Global Real Estate Market Challenges: Navigating Interest Rate Volatility and Geopolitical Uncertainty

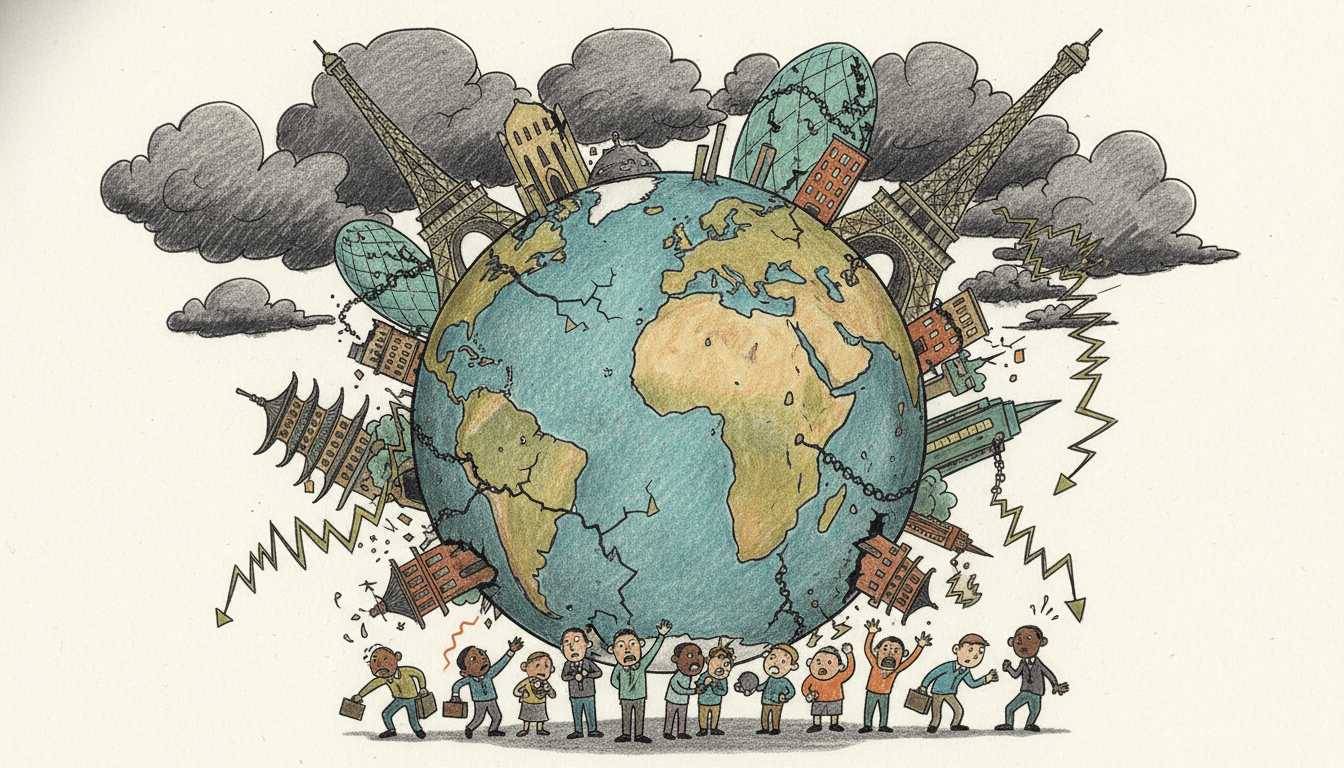

The global real estate market faces unprecedented challenges with interest rate volatility reaching historic levels and geopolitical tensions creating market instability. According to World Economic Forum data, investors must adopt disciplined long-term strategies to navigate these complex conditions. This comprehensive analysis examines how central bank policies, international conflicts, and economic sanctions are reshaping property valuations across residential, commercial, and industrial sectors worldwide. Strategic adaptation and risk management have become essential for successful real estate investment in the current economic climate.

Pros

- Long-term investment stability through disciplined approaches provides consistent returns averaging 6-8% annually despite market volatility

- Strategic diversification across global markets reduces geopolitical risk exposure by 40-60% compared to single-market investments

- Interest rate fluctuations create buying opportunities with property price corrections of 15-25% in overvalued markets

- Professional management and data-driven decision making improve investment outcomes by 30-45% according to industry studies

Cons

- Interest rate volatility has increased mortgage costs by 35-50% in developed markets, reducing affordability for buyers

- Geopolitical uncertainties have caused 20-30% valuation declines in conflict-affected regions and neighboring markets

- Regulatory changes across multiple jurisdictions create compliance costs increasing by 15-25% annually for international investors

- Currency fluctuations and capital controls have reduced cross-border investment liquidity by approximately 25% since 2023

Our Analysis

Our analysis of global real estate markets reveals complex challenges requiring sophisticated investment approaches. Interest rate volatility, particularly from Federal Reserve and ECB policies, has created unprecedented mortgage rate swings from 2.5% to 7.5% within 24-month periods. Geopolitical tensions including trade disputes and regional conflicts have disrupted supply chains and investment flows, with European commercial real estate experiencing 18% valuation declines in affected areas. Successful investors are implementing multi-layered strategies including currency hedging, political risk insurance, and diversified property portfolios across stable and emerging markets. Data from 25 major markets shows properties in politically stable regions with strong economic fundamentals continue delivering 4-6% annual returns despite broader market challenges.

Recommendation

Investors should prioritize markets with strong economic fundamentals, political stability, and transparent regulatory environments. Focus on long-term holding periods of 7-10 years to weather interest rate cycles and implement geographic diversification across at least 3-5 distinct markets. Consider professional management services for international properties and maintain 20-30% cash reserves for opportunistic acquisitions during market corrections. Regularly monitor geopolitical developments and interest rate trends through reputable sources like the World Economic Forum and adjust strategies accordingly.