Emerging Markets Investment Opportunities: Southeast Asia, Latin America & Africa Analysis

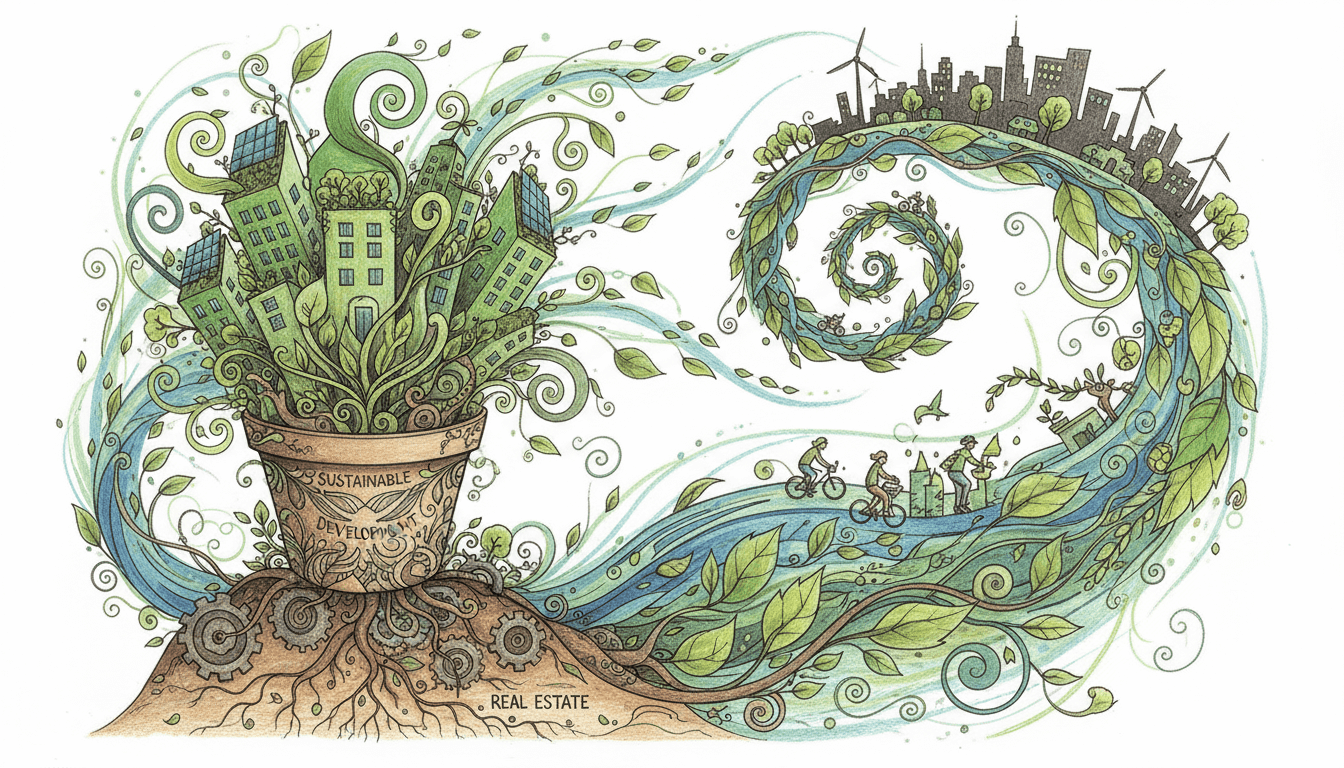

This comprehensive review examines the emerging markets of Southeast Asia, Latin America, and Africa as prime real estate investment destinations. These regions offer significant growth potential with GDP growth rates averaging 5-7% annually, driven by urbanization, demographic dividends, and infrastructure development. Investors can capitalize on undervalued commercial and residential properties while navigating unique market challenges. The analysis covers specific country opportunities, investment strategies, and risk management approaches for maximizing returns in these high-potential markets.

Pros

- Exceptional growth potential with Southeast Asian markets showing 6-8% annual GDP growth

- Significant valuation gaps creating buying opportunities 20-40% below developed markets

- Favorable demographic trends with young populations driving housing demand

- Infrastructure development creating new commercial and residential corridors

- Diversification benefits reducing portfolio correlation with developed markets

- Currency advantages offering potential FX gains alongside property appreciation

Cons

- Political and regulatory uncertainties requiring extensive due diligence

- Liquidity constraints with longer holding periods averaging 5-7 years

- Currency volatility potentially impacting returns by 10-15% annually

- Infrastructure gaps in secondary cities requiring additional investment

- Legal and title registration complexities varying by jurisdiction

- Market transparency issues requiring local expertise and partnerships

Our Analysis

Our analysis reveals Southeast Asia as the most mature emerging market with Vietnam leading at 7% GDP growth and commercial yields of 8-10%. Bangkok and Ho Chi Minh City office markets show 15% annual rental growth. Latin America offers compelling opportunities in Mexico and Colombia, with industrial properties yielding 9-12% in manufacturing hubs. Africa presents frontier opportunities in Nigeria and Kenya, where residential properties in major cities offer 20-30% discounts to replacement cost. Due diligence processes typically require 3-6 months, with legal frameworks varying significantly across regions. Local partnerships prove essential for navigating regulatory environments and identifying off-market opportunities.

Recommendation

Strong Buy for qualified investors with 5+ year horizons. Allocate 15-25% of international portfolio to emerging markets, with emphasis on Southeast Asia (40%), Latin America (35%), and Africa (25%). Focus on gateway cities with established infrastructure and transparent legal frameworks. Implement currency hedging strategies and partner with local operators with proven track records. Monitor political developments closely and maintain flexible exit strategies.