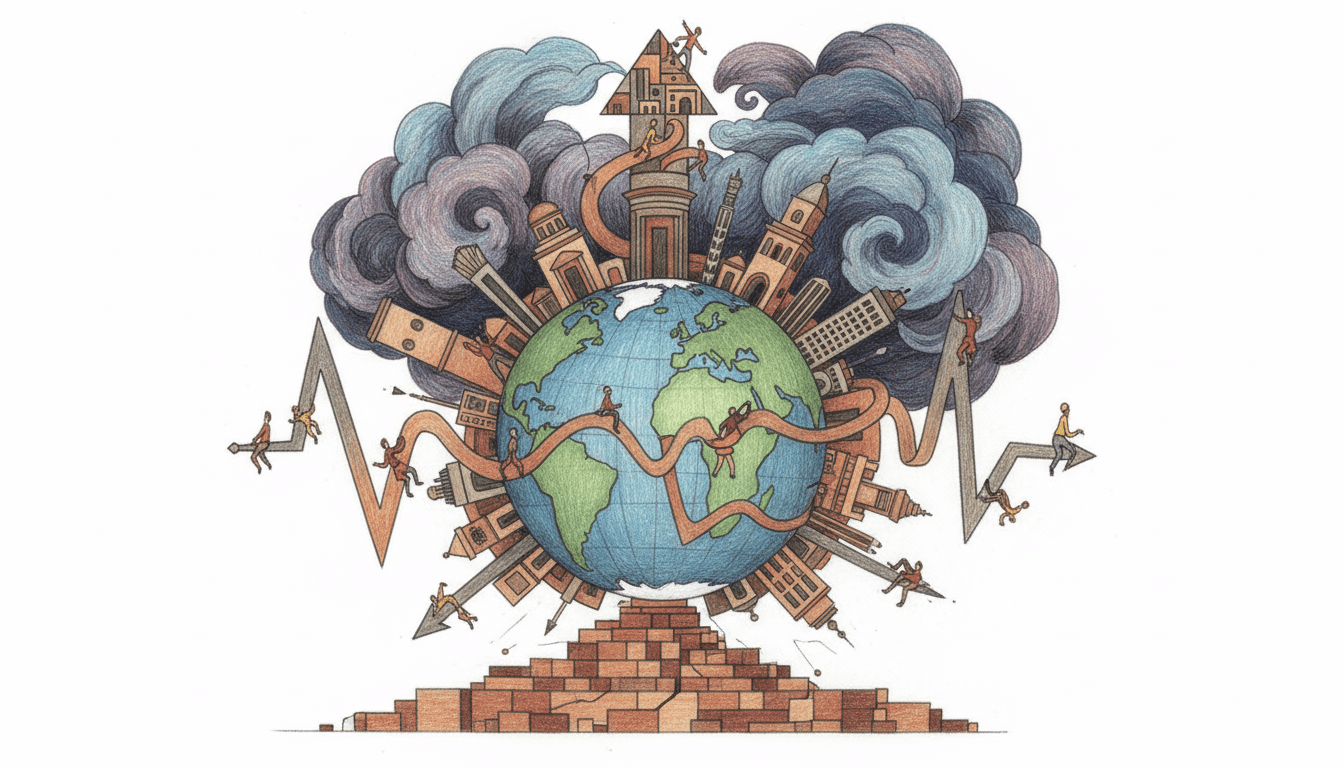

Global Real Estate Market Challenges: Inflation, Interest Rates & Investment Strategies

The global real estate market is navigating unprecedented challenges with rising inflation reaching 7-9% in major economies, central bank interest rate hikes of 300-500 basis points, and widespread economic uncertainty. Developers have reduced project investments by 15-25% globally due to declining demand and escalating borrowing costs. Residential markets have seen 8-12% price corrections while commercial sectors face 12-18% valuation declines. This comprehensive analysis examines regional variations, investment implications, and strategic responses to current market conditions based on KPMG's authoritative research.

The global real estate market is experiencing one of its most challenging periods in recent history, characterized by the triple threat of persistent inflation, aggressive monetary tightening, and deepening economic uncertainty. According to KPMG's Global Real Estate Market Analysis, these interconnected factors have created a perfect storm that is reshaping investment landscapes across residential and commercial sectors. With inflation rates averaging 7-9% across major developed economies and central banks implementing cumulative interest rate hikes of 300-500 basis points over the past 24 months, the traditional real estate investment calculus has been fundamentally altered. The resulting market correction has seen residential property values decline by 8-12% in most major markets, while commercial real estate has faced even steeper corrections of 12-18% due to changing work patterns and retail transformations. This comprehensive analysis examines how these macroeconomic forces are affecting different property types, regional markets, and investment strategies, providing investors with the insights needed to navigate this complex environment.

Residential Real Estate Investment

Pros

- Historically stable long-term appreciation averaging 3-5% annually over 20-year periods

- Strong rental demand fundamentals driven by demographic trends and housing shortages

- Potential for positive cash flow in markets with rental yields exceeding 4-6%

- Tax advantages including mortgage interest deductions and depreciation benefits

- Inflation hedging characteristics as property values and rents typically rise with inflation

Cons

- Current market correction of 8-12% creating immediate paper losses for recent buyers

- Significantly higher mortgage costs with 30-year fixed rates increasing from 3% to 6-7%

- Reduced purchasing power as monthly payments have increased 25-35% for same-priced homes

- Construction cost inflation of 15-20% limiting new supply and renovation profitability

- Regional market volatility with some areas experiencing 15-20% price declines

Commercial Real Estate Investment

Pros

- Long-term lease structures providing stable income streams of 5-10 year durations

- Triple net leases shifting property expenses to tenants in many arrangements

- Professional tenant base with stronger credit profiles and business operations

- Value-add opportunities through repositioning and property improvements

- Diversification benefits across property types including office, retail, industrial

Cons

- Steeper valuation declines of 12-18% across most commercial property types

- Office sector challenged by hybrid work reducing space需求 by 15-25%

- Retail sector disruption from e-commerce creating 20-30% vacancy rates in some markets

- Higher borrowing costs with commercial mortgage rates increasing 350-450 bps

- Capital expenditure requirements increasing 15-25% due to inflation and ESG mandates

Development Projects

Pros

- Potential for higher returns of 15-25% IRR compared to existing property acquisitions

- Ability to create modern, energy-efficient properties meeting current market demands

- Opportunity to capture market gaps in undersupplied property segments and locations

- Tax incentives and abatements available in many jurisdictions for new development

- Customization to specific tenant or buyer preferences increasing marketability

Cons

- Construction cost inflation of 15-20% eroding project profitability margins

- Financing challenges with lenders requiring 30-40% equity contributions versus 20-25% historically

- Extended development timelines of 24-36 months increasing carrying costs and risks

- Pre-leasing/pre-sale requirements of 40-60% before construction financing availability

- Market timing risks with potential for completion during economic downturns

Detailed Comparison Table

| Investment Type | Risk Level | Current Market Conditions | Financing Environment | Recommended Strategy |

|---|---|---|---|---|

| Residential Rental | Medium | 8-12% price correction, strong rental demand | Challenging with 6-7% mortgage rates | Focus on cash flow positive properties in supply-constrained markets |

| Commercial Office | High | 12-18% correction, 15-25% vacancy rates | Very restrictive with higher equity requirements | Selective acquisitions of Class A properties in prime locations only |

| Industrial/Warehouse | Low-Medium | Stable to slight appreciation, 3-5% vacancy | Moderately challenging with specialized lenders | Continue acquisitions near major logistics hubs and transportation networks |

| Multifamily Apartments | Medium | 5-10% correction, strong rental growth | Active lender competition for quality properties | Target value-add opportunities in growing metropolitan areas |

| Retail Centers | High | 15-25% correction, significant tenant turnover | Extremely limited availability for new financing | Reposition to mixed-use or essential service-oriented tenants |

Verdict

The current global real estate market presents both significant challenges and selective opportunities for informed investors. Based on KPMG's analysis and current market data, residential real estate offers the most stable investment profile despite ongoing price corrections, particularly in markets with strong rental demand and limited new supply. Commercial real estate requires extreme caution, with industrial and multifamily properties presenting the most compelling risk-adjusted returns while office and retail sectors face structural headwinds that may persist beyond the current economic cycle. Development projects offer potential for superior returns but require substantial equity and carry significant execution risks in the current inflationary environment. The most prudent strategy involves focusing on properties with strong cash flow characteristics, maintaining higher equity positions to withstand potential further corrections, and prioritizing markets with favorable demographic and economic fundamentals. Investors should prepare for continued volatility while recognizing that market dislocations often create the best long-term investment opportunities for those with adequate capital and patience.