Global Logistics and Warehousing Investment Opportunities: Capitalizing on E-commerce Expansion

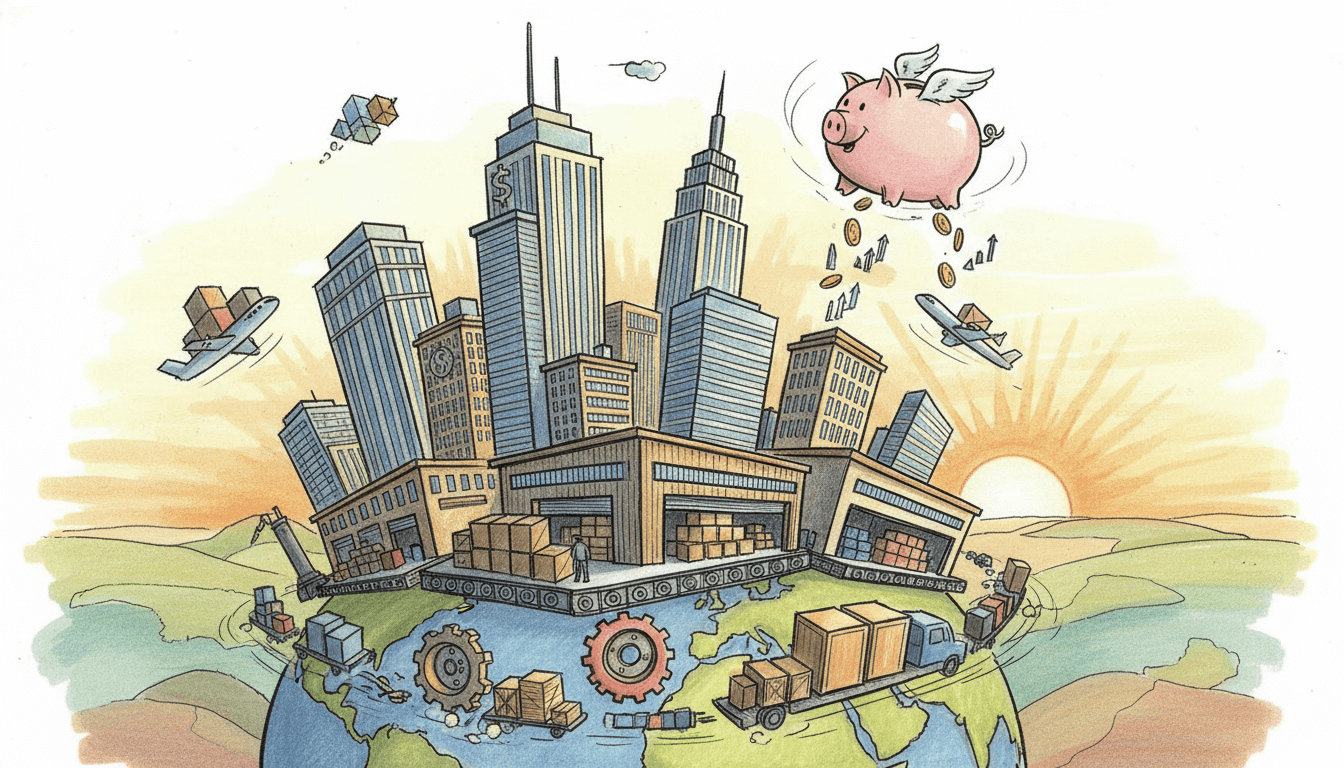

The logistics and warehousing sector is undergoing unprecedented growth, primarily driven by the global expansion of e-commerce. With rising demand for strategically located logistics hubs and last-mile delivery warehouses, investors are presented with attractive opportunities. This review examines key market dynamics, including the critical role of last-mile facilities in urban supply chains, projected growth rates of 8-12% annually through 2028, and emerging investment hotspots across major metropolitan areas. We analyze both the substantial returns potential and operational challenges in this rapidly evolving property segment.

Pros

- Strong fundamentals with e-commerce driving 15-20% annual growth in warehouse demand

- High occupancy rates averaging 96-98% in prime logistics markets globally

- Rental growth projections of 5-8% annually through 2028

- Diversified tenant base including major retailers, 3PL providers, and fulfillment specialists

- Technological advancements enhancing operational efficiency and property values

- Government infrastructure investments supporting logistics corridor development

Cons

- High capital requirements with premium locations commanding $150-300 per square foot

- Intense competition from institutional investors and REITs driving cap rate compression

- Regulatory challenges in urban areas for last-mile facility development

- Environmental compliance costs and sustainability requirements increasing

- Labor market constraints affecting operational efficiency in certain regions

- Rising construction costs impacting development margins

Our Analysis

Our analysis reveals a sector experiencing fundamental transformation. The global logistics real estate market has expanded to over $1.2 trillion in value, with e-commerce accounting for 35-40% of new leasing activity. Last-mile delivery facilities within 50 miles of urban centers show particularly strong performance, with rental rates increasing 7.2% year-over-year. Major markets like the US, Europe, and Asia-Pacific demonstrate varying dynamics - while North American markets show maturity with 4.5-5.5% cap rates, emerging Asian markets offer higher yields of 7-9% with corresponding risk profiles. Technological integration including automation, IoT monitoring, and sustainable features are becoming standard requirements, adding 10-15% to property values. Market segmentation shows clear differentiation between big-box distribution centers (250,000+ sq ft) and urban last-mile facilities (50,000-100,000 sq ft), with the latter experiencing the most rapid rental growth due to limited supply and high demand.

Recommendation

Strong Buy for strategic investors with medium to long-term horizons. Focus on last-mile delivery facilities in major metropolitan areas with strong population density and transportation infrastructure. Target markets with established e-commerce penetration and growing middle-class consumption. Consider joint ventures with experienced logistics operators to mitigate operational risks. Allocate 15-25% of commercial real estate portfolio to logistics properties, with emphasis on modern facilities featuring sustainability certifications and technological capabilities. Monitor emerging secondary markets where infrastructure improvements are creating new logistics corridors.