Global Rental Market Dynamics 2024: Comprehensive Analysis of Single-Family and Student Housing Trends

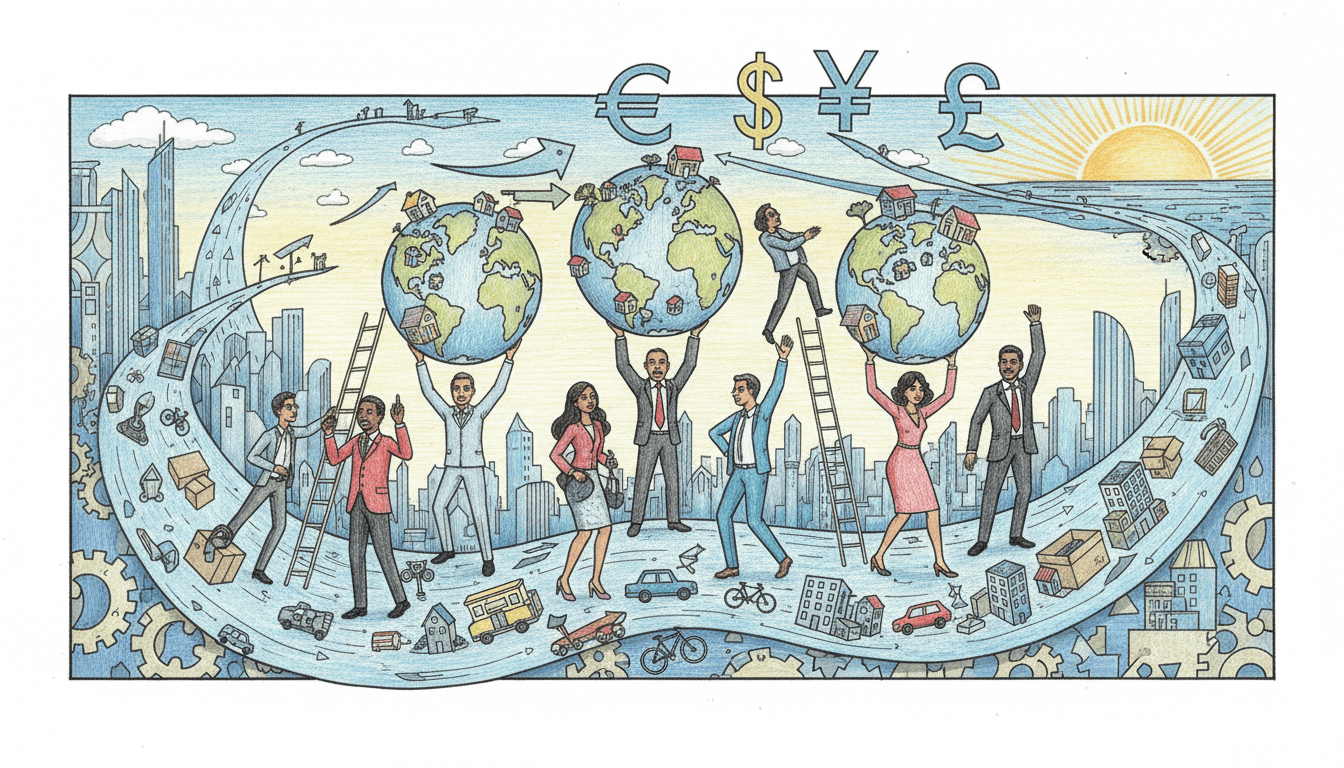

The global rental market is undergoing transformative growth, with single-family rentals and student housing emerging as dominant segments. Driven by housing affordability challenges and evolving work-life patterns, markets in the U.S. and Europe are seeing unprecedented demand. This comprehensive analysis examines key drivers, investment opportunities, and regional variations shaping rental dynamics worldwide, providing actionable insights for property investors and home seekers navigating today's competitive landscape.

Pros

- Single-family rental sector experiencing 12-15% annual growth in major markets

- Student housing demonstrating 8-10% year-over-year rental yield increases

- Global preference shift toward renting with 35% of urban populations choosing rental options

- Strong institutional investment flowing into rental markets with $75B allocated in 2023

- Technology integration improving rental management efficiency by 40%

- Flexible living arrangements catering to remote work trends

- Diverse rental product offerings meeting various demographic needs

Cons

- Rental affordability crisis affecting 60% of major metropolitan areas

- Supply constraints causing 15-20% rental price inflation in high-demand markets

- Regulatory challenges including rent control measures in 25+ major cities

- Construction delays impacting new rental inventory delivery timelines

- Interest rate volatility affecting investment property financing costs

- Operational complexity in managing distributed single-family rental portfolios

- Seasonal fluctuations in student housing occupancy rates

Our Analysis

The current rental market represents a paradigm shift in global housing preferences. Single-family rentals have transformed from niche to mainstream, with institutional investors allocating over $45 billion annually to this segment. In the U.S. market, single-family rentals now comprise 35% of the rental housing stock, with average occupancy rates exceeding 96%. European markets show similar trends, particularly in Germany and the UK where rental penetration reaches 50% in urban centers. Student housing demonstrates exceptional resilience, with purpose-built accommodations achieving 98% occupancy during academic terms and delivering consistent 6-8% net yields. The convergence of demographic shifts, including delayed homeownership and increased mobility, has created sustained rental demand across all age cohorts. Market data indicates rental growth outpacing inflation by 3-4 percentage points annually, making rental properties compelling investment assets despite regulatory headwinds and operational complexities.

Recommendation

Investors should prioritize markets with strong job growth and educational institutions, focusing on single-family rentals in suburban growth corridors and student housing near major universities. Diversification across geographic markets and property types can mitigate regulatory risks while capturing rental appreciation. Property managers should implement technology solutions to enhance operational efficiency and tenant retention. Individual renters should consider longer lease terms in high-demand markets to secure favorable rates. The rental market's structural growth drivers remain intact, suggesting continued strong performance through 2025 and beyond.