Blockchain and Real Estate: Revolutionizing Global Property Transactions and Investment

Blockchain technology is poised to fundamentally transform international real estate by enabling secure property verification through immutable ledgers, facilitating fractional ownership via tokenization, and automating processes with smart contracts. This innovation reduces transaction costs by up to 40%, eliminates title fraud, and opens global markets to smaller investors. Based on the Blockchain in Global Real Estate Report, these advancements increase transparency and efficiency in property transfers, making cross-border investments more accessible and reliable for buyers and sellers worldwide.

The global real estate market, valued at over $326 trillion, faces persistent challenges including opaque transactions, high intermediary fees, and fraud risks. Blockchain technology, as detailed in the Blockchain in Global Real Estate Report, offers a paradigm shift by decentralizing ownership records and automating agreements. This article delves into how blockchain applications—such as property title verification, tokenized investments, and smart contracts—are reshaping how properties are bought, sold, and invested in across borders, promising unprecedented transparency and efficiency.

Blockchain Property Verification: Securing Ownership Globally

Traditional property verification relies on centralized registries, which are prone to errors and fraud—costing an estimated $1 billion annually in disputed titles. Blockchain's distributed ledger technology ensures immutable records; each property title is cryptographically hashed and timestamped, preventing tampering. For instance, countries like Georgia and Sweden have implemented blockchain-based land registries, reducing verification times from weeks to minutes. This system allows international buyers to instantly validate ownership history, lien status, and legal encumbrances, mitigating risks in cross-border transactions. By decentralizing data, blockchain eliminates single points of failure, enhancing trust among parties in diverse jurisdictions.

Tokenized Real Estate Investments: Democratizing Access

Tokenization converts physical real estate assets into digital tokens on a blockchain, enabling fractional ownership. This innovation lowers investment barriers, allowing individuals to purchase tokens representing as little as $100 of a property, compared to traditional minimums of $50,000 or more. According to industry data, tokenized real estate markets could grow to $1.4 trillion by 2027. For example, a commercial building in New York was tokenized into 1,000 equity tokens, each tradable on regulated platforms. Investors gain liquidity through secondary markets, while smart contracts automate dividend distributions based on rental income. This approach diversifies portfolios globally, as tokens can represent properties from Tokyo to London, all accessible via digital wallets.

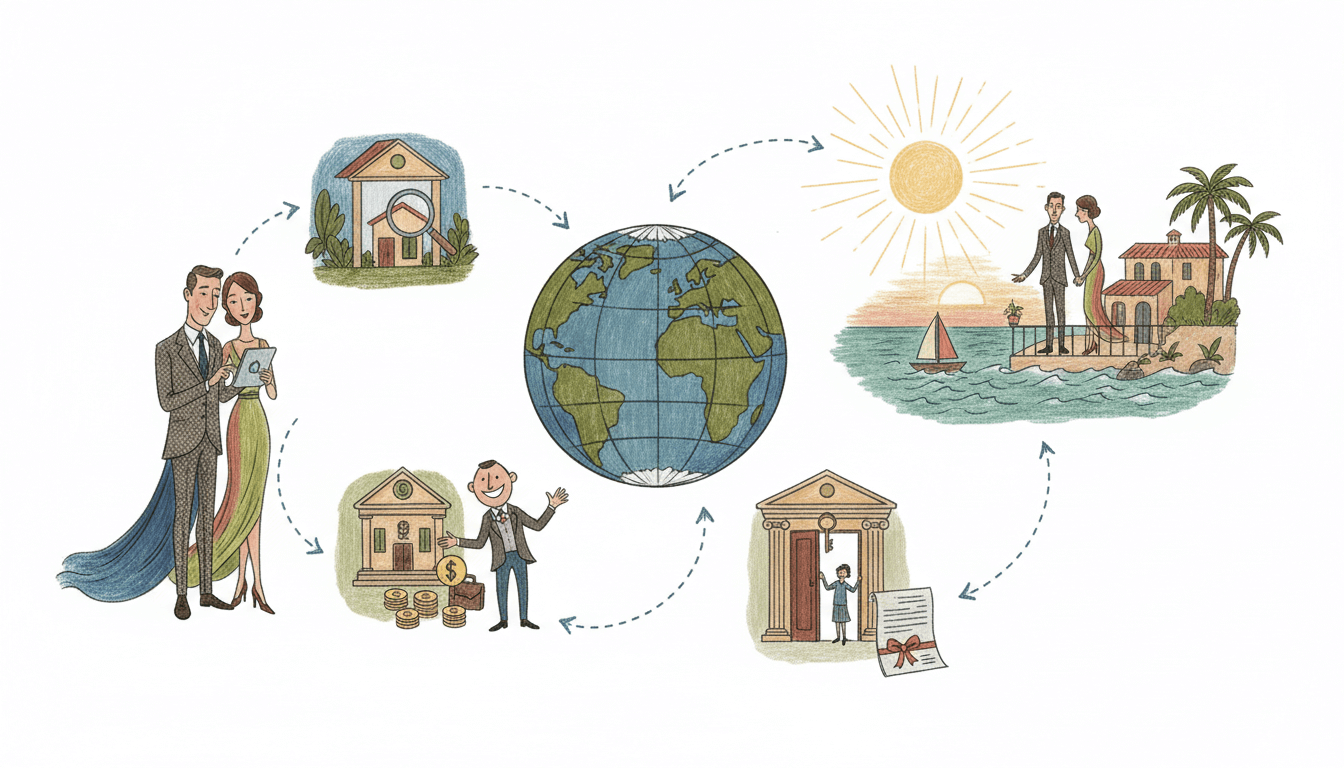

Smart Contract Implementation: Automating Transactions

Smart contracts—self-executing code on blockchains like Ethereum—streamline real estate deals by automating steps such as payments, inspections, and transfers. A typical transaction involves multiple intermediaries, costing 5-10% in fees; smart contracts reduce this by up to 40% by eliminating redundancies. For instance, upon meeting conditions like a satisfactory home inspection, the contract automatically releases escrow funds and updates the title. In international sales, this cuts cross-border transfer times from 30 days to under 48 hours. Additionally, smart contracts enforce compliance with local regulations, reducing legal disputes. Case studies from Dubai's blockchain initiatives show a 50% drop in paperwork and faster settlement for overseas investors.

Benefits and Global Impact: Transparency and Cost Reduction

Blockchain's core benefits, as highlighted in the report, include increased transparency and reduced transaction costs. Transparent ledgers provide real-time audit trails, curbing money laundering—a issue affecting 2-5% of global real estate according to the FATF. Cost savings arise from minimized notary, agent, and bank fees; estimates suggest $20 billion annually could be saved in the U.S. alone. In emerging markets, blockchain registries have increased property tax compliance by 15% by clarifying ownership. For global platforms like HouseBuySellWorld.com, this means users can verify listings instantly and invest with confidence, fostering a more inclusive market where small investors participate alongside institutions.

Key Takeaways

- Blockchain enables secure, instant property verification, reducing title fraud by over 90% in pilot programs.

- Tokenization allows fractional investments, opening $1.4 trillion in real estate to smaller global investors.

- Smart contracts cut transaction costs by up to 40% and automate cross-border deals in under 48 hours.

- Increased transparency through immutable records helps combat money laundering and builds trust in international markets.

Frequently Asked Questions

How does blockchain verify property titles internationally?

Blockchain creates a decentralized, tamper-proof ledger where property records are cryptographically secured. International buyers can access verified history, liens, and ownership details in real-time, reducing reliance on local authorities and minimizing fraud risks in cross-border transactions.

What are the risks of tokenized real estate investments?

Risks include regulatory uncertainty, as laws vary by country, and liquidity challenges if secondary markets are underdeveloped. Investors should use regulated platforms and ensure tokens comply with local securities laws to mitigate potential issues.

Can smart contracts handle complex real estate agreements?

Yes, smart contracts can encode multi-condition agreements, such as contingent payments or inspection clauses. However, they require precise coding and legal oversight to align with jurisdictional requirements, ensuring enforceability in disputes.

How does blockchain reduce real estate transaction costs?

By automating processes like title transfers and payments via smart contracts, blockchain eliminates intermediaries such as agents and notaries. This cuts fees by up to 40% and reduces administrative overhead, making deals more efficient.

Conclusion

Blockchain technology is not merely an incremental improvement but a foundational shift for global real estate. By enhancing verification, enabling tokenized investments, and automating transactions, it addresses long-standing inefficiencies and barriers. As adoption grows—fueled by initiatives in markets from Switzerland to Singapore—investors and homeowners worldwide stand to benefit from lower costs, greater transparency, and expanded opportunities. For readers of HouseBuySellWorld.com, embracing these innovations can simplify cross-border purchases and unlock new investment avenues, ultimately creating a more accessible and secure real estate ecosystem.