Senior Living Real Estate Market: Comprehensive Investment Analysis and Growth Outlook

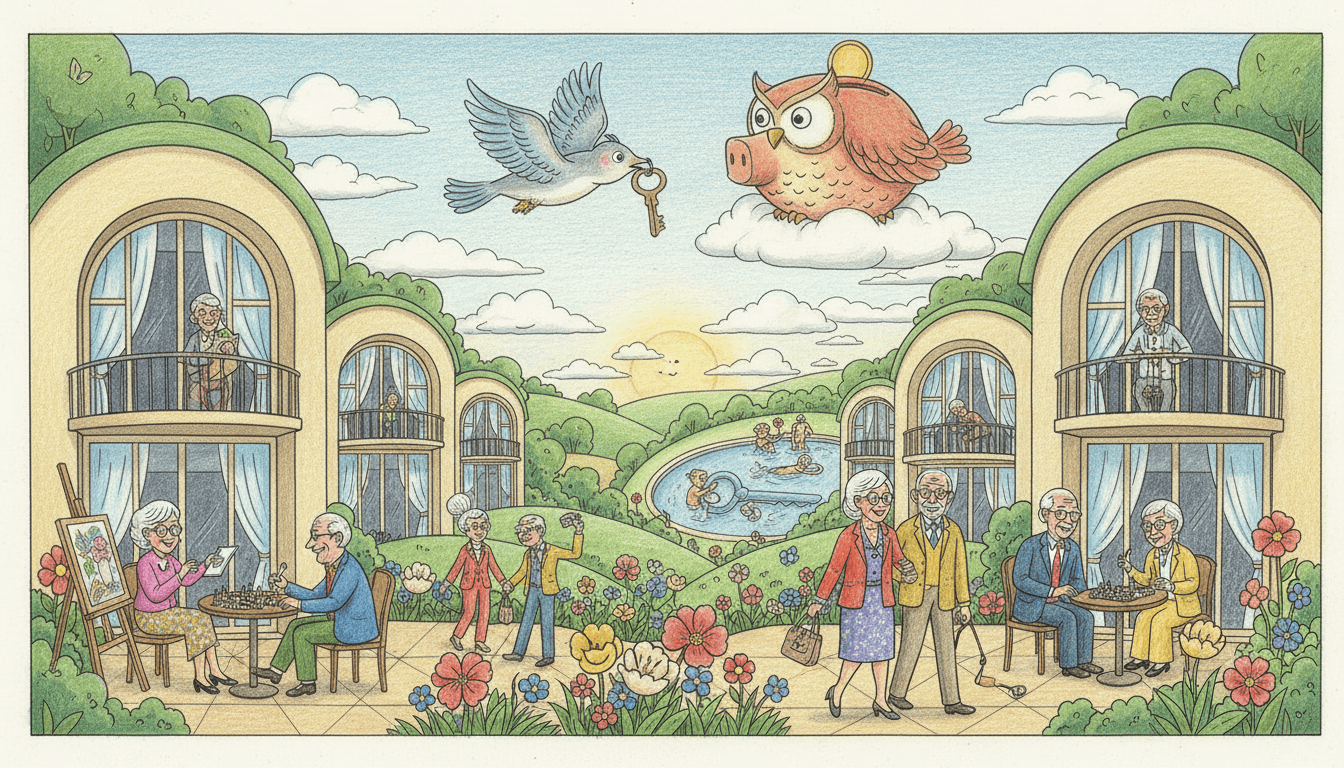

The senior living real estate sector represents one of the most promising investment opportunities in today's property market, driven by unprecedented demographic shifts and an aging global population. With over 1 billion people aged 60+ worldwide and this number projected to double by 2050, specialized housing and care facilities are experiencing explosive demand. This comprehensive review examines market dynamics, investment potential, operational considerations, and future growth trajectories, providing investors with actionable insights into this high-yield sector that combines social impact with strong financial returns.

Pros

- Exceptionally strong demographic tailwinds with global population aged 65+ growing at 3% annually, creating sustained demand for specialized housing

- High investment potential with average cap rates of 6-8% and occupancy rates consistently above 85% in well-managed facilities

- Diverse property types including independent living, assisted living, memory care, and continuing care retirement communities (CCRCs)

- Stable revenue streams through combination of entrance fees and monthly service charges, providing predictable cash flow

- Limited new supply due to complex regulatory requirements and high development costs, protecting existing property values

- Recession-resistant characteristics as senior housing is considered essential service rather than discretionary spending

- Multiple exit strategies including sale-leaseback transactions with healthcare operators and portfolio sales to REITs

Cons

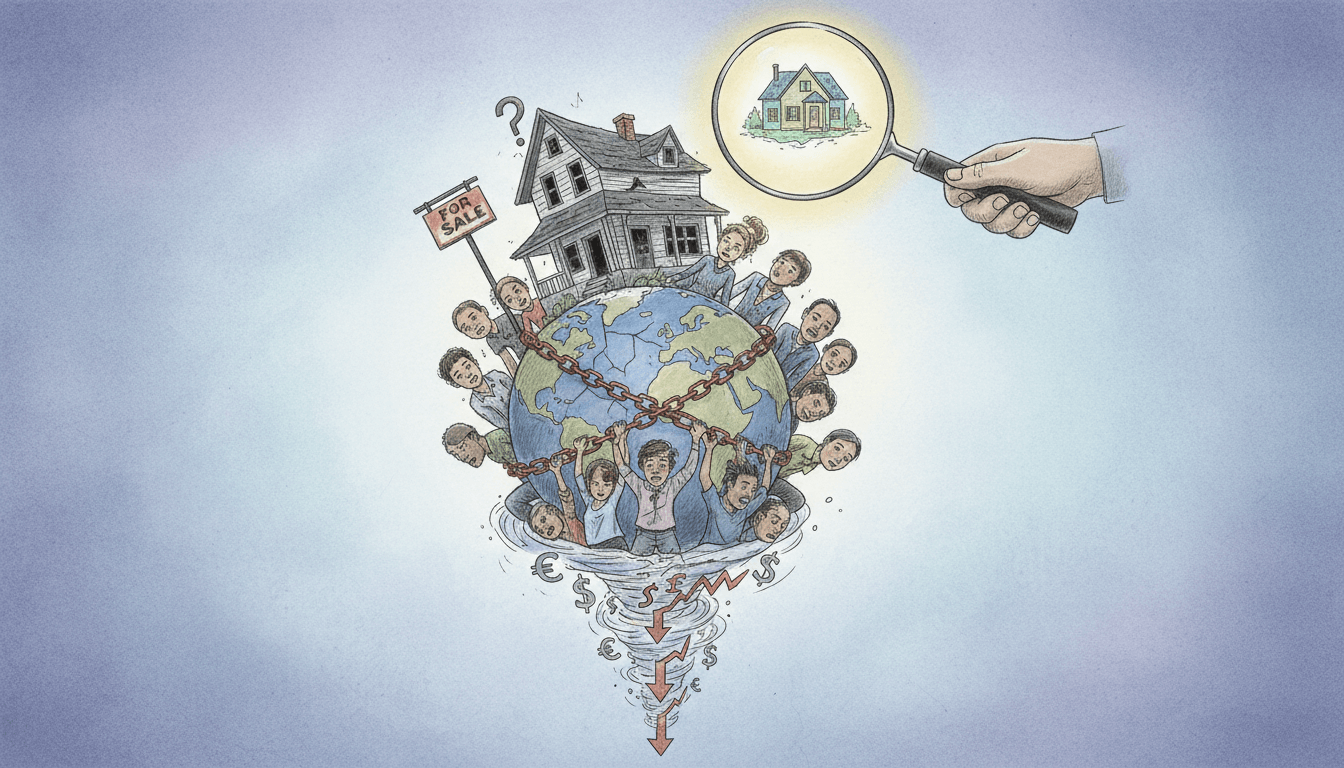

- High operational complexity requiring specialized management expertise in healthcare regulations and staffing

- Significant regulatory compliance burden including state licensing, Medicare/Medicaid certification, and healthcare standards

- Labor-intensive operations with staffing ratios typically requiring 0.4-0.6 employees per resident depending on care level

- Substantial capital expenditure requirements for regular facility upgrades and medical equipment updates

- Market fragmentation with many small operators creating consolidation challenges for large-scale investors

- Geographic concentration risk as demand varies significantly by region based on demographic patterns and wealth distribution

- Sensitivity to economic conditions affecting private-pay residents' ability to afford premium senior living services

Our Analysis

The senior living real estate market demonstrates remarkable resilience and growth potential driven by fundamental demographic shifts. Investment analysis reveals that properties located in markets with strong population growth among the 75+ age cohort and high median household income consistently outperform. Operational excellence is paramount - facilities with strong clinical outcomes, high resident satisfaction scores, and efficient staffing models achieve premium valuations. Market segmentation shows distinct performance patterns: memory care facilities command the highest margins due to specialized services, while independent living properties benefit from lower operational complexity. Development activity remains concentrated in Sun Belt states and metropolitan statistical areas with favorable demographic trends. The sector's evolution includes increasing integration of technology solutions for remote monitoring, telehealth services, and operational efficiency. Investment structures have matured with specialized REITs, private equity funds, and institutional capital all actively pursuing opportunities. Market consolidation continues as larger operators acquire smaller portfolios to achieve scale efficiencies and geographic diversification.

Recommendation

Strong Buy - The senior living real estate sector presents one of the most compelling investment opportunities in the current property market landscape. Investors should prioritize properties in markets with favorable demographic trends, strong economic fundamentals, and limited new supply. Focus on operators with proven management expertise, strong clinical outcomes, and sustainable business models. Consider diversified exposure across care levels to mitigate specific operational risks. Target properties with potential for value-add improvements through operational enhancements, physical plant upgrades, or service expansion. Maintain long-term investment horizon to capture full demographic tailwinds while implementing rigorous due diligence on operator track records and market fundamentals. Portfolio allocation should consider both direct property investments and securitized alternatives through healthcare REITs for balanced risk exposure.