European Real Estate Market Dynamics 2024: Investment Surge & Rental Growth Analysis

The European real estate market demonstrated remarkable resilience in 2024, with investment volumes surging 46% in the fourth quarter and achieving a 15% annual increase. Property rents across Europe grew by 4% annually, led by standout performances in the Netherlands, Portugal, Sweden, Spain, and Denmark. This comprehensive analysis examines the driving factors behind this growth, compares different investment strategies, and provides actionable insights for global investors seeking to capitalize on Europe's evolving property landscape.

The European real estate market has emerged as a beacon of stability and growth amid global economic uncertainties, with 2024 performance metrics exceeding expectations across multiple dimensions. According to the latest data from Aberdeen Investments and INREV Quarterly Consensus Indicator, the market witnessed unprecedented momentum in the final quarter, driving annual performance to impressive heights. The 46% quarter-over-quarter investment volume increase represents the strongest Q4 performance in a decade, while the sustained 15% annual growth demonstrates the market's underlying strength. Simultaneously, the 4% average rental growth across all property types indicates robust demand fundamentals, with several European nations delivering exceptional returns that merit detailed examination for strategic investment planning.

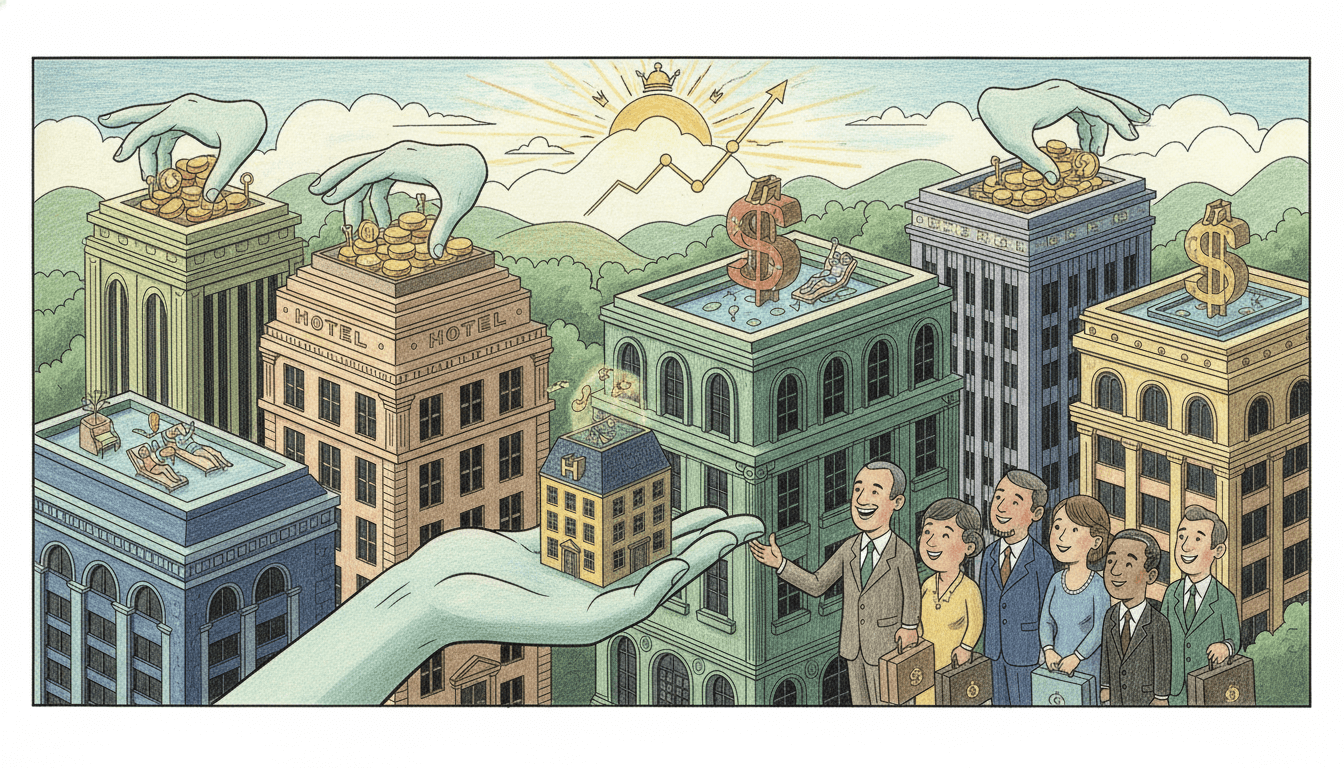

Commercial Real Estate Investment

Pros

- 46% quarterly volume growth indicates strong investor confidence

- Stable 15% annual investment volume increase provides predictable growth patterns

- Superior rental yield potential in prime locations (5-7% average)

- Long-term lease structures provide cash flow stability

- Portfolio diversification benefits across office, retail, and industrial sectors

Cons

- Higher capital requirements for entry compared to residential properties

- Longer vacancy periods during economic downturns

- Complex regulatory compliance across different European jurisdictions

- Significant maintenance and operational costs

- Sensitivity to macroeconomic fluctuations and interest rate changes

Residential Property Investment

Pros

- 4% annual rental growth provides consistent income appreciation

- Strong demographic support from urbanization trends

- Lower vacancy rates compared to commercial properties (2-4% average)

- Multiple exit strategies including sale-leaseback arrangements

- Favorable financing terms available through European banking institutions

Cons

- Intense competition in prime residential markets driving up acquisition costs

- Increasing regulatory scrutiny on rental pricing in major cities

- Higher management intensity for multi-unit residential portfolios

- Limited scalability compared to commercial real estate investments

- Vulnerability to local housing policy changes and rent control measures

Specialized Property Sectors

Pros

- Outperformance in Netherlands (7.2% rental growth), Portugal (6.8%), Sweden (6.5%)

- Niche market opportunities in logistics and healthcare properties

- Lower correlation to traditional real estate cycles

- Government incentives for sustainable and green building developments

- Strong demographic tailwinds in student housing and senior living

Cons

- Limited liquidity in specialized property transactions

- Higher due diligence requirements for sector-specific investments

- Concentrated risk exposure to specific industry dynamics

- Longer holding periods required for optimal returns

- Complex valuation methodologies for unique property types

Detailed Comparison Table

| Market Segment | Q4 Investment Growth | Annual Volume Increase | Rental Growth | Prime Yield | Risk Profile |

|---|---|---|---|---|---|

| Office Properties | 42% | 13% | 3.8% | 4.2% | Medium |

| Retail Centers | 28% | 9% | 2.5% | 5.1% | Medium-High |

| Industrial/Logistics | 61% | 22% | 5.3% | 4.0% | Low-Medium |

| Residential Multi-family | 38% | 16% | 4.2% | 3.8% | Low |

| Hotel & Leisure | 33% | 11% | 4.7% | 5.8% | High |

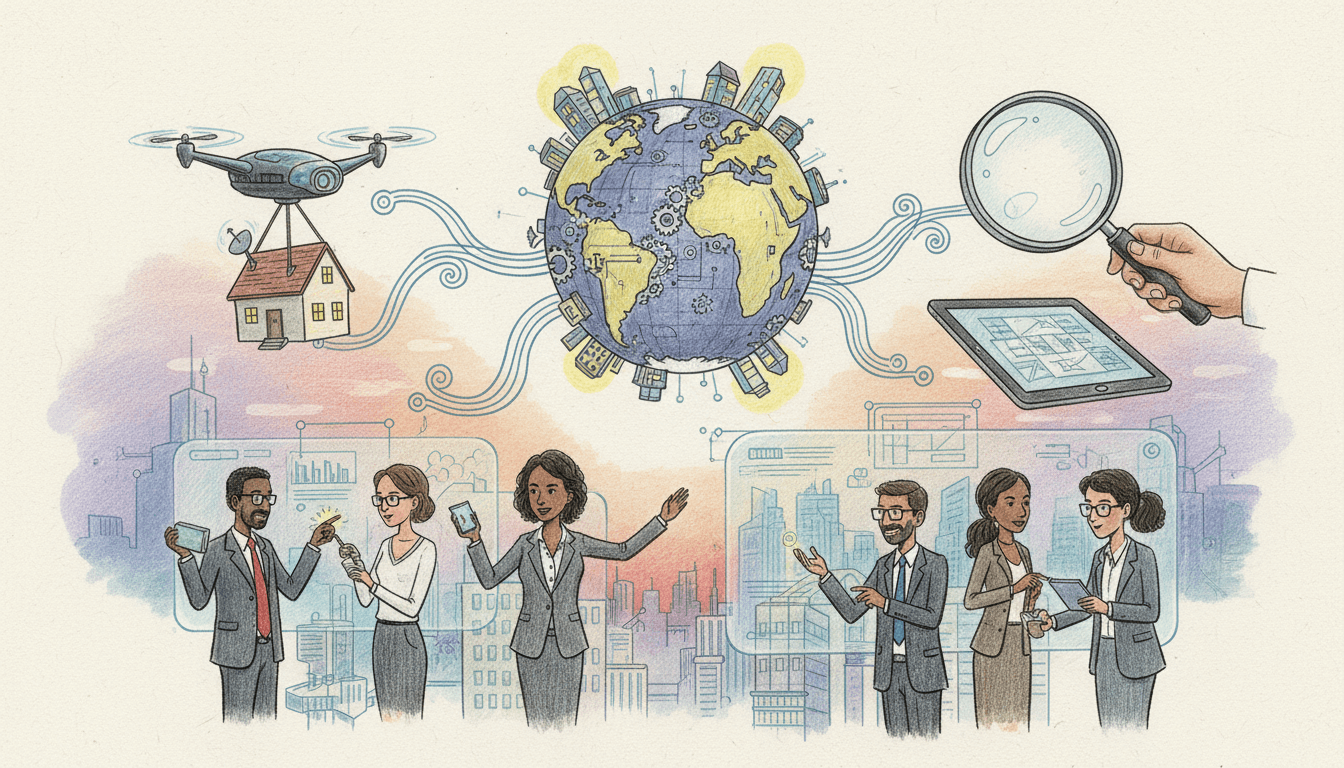

Verdict

The European real estate market presents compelling investment opportunities driven by the remarkable 46% Q4 investment volume surge and sustained 15% annual growth. The consistent 4% rental growth across property types, coupled with exceptional performance in markets like the Netherlands, Portugal, and Sweden, creates a favorable environment for strategic capital allocation. Commercial real estate offers superior scale and institutional-grade opportunities, while residential properties provide stability and demographic support. Specialized sectors demonstrate the highest growth potential but require sophisticated risk management. Investors should prioritize markets with strong fundamentals, focus on properties with sustainable characteristics, and maintain diversification across geographies and property types to maximize returns while mitigating regional economic risks. The current market dynamics suggest continued strength through 2025, though careful due diligence remains essential given varying regulatory environments across European jurisdictions.