All Comparisons

Side-by-side analysis of investment properties and market segments. Compare risk profiles, returns, and opportunities to build your optimal real estate portfolio.

Rental Property Market Dynamics: Multifamily vs Student Accommodation Investment Analysis

The global rental property market is experiencing unprecedented growth driven by demographic shifts and changing lifestyle preferences. This comprehensive analysis examines the two most attractive rental segments - multifamily housing and student accommodation - comparing their investment fundamentals, operational requirements, risk profiles, and income potential. With multifamily properties offering stable long-term returns and student housing delivering exceptional yields during academic cycles, investors must understand the distinct advantages and challenges of each segment to optimize their real estate portfolios.

Emerging Markets Real Estate Opportunities: India vs Africa Investment Analysis

Emerging economies in Asia and Africa present compelling real estate investment opportunities driven by rapid urbanization and demographic growth. India's urban population is projected to reach 600 million by 2030, creating massive demand for residential and commercial properties. African markets offer frontier opportunities with infrastructure development and growing middle classes. Both regions show strong potential but require different investment strategies and risk management approaches.

2024 Global Commercial Real Estate Market Analysis: Investment Strategies & Sector Performance

The global commercial real estate market reached a record $757 billion in total investment volume during 2024, marking a substantial 13% year-over-year growth from 2023. This comprehensive analysis examines the divergent performance across major property sectors, with multifamily properties leading growth through a $37 billion investment surge while office vacancies approach critical levels. Key factors including technological transformation, evolving workplace dynamics, and economic conditions are reshaping investment strategies worldwide, creating both significant opportunities and challenges for international property investors.

Global Real Estate Investment Strategies: Resilient Sector Analysis & Portfolio Allocation

Current global real estate markets present strategic opportunities at the base of the capital market cycle. According to Aberdeen Investments Global Real Estate Market Outlook, investors should adopt overweight allocations to defensive sectors including rented residential properties, student accommodation facilities, data centers, retail warehousing, and core office spaces. This comprehensive analysis examines each sector's risk-return profile, income stability characteristics, and growth potential, providing detailed comparisons for portfolio construction. The recommended long-term, diversified approach emphasizes high-quality assets with stable income returns during market transitions.

Global Real Estate Technology Integration: AI, IoT, and Blockchain Compared

Technological advancements are fundamentally reshaping global real estate markets through PropTech innovations. Artificial Intelligence, Internet of Things, and blockchain technologies are driving unprecedented efficiency, transparency, and automation in property transactions and management. According to Straits Research analysis, these technologies collectively enhance market operations while smart city initiatives expand infrastructure investments. This comprehensive comparison examines how each technology impacts property investment strategies, operational costs, and long-term value creation for international real estate portfolios.

PropTech Revolution: AI, IoT, and Blockchain Transforming Real Estate Investment

Property Technology (PropTech) is fundamentally reshaping global real estate through AI-driven analytics, IoT-enabled smart infrastructure, and blockchain-secured transactions. These innovations enhance property management efficiency by 30-40%, boost market transparency with immutable records, and increase property values by 15-25% through smart home integrations. According to Straits Research, investments in PropTech surged by 78% in 2024, making technological readiness a critical factor for modern property investments. This comparison evaluates core technologies to guide investors in leveraging PropTech for superior returns.

2024-2025 Global Commercial Real Estate Market Analysis: Investment Opportunities & Sector Comparisons

The global commercial real estate market demonstrated remarkable resilience in 2024-2025, with total transaction volumes surging to $757 billion, representing a robust 13% increase from 2023 levels. This comprehensive analysis examines the multifamily sector's $37 billion investment surge and the surprising $22 billion growth in office investments despite persistent 14-19% vacancy rates. The market shift toward operational-intensive assets like rented residential, student accommodation, and data centers reflects evolving investor preferences for stable cash flow and technological infrastructure. This detailed comparison provides strategic insights for navigating today's complex commercial property landscape.

European Real Estate Market Dynamics 2024: Investment Surge & Rental Growth Analysis

The European real estate market demonstrated remarkable resilience in 2024, with investment volumes surging 46% in the fourth quarter and achieving a 15% annual increase. Property rents across Europe grew by 4% annually, led by standout performances in the Netherlands, Portugal, Sweden, Spain, and Denmark. This comprehensive analysis examines the driving factors behind this growth, compares different investment strategies, and provides actionable insights for global investors seeking to capitalize on Europe's evolving property landscape.

Commercial Real Estate Segment Analysis: Office, Industrial, Retail & Alternative Property Investment Comparison

This comprehensive analysis examines four primary commercial real estate segments: office buildings, industrial/logistics facilities, retail spaces, and alternative properties like data centers. The market evolution driven by e-commerce growth, technological advancements, and changing work patterns has reshaped investment priorities, with industrial and office segments leading in investment value. Understanding each segment's unique characteristics, risk profiles, and growth drivers is essential for strategic property investment decisions in today's dynamic global real estate landscape.

Global Real Estate Market Forecast 2025-2029: Residential vs Commercial Investment Analysis

The global real estate market is positioned for substantial growth, with residential real estate projected to reach $727.80 trillion by 2029 and the United States leading with $136.6 trillion in market value by 2025. This comprehensive analysis examines residential versus commercial investment opportunities, evaluating urbanization trends, technological integration, and shifting work patterns. We provide detailed comparisons of risk profiles, capital requirements, and regional market dynamics to help investors make informed decisions in this rapidly evolving landscape.

REITs vs. Direct Property Investment: Comprehensive Market Analysis 2025

Real Estate Investment Trusts (REITs) have transformed real estate investing by providing liquid access to diversified property portfolios. Unlike direct ownership requiring substantial capital and management, REITs offer institutional-grade exposure with daily liquidity. The global REIT market has grown to over $2.5 trillion, attracting both institutional funds managing pension assets and individual investors seeking stable dividend income. This comparison examines structural differences, risk profiles, and performance metrics between REITs and traditional property investment across residential, commercial, and industrial sectors.

Global Residential Real Estate Trends 2023-2050: Urbanization vs Suburban Shift Analysis

The global residential real estate market is undergoing transformative changes with 55% current urban population projected to reach 68% by 2050. India alone expects 416 million new urban residents, creating unprecedented demand pressures. This comprehensive analysis compares urban versus suburban investment opportunities, examining demographic shifts, flexible living demands, and emerging market dynamics. Strategic investors must navigate rising urban density against growing preference for suburban spaces driven by remote work patterns and quality-of-life considerations.

Real Estate Market Risk Management: Strategic Approaches for Global Investors

In today's volatile global real estate market, investors are increasingly adopting cautious, strategic approaches to mitigate risks while maximizing returns. According to Aberdeen Investments' Global Investment Strategies, key risk management strategies include diversification across property types and geographic regions, maintaining a long-term investment horizon of 7-10 years, and focusing on high-quality assets with strong operational fundamentals. This comprehensive analysis compares traditional versus modern risk management approaches, examines sectors with stable income potential like multifamily housing and industrial properties, and provides data-driven insights for strategic market entry during different phases of the real estate cycle.

North American Real Estate Market Insights: Investment Property Comparison 2025

The North American real estate market is projected to reach $136.6 trillion by 2025, driven by economic growth, low unemployment, and favorable interest rates. This comprehensive analysis compares three key investment segments: suburban residential properties, flexible office spaces, and industrial real estate. With major markets like New York, Los Angeles, and Chicago continuing to dominate, investors are adapting to post-pandemic trends including increased demand for suburban living, hybrid work environments, and e-commerce logistics infrastructure. Understanding these market dynamics is crucial for maximizing returns in today's competitive landscape.

Urban Real Estate Development Trends: Global Mega-City Property Investment Analysis

This comprehensive analysis examines urban real estate development trends driven by rapid urbanization, projected to reach 68% global urban population by 2050. We compare investment opportunities in key mega-cities including Beijing, Mumbai, and Lagos, analyzing residential and commercial property markets, infrastructure developments, regulatory environments, and growth potential. The comparison reveals distinct advantages and challenges across these emerging urban centers, providing investors with data-driven insights for strategic property allocation in high-growth urban markets.

Sustainable Real Estate Development: Green Building vs Traditional Construction Investment Analysis

This comprehensive analysis compares sustainable real estate development against traditional construction methods, examining key investment metrics, environmental impact, and market performance. Sustainable properties demonstrate 15-25% higher energy efficiency, 10-20% premium valuations, and significantly lower operating costs. With global green building certification growth exceeding 30% annually and smart technology integration becoming standard, environmentally conscious developments now outperform conventional properties across multiple investment criteria while addressing climate change concerns.

Hospitality Real Estate Investment Trends: High-End vs Budget Hotels Analysis

The hospitality real estate sector has demonstrated remarkable resilience and growth, with hotels ranking among the top 10 asset types by income according to PwC's Emerging Trends in Real Estate Report. This comprehensive analysis examines the current investment landscape, focusing on the outperformance of high-end luxury properties and budget hotel segments. The sector's unique ability to reprice quickly in response to inflation has attracted significant capital investment, particularly in European markets experiencing strong tourism rebound. We explore the specific metrics, operational considerations, and investment strategies that make hospitality real estate a compelling opportunity for global investors.

Asia-Pacific Real Estate Market Trends 2024: Investment Opportunities Analysis

The Asia-Pacific commercial real estate market has reached a staggering $11.9 trillion valuation in 2024, establishing itself as the world's largest property investment region. Office and industrial/logistics segments are driving the majority of investment activity, with Japan experiencing unprecedented growth due to currency advantages, tourism expansion, and global capital inflows. This comprehensive analysis examines the key market drivers, regional variations, and investment strategies for institutional funds, REITs, and private equity firms operating in the APAC property landscape.

Global Real Estate Market Challenges: Inflation, Interest Rates & Investment Strategies

The global real estate market is navigating unprecedented challenges with rising inflation reaching 7-9% in major economies, central bank interest rate hikes of 300-500 basis points, and widespread economic uncertainty. Developers have reduced project investments by 15-25% globally due to declining demand and escalating borrowing costs. Residential markets have seen 8-12% price corrections while commercial sectors face 12-18% valuation declines. This comprehensive analysis examines regional variations, investment implications, and strategic responses to current market conditions based on KPMG's authoritative research.

Alternative Real Estate Investment Segments: Data Centers, Senior Living & Specialized Industrial Properties

As traditional residential and commercial real estate markets become increasingly saturated, savvy investors are turning to alternative segments offering superior risk-adjusted returns. This comprehensive analysis examines three high-growth alternative real estate categories: data centers experiencing explosive demand from cloud computing and AI, senior living facilities benefiting from demographic shifts, and specialized industrial properties serving e-commerce and supply chain modernization. Each segment presents unique investment characteristics, with data centers showing 12-15% average annual returns, senior living facilities demonstrating 8-11% stabilized yields, and specialized industrial properties generating 7-10% cash-on-cash returns while offering portfolio diversification benefits.

Asia Pacific Real Estate Market Dynamics: Investment Opportunities and Regional Analysis

The Asia Pacific real estate market has surged to a commercial valuation of $11.9 trillion in 2024, driven by rapid urbanization, economic growth, and infrastructure investments. Key sectors like office, industrial, and logistics properties are leading investment activity, with emerging markets such as China and India offering significant opportunities. This analysis compares regional dynamics, investment strategies, and sector-specific trends to guide investors in navigating this robust market.

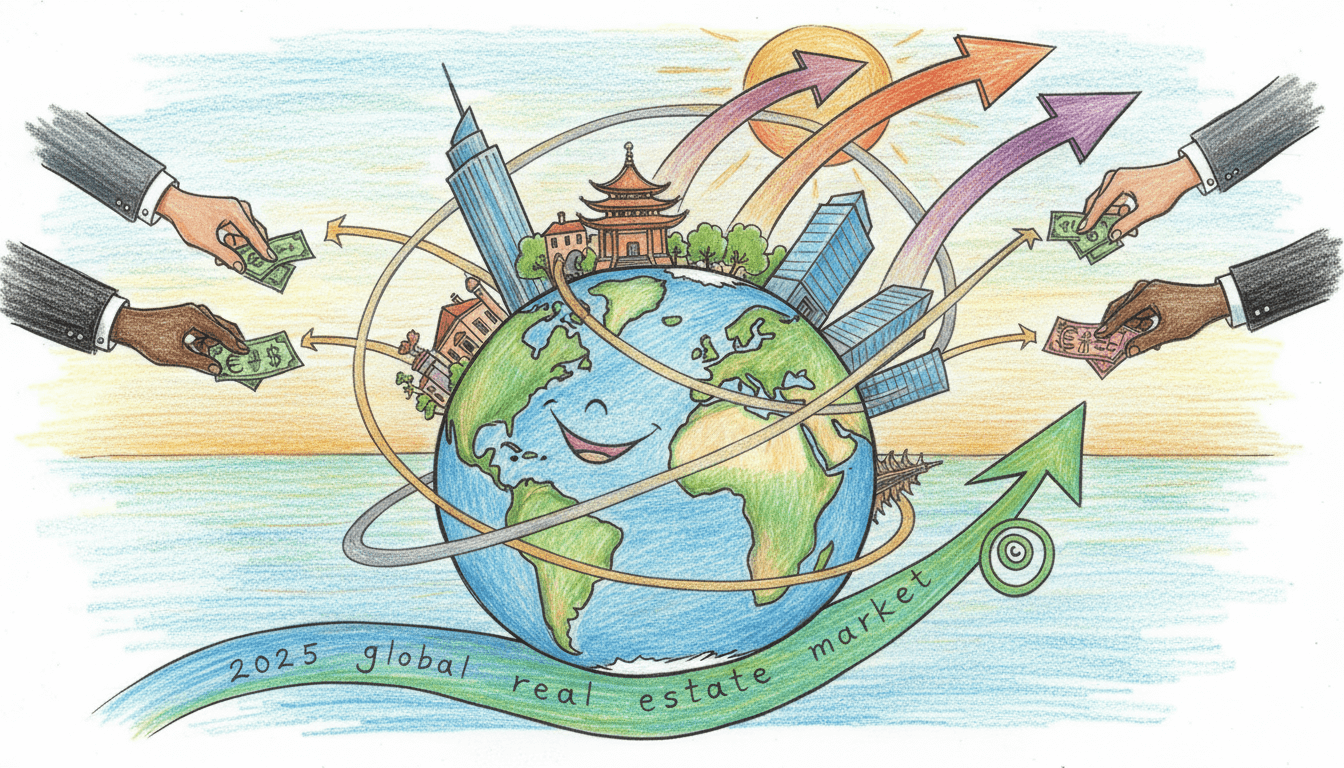

Global Real Estate Investment Landscape 2025: Sector Comparison and Regional Analysis

The 2025 global real estate market demonstrates remarkable resilience with industrial properties leading at $37 billion Q4 2023 investments, while hospitality shows unprecedented recovery. North America, Europe, and Asia-Pacific emerge as dominant regions with distinct sector advantages. Commercial real estate maintains robust growth patterns, supported by 17% global direct investment volume increase in Q3 2025. This comprehensive analysis examines investment strategies, risk factors, and future projections across key property sectors.