North American Real Estate Market Insights: Investment Property Comparison 2025

The North American real estate market is projected to reach $136.6 trillion by 2025, driven by economic growth, low unemployment, and favorable interest rates. This comprehensive analysis compares three key investment segments: suburban residential properties, flexible office spaces, and industrial real estate. With major markets like New York, Los Angeles, and Chicago continuing to dominate, investors are adapting to post-pandemic trends including increased demand for suburban living, hybrid work environments, and e-commerce logistics infrastructure. Understanding these market dynamics is crucial for maximizing returns in today's competitive landscape.

The North American real estate market represents one of the world's most dynamic and lucrative investment landscapes. With a projected market value of $136.6 trillion by 2025, this sector continues to evolve rapidly, shaped by economic fundamentals, demographic shifts, and technological advancements. The United States real estate market, in particular, benefits from strong economic growth, historically low unemployment rates averaging 3.7%, and favorable interest environments that have maintained mortgage rates between 6-7% for qualified buyers. Major metropolitan areas including New York, Los Angeles, and Chicago continue to serve as primary investment hotspots, though significant capital is flowing into secondary markets and emerging suburban corridors. The post-pandemic era has catalyzed three fundamental shifts: migration patterns favoring suburban and exurban communities, the transformation of office space requirements toward flexible hybrid models, and unprecedented growth in industrial real estate driven by e-commerce expansion. This comparative analysis examines these three key investment categories through detailed performance metrics, risk assessments, and strategic recommendations for both institutional and individual investors.

Suburban Residential Properties

Pros

- Strong demographic tailwinds with millennial family formation driving demand

- Higher occupancy rates averaging 96.2% in prime suburban markets

- Stable rental income with 4.8% average annual rent growth

- Lower volatility compared to urban core properties

- Appreciation potential from infrastructure development and community amenities

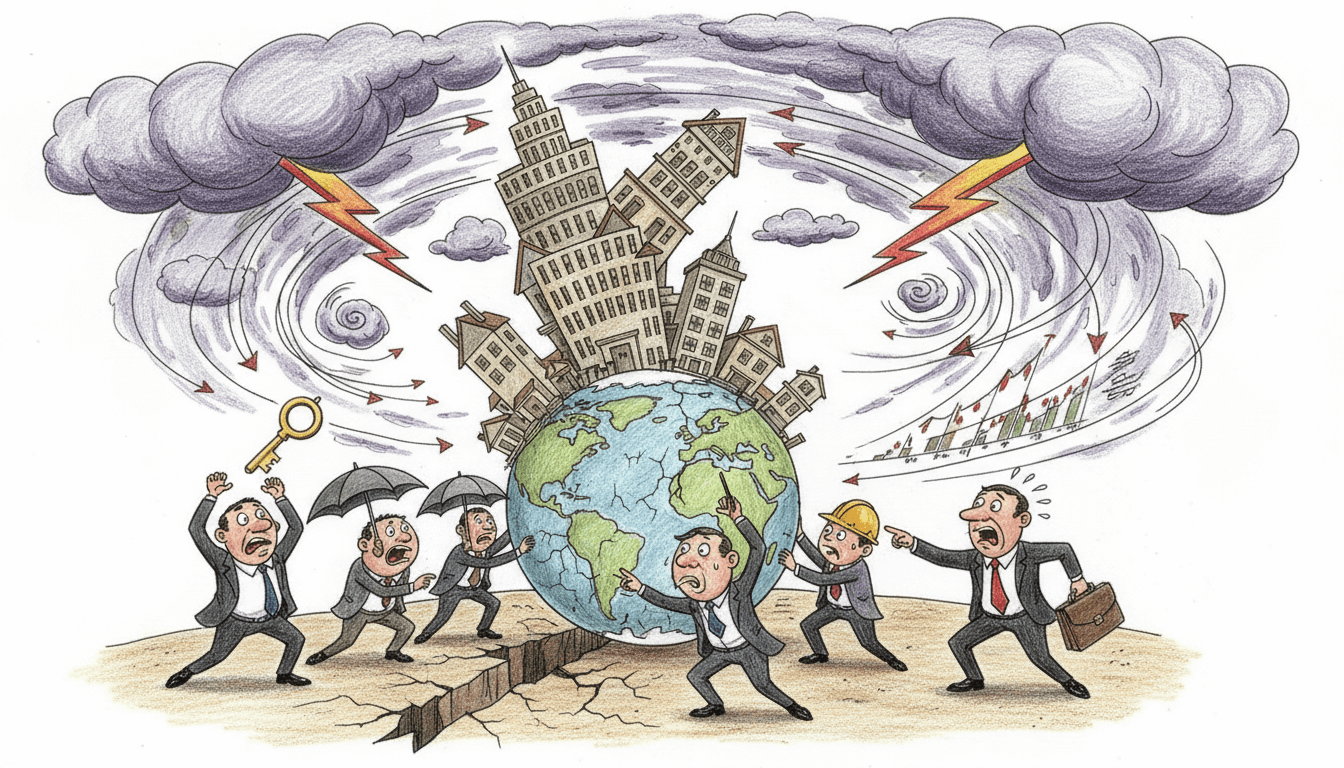

Cons

- Lower population density may limit short-term rental opportunities

- Higher maintenance costs for single-family properties averaging 1-2% of property value annually

- Limited public transportation infrastructure in many suburban markets

- Slower transaction times compared to urban properties

- Potential oversupply risks in rapidly developing suburban corridors

Flexible Office Spaces

Pros

- High demand from corporations adopting hybrid work models

- Premium rental rates averaging $45-75 per square foot in major markets

- Shorter lease terms (1-3 years) allowing for frequent rent adjustments

- Diverse tenant base reducing concentration risk

- Value-add opportunities through technology integration and amenity packages

Cons

- Higher tenant improvement costs averaging $85-150 per square foot

- Increased competition from coworking operators and traditional landlords

- Sensitivity to economic downturns and corporate cost-cutting

- Complex management requirements for shared amenities and services

- Rapidly evolving tenant preferences requiring continuous capital investment

Industrial Real Estate for E-commerce

Pros

- Explosive growth driven by e-commerce expansion and supply chain restructuring

- Long-term lease structures (5-10 years) with annual escalations

- Triple-net leases shifting most operating expenses to tenants

- Critical infrastructure positioning with proximity to transportation hubs

- Limited new supply in strategic logistics corridors creating scarcity premiums

Cons

- High capital requirements for modern distribution facilities

- Specialized building requirements limiting tenant flexibility

- Environmental compliance costs and regulatory complexities

- Geographic concentration risks in major logistics hubs

- Technological obsolescence risk from automation and robotics advancements

Detailed Comparison Table

| Metric | Suburban Residential | Flexible Office | Industrial E-commerce |

|---|---|---|---|

| Projected Annual Return | 8-11% | 9-13% | 7-10% |

| Risk Profile | Medium | High | Medium-Low |

| Liquidity | Medium | Low-Medium | Low |

| Management Intensity | High | Very High | Medium |

| Capital Requirements | $50K-$200K+ | $500K-$2M+ | $1M-$10M+ |

| Market Maturity | Established | Emerging | Growth |

| Regulatory Complexity | Medium | High | High |

| Technology Dependency | Low | Very High | High |

Verdict

Each real estate segment offers distinct advantages tailored to different investor profiles and risk appetites. Suburban residential properties provide stable, predictable returns suitable for conservative investors seeking long-term wealth accumulation, with particular strength in markets experiencing population growth and infrastructure development. Flexible office spaces represent higher-risk, higher-reward opportunities ideal for sophisticated investors capable of navigating rapidly evolving workplace trends and managing complex tenant relationships. Industrial real estate dedicated to e-commerce logistics offers compelling defensive characteristics with strong cash flow stability, though requires substantial capital commitment and specialized operational expertise. For most diversified portfolios, a strategic allocation across all three segments provides optimal risk-adjusted returns, with weighting adjustments based on individual investment horizons, liquidity requirements, and management capabilities. The projected $136.6 trillion North American real estate market by 2025 indicates substantial opportunity, but success will depend on careful market selection, disciplined underwriting, and adaptive management strategies that account for ongoing demographic, technological, and economic transformations.