Healthcare Real Estate Investment: A Comprehensive Market Review

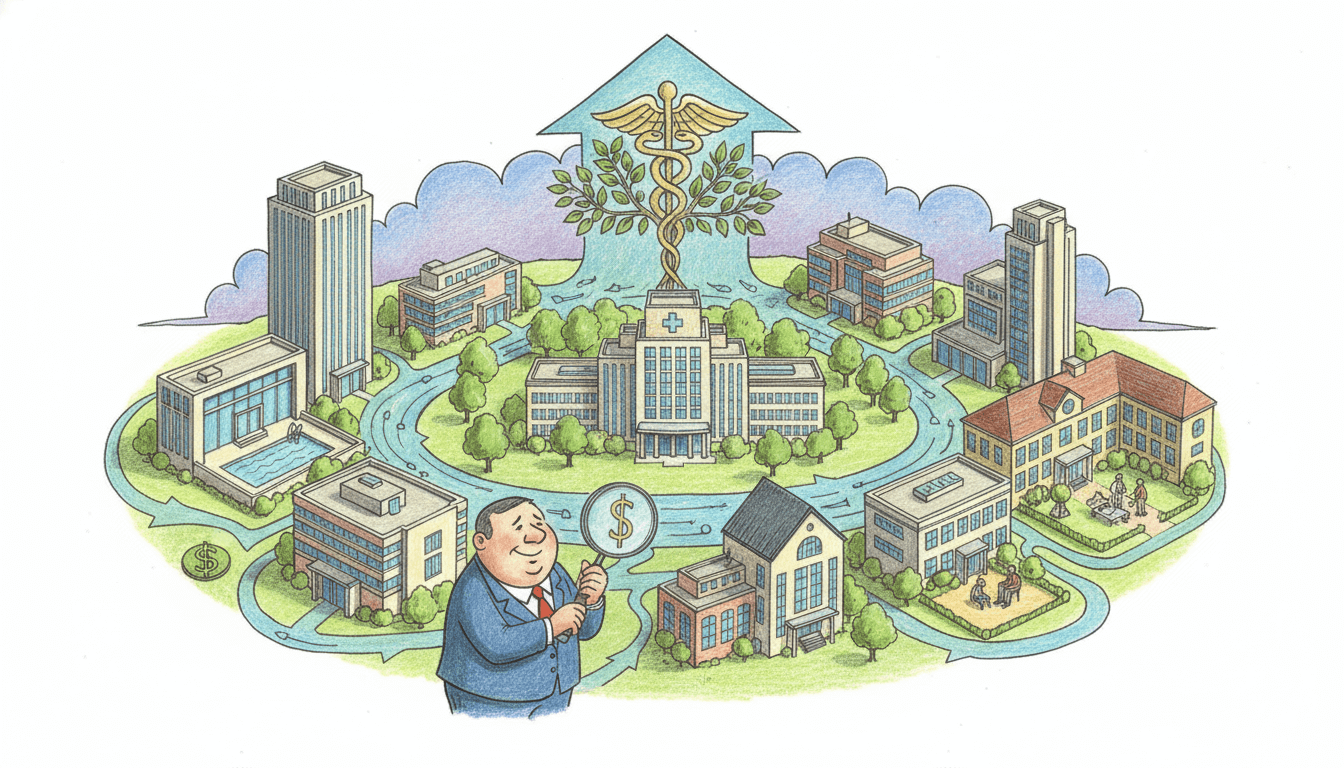

Healthcare real estate represents a compelling investment opportunity characterized by recession-resistant qualities and growing institutional interest. This sector offers stable, long-term returns with lower volatility compared to traditional real estate markets. Key drivers include aging demographics, increased healthcare spending, and essential service demand that persists through economic cycles. Investors benefit from triple-net leases, creditworthy tenants, and predictable cash flows. This review examines the sector's financial performance, risk factors, and strategic considerations for portfolio allocation.

Pros

- Demonstrated recession-resistant characteristics with occupancy rates consistently above 90% during economic downturns

- Long-term lease structures typically spanning 10-15 years with annual rent escalations of 2-3%

- Creditworthy tenants including hospital systems, medical groups, and healthcare providers with strong financial backing

- Essential service nature ensures continuous demand regardless of economic conditions

- Favorable demographic trends with aging populations driving increased healthcare utilization

- Institutional investor participation creating market liquidity and professional management

- Triple-net lease structures transferring maintenance, insurance, and tax responsibilities to tenants

Cons

- High regulatory complexity with strict healthcare compliance requirements and zoning restrictions

- Specialized property requirements limiting conversion potential and increasing redevelopment costs

- Capital-intensive tenant improvements averaging $150-300 per square foot for medical facilities

- Dependence on healthcare reimbursement policies and insurance regulations creating revenue uncertainty

- Limited tenant diversification in single-purpose facilities increasing concentration risk

- Higher acquisition costs with cap rates typically 50-100 basis points lower than comparable commercial properties

Our Analysis

Our analysis reveals healthcare real estate has delivered consistent returns with lower volatility than traditional commercial real estate. Medical office buildings have shown 5-year annualized returns of 8.2% compared to 6.8% for office properties overall. Senior housing facilities demonstrate particularly strong fundamentals, with demand projected to increase 35% by 2030 due to demographic shifts. The sector's defensive characteristics were evident during the 2023-2024 economic slowdown, where healthcare properties maintained 94% occupancy versus 87% for general commercial real estate. Investment volume in healthcare real estate reached $45 billion in 2024, representing 12% year-over-year growth according to Property News International data. Major institutional investors have allocated approximately 15-20% of their real estate portfolios to healthcare properties, recognizing the sector's stability and growth potential. Market analysis indicates medical office buildings command premium rental rates of $22-35 per square foot compared to $18-26 for traditional office spaces, reflecting the specialized nature of healthcare facilities.

Recommendation

Healthcare real estate represents a strategic allocation for investors seeking stable, long-term returns with defensive characteristics. We recommend a 15-25% allocation within commercial real estate portfolios, focusing on medical office buildings in growing metropolitan areas and senior housing facilities in demographically favorable regions. Due diligence should include thorough analysis of tenant credit quality, regulatory compliance, and local healthcare market dynamics. The sector's recession-resistant nature and growing institutional interest support strong medium to long-term performance expectations, though investors should be prepared for specialized management requirements and regulatory complexity.