Hospitality Real Estate Investment Trends: High-End vs Budget Hotels Analysis

The hospitality real estate sector has demonstrated remarkable resilience and growth, with hotels ranking among the top 10 asset types by income according to PwC's Emerging Trends in Real Estate Report. This comprehensive analysis examines the current investment landscape, focusing on the outperformance of high-end luxury properties and budget hotel segments. The sector's unique ability to reprice quickly in response to inflation has attracted significant capital investment, particularly in European markets experiencing strong tourism rebound. We explore the specific metrics, operational considerations, and investment strategies that make hospitality real estate a compelling opportunity for global investors.

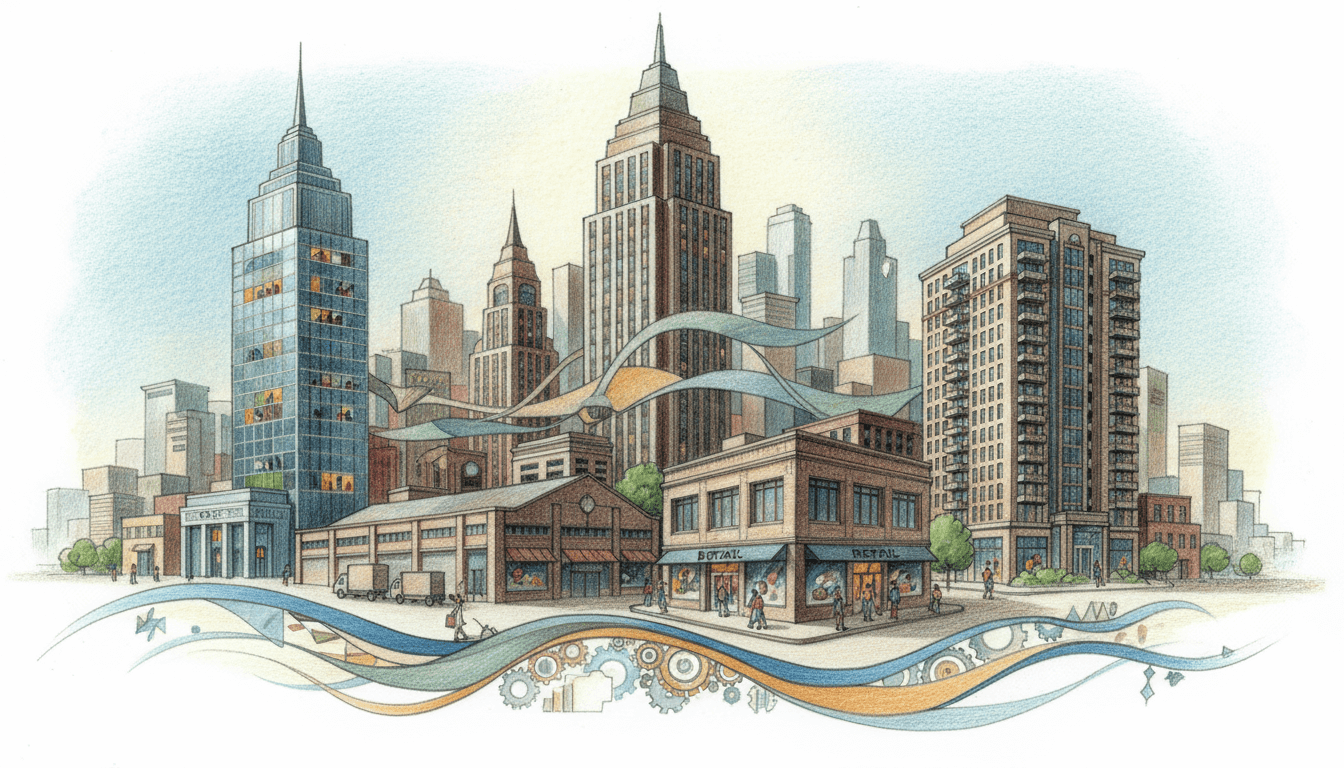

The hospitality real estate sector has emerged as a standout performer in the global property market, demonstrating exceptional resilience and growth potential. According to the authoritative PwC Emerging Trends in Real Estate Report, hotels have secured their position among the top 10 asset types ranked by income generation, marking a significant shift in investor preferences. This remarkable performance is largely attributed to the sector's unique ability to reprice room rates quickly in response to inflationary pressures, providing a natural hedge against economic volatility. The post-pandemic tourism rebound, particularly strong in European markets, has further accelerated investment activity, with capital flowing into both luxury and budget segments. This comprehensive analysis delves into the specific factors driving this trend, examining the operational characteristics, financial metrics, and strategic considerations that distinguish high-end hotels from their budget counterparts in today's competitive investment landscape.

High-End Luxury Hotels

Pros

- Premium average daily rates (ADR) ranging from $300-$800+ depending on location and brand

- Strong revenue per available room (RevPAR) performance with typical margins of 25-35%

- Multiple revenue streams including fine dining, spa services, and event spaces

- Brand recognition and loyalty program benefits driving consistent occupancy

- Higher barrier to entry limits competition in premium segments

- Better positioned for corporate contracts and international tourism

Cons

- Substantial capital expenditure requirements averaging $50,000-$150,000 per key

- Higher operating costs with staff-to-room ratios of 1.2-1.8 employees per room

- Vulnerability to economic downturns and corporate travel budget cuts

- Longer development timelines of 24-36 months for new constructions

- Intensive management requirements and specialized operational expertise needed

- Seasonal fluctuations more pronounced in luxury leisure destinations

Budget Hotels

Pros

- Lower development costs averaging $75,000-$125,000 per key

- Streamlined operations with staff-to-room ratios of 0.3-0.6 employees per room

- Consistent demand driven by essential travel and price-sensitive segments

- Faster development cycles of 12-18 months for new constructions

- Strong franchise support and standardized operating procedures

- Resilient performance during economic downturns due to essential travel nature

Cons

- Lower average daily rates typically ranging from $80-$150

- Thinner profit margins of 15-25% requiring volume-driven strategy

- Intense competition from new entrants and alternative accommodations

- Limited ancillary revenue opportunities beyond basic amenities

- Higher customer acquisition costs due to price sensitivity

- Franchise dependency with royalty fees of 4-6% of room revenue

Extended Stay Properties

Pros

- Stable revenue streams with average length of stay of 7-21 days

- Lower operating costs due to reduced housekeeping and linen requirements

- Consistent demand from corporate relocations, project teams, and medical stays

- Higher operational efficiency with limited food and beverage requirements

- Reduced seasonality compared to traditional transient hotels

- Attractive to both business and leisure extended-stay travelers

Cons

- Specialized market knowledge required for optimal performance

- Limited brand recognition in some markets compared to traditional hotels

- Higher utility costs due to extended guest stays and kitchen facilities

- Smaller potential guest base focused specifically on extended-stay needs

- More complex unit turnover processes between long-term guests

- Limited opportunities for dynamic pricing compared to daily-rate hotels

Detailed Comparison Table

| Metric | High-End Hotels | Budget Hotels | Extended Stay |

|---|---|---|---|

| Average Daily Rate (ADR) | $300-$800+ | $80-$150 | $120-$250 |

| Occupancy Percentage | 68-78% | 72-82% | 75-85% |

| RevPAR Performance | High Volatility | Moderate Stability | High Stability |

| Development Cost per Key | $250,000-$500,000 | $75,000-$125,000 | $100,000-$200,000 |

| Cap Rate Range | 5.5-7.5% | 7.5-9.5% | 6.5-8.5% |

| Staff to Room Ratio | 1.2-1.8 | 0.3-0.6 | 0.4-0.8 |

| Typical ROI Period | 7-10 years | 5-8 years | 6-9 years |

| Operating Margin | 25-35% | 15-25% | 20-30% |

| Brand Dependency | High | Medium-High | Medium |

| Economic Resilience | Moderate | High | Very High |

Verdict

The hospitality real estate sector presents compelling investment opportunities across all segments, with each offering distinct advantages tailored to different investor profiles and risk appetites. High-end luxury hotels deliver premium returns through superior average daily rates and multiple revenue streams, making them ideal for institutional investors with substantial capital and long-term horizons. Budget hotels offer attractive entry points with lower capital requirements and demonstrated resilience during economic fluctuations, appealing to private investors and regional operators. Extended stay properties occupy a strategic middle ground, combining stable revenue streams with operational efficiencies that cater to both corporate and leisure extended-stay markets. According to PwC's comprehensive analysis, the sector's position among the top 10 asset types by income is well-deserved, driven by strong tourism recovery, inflationary repricing advantages, and diversified demand drivers. Successful investment strategies should consider market-specific dynamics, operator expertise, and alignment with broader portfolio objectives while maintaining focus on operational excellence and asset quality.