Emerging Markets Real Estate Opportunities: India vs Africa Investment Analysis

Emerging economies in Asia and Africa present compelling real estate investment opportunities driven by rapid urbanization and demographic growth. India's urban population is projected to reach 600 million by 2030, creating massive demand for residential and commercial properties. African markets offer frontier opportunities with infrastructure development and growing middle classes. Both regions show strong potential but require different investment strategies and risk management approaches.

The global real estate landscape is undergoing a significant transformation as emerging markets in Asia and Africa present unprecedented investment opportunities. According to Straits Research Global Market Analysis, rapid urbanization, population growth, and infrastructure development are creating robust demand for both residential and commercial properties. With India's urban population projected to grow substantially and African markets experiencing economic transformation, investors are increasingly looking beyond traditional markets for higher returns. This comprehensive analysis examines the key opportunities, challenges, and strategic considerations for real estate investment in these dynamic regions, providing investors with actionable insights to navigate these complex markets effectively.

India Real Estate Market

Pros

- Massive urbanization with projected 600 million urban residents by 2030

- Strong economic growth averaging 6-7% annually driving property demand

- Government initiatives like Smart Cities Mission and Housing for All

- Growing middle class with increasing purchasing power

- Well-established legal framework for property transactions

- Diversified market opportunities across residential, commercial, and industrial sectors

Cons

- Complex regulatory environment with varying state-level regulations

- Infrastructure challenges in rapidly growing urban centers

- Price volatility in certain market segments

- Bureaucratic hurdles for foreign investors

- Land acquisition challenges and title verification issues

- Environmental compliance requirements adding to project costs

Africa Real Estate Market

Pros

- Frontier market opportunities with early-mover advantages

- Rapid urban migration creating housing demand gaps

- Young demographic profile with 60% population under 25 years

- Infrastructure development driving property values

- Growing middle class and consumer spending power

- Diversified opportunities across multiple countries and sectors

Cons

- Political instability in certain regions affecting investment security

- Underdeveloped legal frameworks for property rights

- Currency volatility and exchange rate risks

- Limited reliable market data and transparency

- Infrastructure deficits affecting property development

- Higher perceived risk profile requiring specialized expertise

Detailed Comparison Table

| Factor | India | Africa | Advantage |

|---|---|---|---|

| Market Maturity | Established with clear cycles | Emerging with growth potential | Africa for growth, India for stability |

| Regulatory Framework | Comprehensive but complex | Developing with variations | India for structure, Africa for flexibility |

| Urbanization Rate | 35% growing to 40% by 2030 | 43% with rapid acceleration | Africa for pace, India for scale |

| Investment Security | High with established systems | Moderate with country variations | India for security, Africa for returns |

| Infrastructure Development | Ongoing major projects | Significant development needs | Both offer opportunities |

| Rental Yields | 2-9% depending on sector | 5-12% across markets | Africa for income generation |

| Capital Appreciation | 6-12% annually | 8-15% annually | Africa for growth potential |

| Foreign Investment Rules | Structured with restrictions | Varied by country, generally open | Both accessible with conditions |

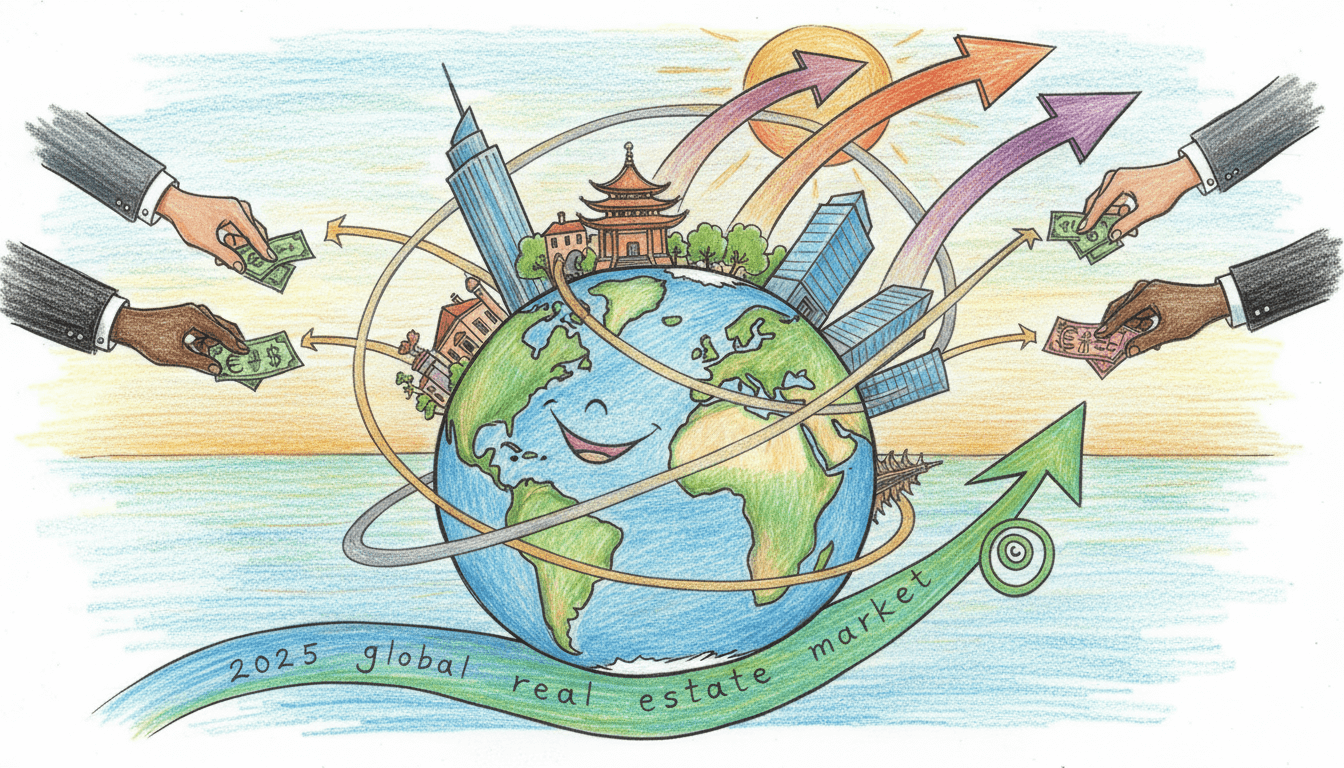

Verdict

Both India and Africa offer compelling real estate investment opportunities, but they cater to different investor profiles and risk appetites. India presents a more structured market with established legal frameworks and predictable growth patterns, making it ideal for risk-averse investors seeking stable returns. The massive scale of urbanization and government initiatives provide multiple entry points across residential, commercial, and industrial sectors. Africa, while carrying higher perceived risks, offers superior growth potential and rental yields for investors with specialized knowledge and risk tolerance. The rapid urbanization and demographic advantages create unique opportunities in markets like Nigeria, Kenya, and Ghana. Strategic investors should consider a diversified approach, allocating to both regions based on their risk profile, investment horizon, and expertise. Due diligence, local partnerships, and long-term perspective are crucial for success in both markets. According to Straits Research data, the combination of urbanization drivers and population growth makes these emerging markets essential components of any global real estate investment portfolio.