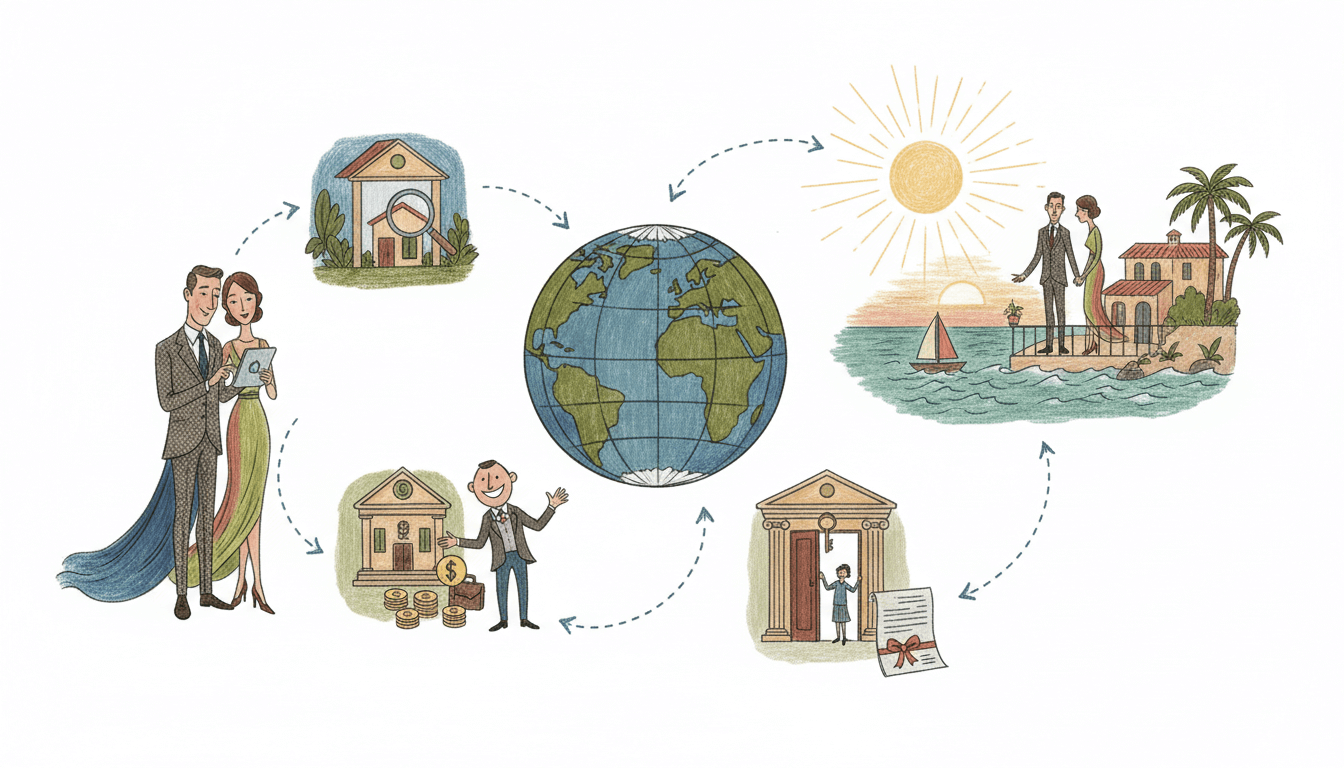

Due Diligence Process and Professional Support

Comprehensive due diligence forms the foundation of successful international property investment. The process should include title searches confirming clean ownership history, zoning verification ensuring intended use compliance, and physical inspection by qualified surveyors. Environmental assessments are particularly important in coastal and rural areas, where development restrictions may apply. Professional team assembly should include local real estate attorneys (average cost: $2,000-8,000), tax advisors specializing in international property (typically $150-400 hourly), and property managers with proven track records. Technical due diligence should assess construction quality, utility infrastructure, and maintenance requirements. Financial due diligence must verify all costs including transfer taxes (2-10% depending on jurisdiction), notary fees (0.5-2%), and ongoing maintenance expenses. Cultural due diligence helps investors understand local business practices and relationship dynamics that impact property management and potential resale.

Key Takeaways

- Foreign ownership restrictions affect 65+ countries globally, requiring specific legal structures for property acquisition

- International mortgage availability varies significantly, with cash purchases representing 45% of cross-border transactions

- Currency exchange risk management is essential, with fluctuations potentially impacting property values by 10-30% annually

- Professional legal and tax advice typically costs 1-5% of property value but is critical for compliance and risk mitigation

- Ongoing management costs average 20% of rental income, necessitating careful financial planning for investment properties

Frequently Asked Questions

What are the most foreigner-friendly countries for property ownership?

Portugal, Spain, and the United States rank among the most accessible markets, with straightforward ownership processes and available financing. Portugal's Golden Visa program specifically encourages foreign investment, while Spain offers non-resident mortgages up to 70% LTV. The United States imposes minimal restrictions beyond standard regulatory requirements, making it particularly attractive for international buyers.

How do currency fluctuations affect international property investments?

Currency movements can significantly impact both purchase costs and investment returns. A 10% appreciation in the local currency relative to your home currency increases effective purchase price by that amount. Similarly, rental income and eventual sale proceeds are subject to exchange rate risk. Professional investors typically hedge 50-70% of currency exposure using forward contracts and options.

What legal documents are essential for international property purchases?

Critical documentation includes certified title deeds, encumbrance certificates confirming no outstanding liens, zoning compliance certificates, and where applicable, foreign investment approval documents. Purchase contracts should be bilingual with certified translations, and power of attorney documents may be necessary if buyers cannot be physically present for transactions.

How do tax obligations differ for international property owners?

Tax obligations typically include property taxes in the host country, potential capital gains taxes upon sale, and possible inheritance taxes. Many countries have tax treaties preventing double taxation, but compliance requirements vary significantly. The United States, for example, imposes FIRPTA withholding of 15% on sale proceeds from foreign investors, while many European countries charge wealth taxes on high-value properties.

Conclusion

International property ownership offers compelling diversification benefits and access to global growth markets, but requires sophisticated approach to legal, financial, and operational challenges. Success hinges on comprehensive due diligence, professional advisory support, and strategic risk management across multiple dimensions. As global economic integration continues advancing, cross-border property investment will likely become increasingly accessible, though the fundamental importance of localized expertise and careful planning remains constant. By understanding the complexities outlined in this guide and building relationships with qualified professionals in target markets, investors can navigate international real estate opportunities with confidence and strategic precision.