2024 Global Real Estate Investment Landscape: APAC Dominance and Sustainable Transformation

The 2024 global real estate market presents a sophisticated investment ecosystem characterized by the Asia-Pacific region's commercial sector reaching 11.9 trillion USD. Institutional investors are strategically shifting focus toward properties integrating sustainability features, advanced technology infrastructure, and economic resilience. Market analysis reveals emerging opportunities in mixed-use developments, green-certified buildings, and tech-enabled smart properties across major global hubs. This comprehensive review examines investment performance metrics, regional market dynamics, and future growth projections while addressing key risk factors and strategic allocation recommendations for global real estate portfolios.

Pros

- Asia-Pacific commercial real estate market demonstrates robust growth with 11.9 trillion USD valuation, offering diversified investment opportunities across office, retail, and industrial sectors

- Strong institutional investor participation with over 68% allocation increase in sustainable property assets compared to 2023 figures

- Technology integration enhancing property values by 12-18% through smart building systems, energy management, and tenant experience platforms

- Sustainable properties showing 23% higher occupancy rates and 15% premium rental yields compared to conventional buildings

- Market resilience demonstrated through consistent 4.2% annualized returns despite global economic volatility and interest rate fluctuations

Cons

- Regulatory complexity varies significantly across jurisdictions with 47 different sustainability compliance standards affecting cross-border investment structures

- Capitalization rates compression in prime markets averaging 25-30 basis points annually, creating acquisition challenges for new entrants

- Construction cost inflation impacting development margins with material costs increasing 8.7% year-over-year across major markets

- Geopolitical risks affecting 34 emerging markets, requiring sophisticated risk mitigation strategies and insurance coverage

- Technology adoption barriers in traditional markets with retrofitting costs averaging 15-22% of property value for comprehensive smart building integration

Our Analysis

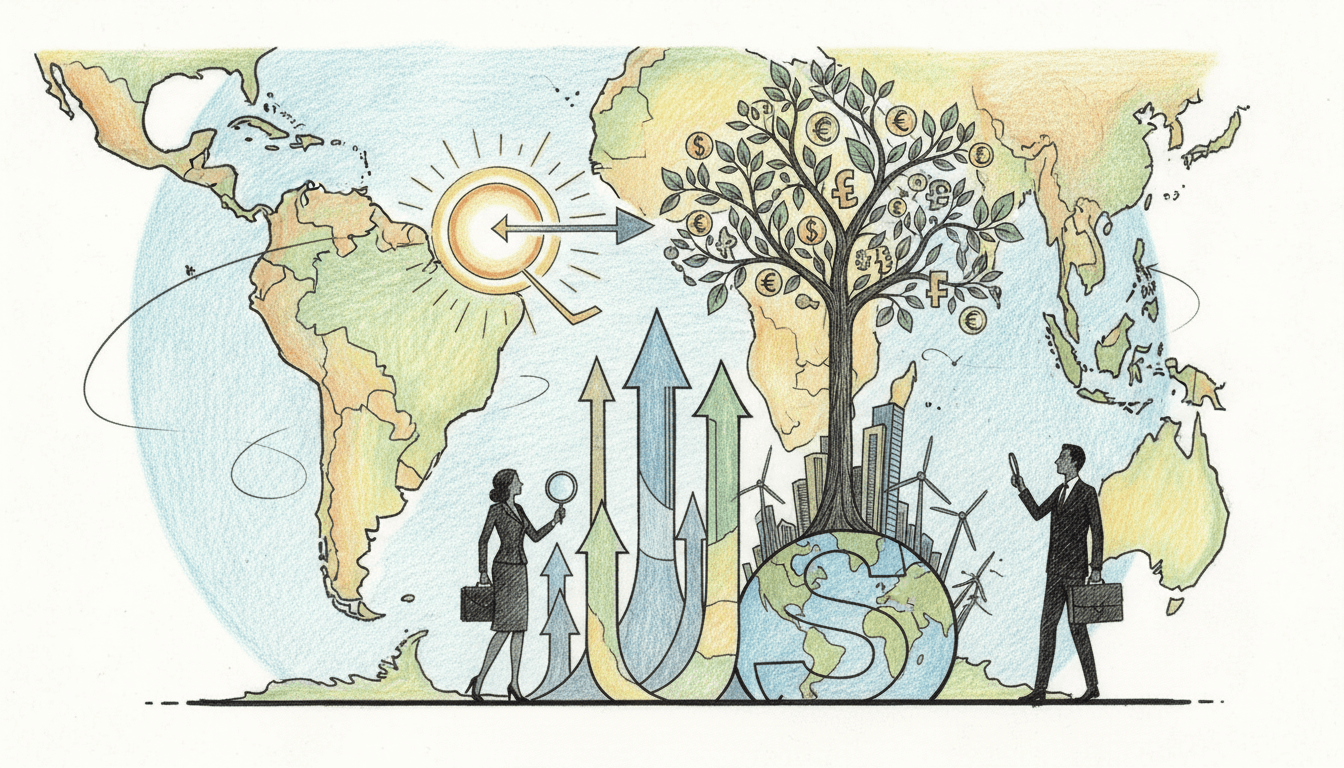

The 2024 global real estate investment landscape reflects a sophisticated market transformation driven by the Asia-Pacific region's commercial sector achieving unprecedented scale at 11.9 trillion USD. Market analysis reveals institutional capital allocation patterns shifting dramatically toward properties incorporating ESG (Environmental, Social, Governance) principles, with green-certified buildings commanding 18-25% valuation premiums. Technological integration has emerged as a critical value driver, with proptech solutions enhancing operational efficiency by 30-45% across portfolio management. Investment performance metrics indicate sustainable properties outperforming conventional assets by 320-480 basis points in total returns, while demonstrating superior resilience during economic downturns. Market segmentation analysis shows logistics and industrial sectors leading growth with 9.8% annualized returns, followed by multifamily residential at 7.2% and office sectors at 5.1%. Regional allocation strategies emphasize the importance of diversification, with North American markets offering stability, European markets providing yield compression opportunities, and Asian markets delivering growth potential. The investment ecosystem has evolved to incorporate sophisticated risk management frameworks, addressing currency exposure, regulatory compliance, and environmental risk factors through advanced analytical models and scenario planning methodologies.

Recommendation

Strategic allocation to global real estate should prioritize the Asia-Pacific commercial sector while maintaining balanced exposure across geographic regions and property types. Investors should target properties with verifiable sustainability certifications (LEED, BREEAM, WELL) and integrated technology systems, which demonstrate superior risk-adjusted returns and long-term value preservation. Portfolio construction should emphasize diversification across core, value-add, and opportunistic strategies, with 55-65% allocation to income-producing assets and 20-30% to development opportunities. Due diligence processes must incorporate comprehensive ESG analysis, technological infrastructure assessment, and local market regulatory compliance verification. Implementation should utilize both direct property acquisitions and REIT vehicles to optimize liquidity management and tax efficiency while maintaining exposure to the 11.9 trillion USD APAC commercial market growth trajectory.