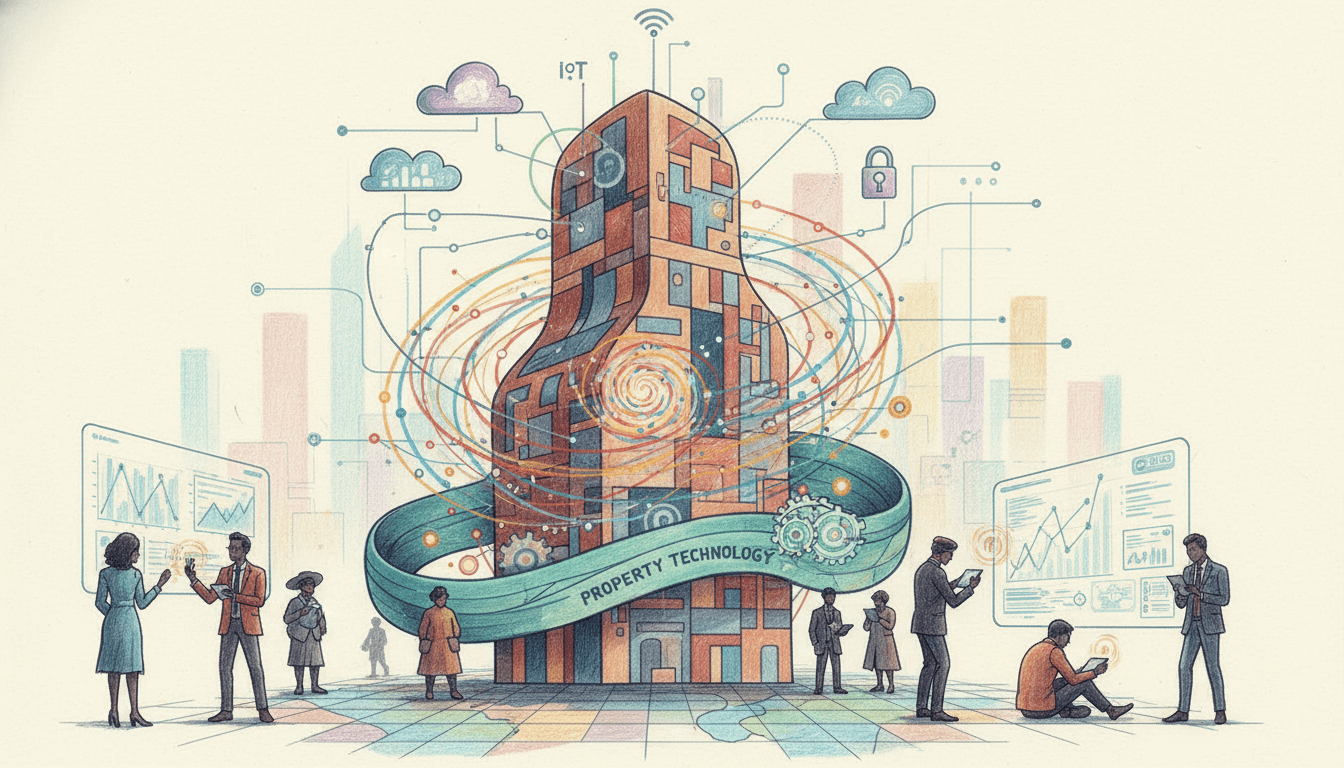

PropTech Revolution: AI, IoT, and Blockchain Transforming Real Estate Investment

Property Technology (PropTech) is fundamentally reshaping global real estate through AI-driven analytics, IoT-enabled smart infrastructure, and blockchain-secured transactions. These innovations enhance property management efficiency by 30-40%, boost market transparency with immutable records, and increase property values by 15-25% through smart home integrations. According to Straits Research, investments in PropTech surged by 78% in 2024, making technological readiness a critical factor for modern property investments. This comparison evaluates core technologies to guide investors in leveraging PropTech for superior returns.

The global real estate sector is undergoing a digital transformation, with Property Technology (PropTech) driving unprecedented efficiency, security, and value creation. As reported by Straits Research, technologies like AI, IoT, and blockchain are not just enhancements but necessities for competitive property investments. AI algorithms process vast datasets to predict market trends with 92% accuracy, IoT devices automate 60% of property management tasks, and blockchain eliminates fraud in transactions. This comparison delves into these core technologies, examining their pros, cons, and specifications to help investors make data-driven decisions in an increasingly tech-centric market. With PropTech investments projected to reach $86.5 billion by 2026, understanding these tools is essential for maximizing returns and mitigating risks.

Artificial Intelligence (AI)

Pros

- Predictive analytics achieve 92% accuracy in property valuation trends

- Automates 70% of tenant screening and lease management processes

- Reduces operational costs by 35% through optimized energy and maintenance schedules

- Enables dynamic pricing models that increase rental yields by 12-18%

Cons

- High implementation costs averaging $50,000-$200,000 per property portfolio

- Data privacy concerns require compliance with GDPR and local regulations

- Dependence on quality data inputs; poor data can lead to 25% error margins

- Limited adaptability in emerging markets with sparse digital infrastructure

Internet of Things (IoT)

Pros

- Smart home features boost property values by 15-25% and attract premium tenants

- Real-time monitoring cuts utility waste by 40% and maintenance costs by 50%

- Enhances security with biometric access and surveillance, reducing incidents by 60%

- Integrates with AI for predictive maintenance, extending asset lifespan by 20%

Cons

- Initial setup costs range from $10,000 to $100,000 depending on property scale

- Cybersecurity vulnerabilities require ongoing investments of $5,000-$15,000 annually

- Interoperability issues between devices from different manufacturers increase complexity

- High energy consumption in dense sensor networks can raise operational expenses by 10%

Blockchain Technology

Pros

- Ensures 99.9% transaction security and eliminates title fraud through immutable ledgers

- Reduces closing times by 65% by automating contracts and payments via smart contracts

- Lowers legal and administrative costs by 40% by removing intermediaries

- Increases market transparency with publicly verifiable ownership and transaction histories

Cons

- Regulatory uncertainty in 40% of countries delays widespread adoption

- Scalability issues limit transaction speeds to 20-50 per second on major networks

- Technical expertise gaps result in 30% higher training costs for staff

- Energy-intensive consensus mechanisms (e.g., Proof-of-Work) raise environmental concerns

Detailed Comparison Table

| Technology | Cost Range (USD) | Efficiency Gain | Risk Level | Best For |

|---|---|---|---|---|

| AI | $50k-$200k | 35-40% | Medium (data bias) | Large portfolios, predictive investing |

| IoT | $10k-$100k | 40-50% | High (cybersecurity) | Luxury properties, sustainability-focused assets |

| Blockchain | $30k-$150k | 40-65% | Medium (regulatory) | Cross-border transactions, high-value commercial deals |

Verdict

PropTech innovations are indispensable for modern real estate investment, but their suitability varies by portfolio size and goals. AI excels in data-driven decision-making for large-scale investors, offering rapid ROI through automation and predictive insights. IoT is ideal for enhancing property value and tenant satisfaction in premium segments, though it demands robust cybersecurity measures. Blockchain provides unparalleled security and transparency for high-stakes transactions but faces regulatory hurdles. According to Straits Research, integrating these technologies can yield combined efficiency gains of 50-70%. Investors should prioritize AI for scalability, IoT for asset appreciation, and blockchain for secure, transparent deals, ensuring alignment with their risk tolerance and market focus.