Global Housing Affordability Crisis 2024: Analyzing the Severe Market Challenges

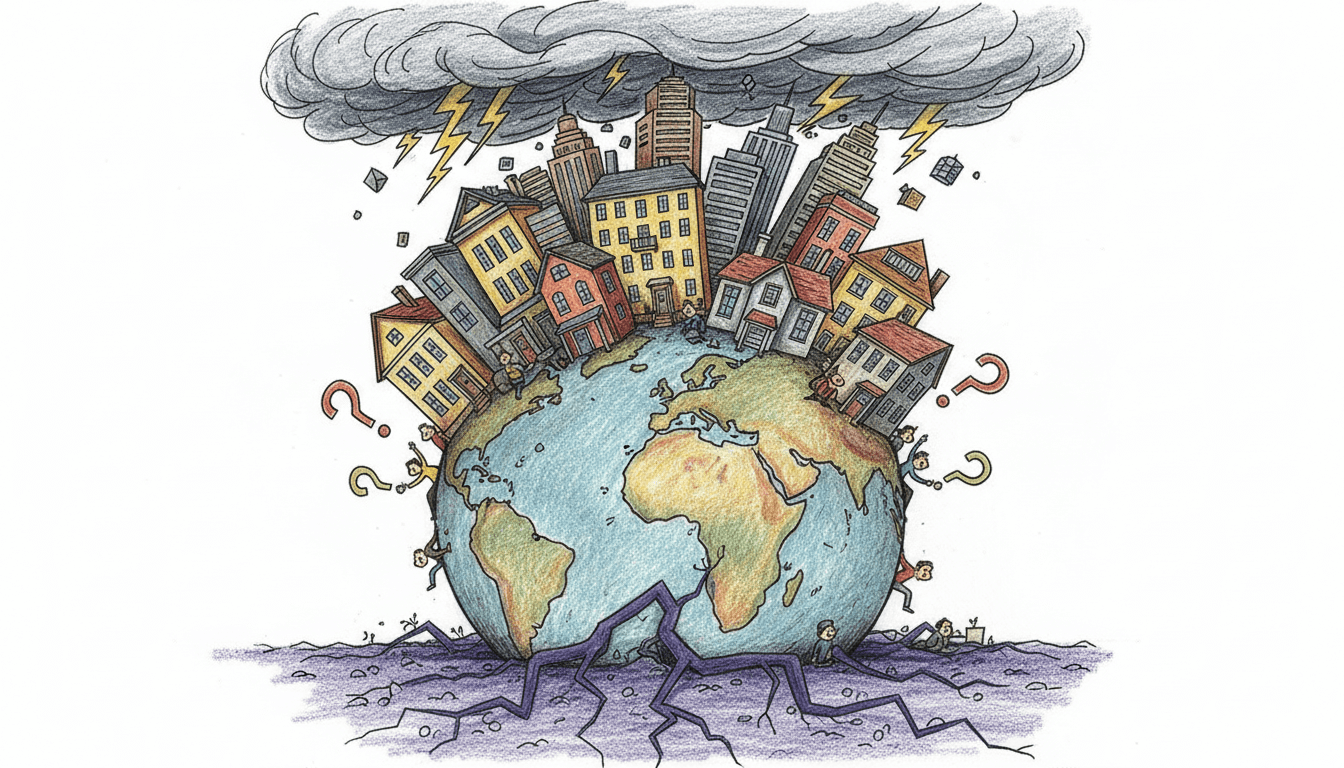

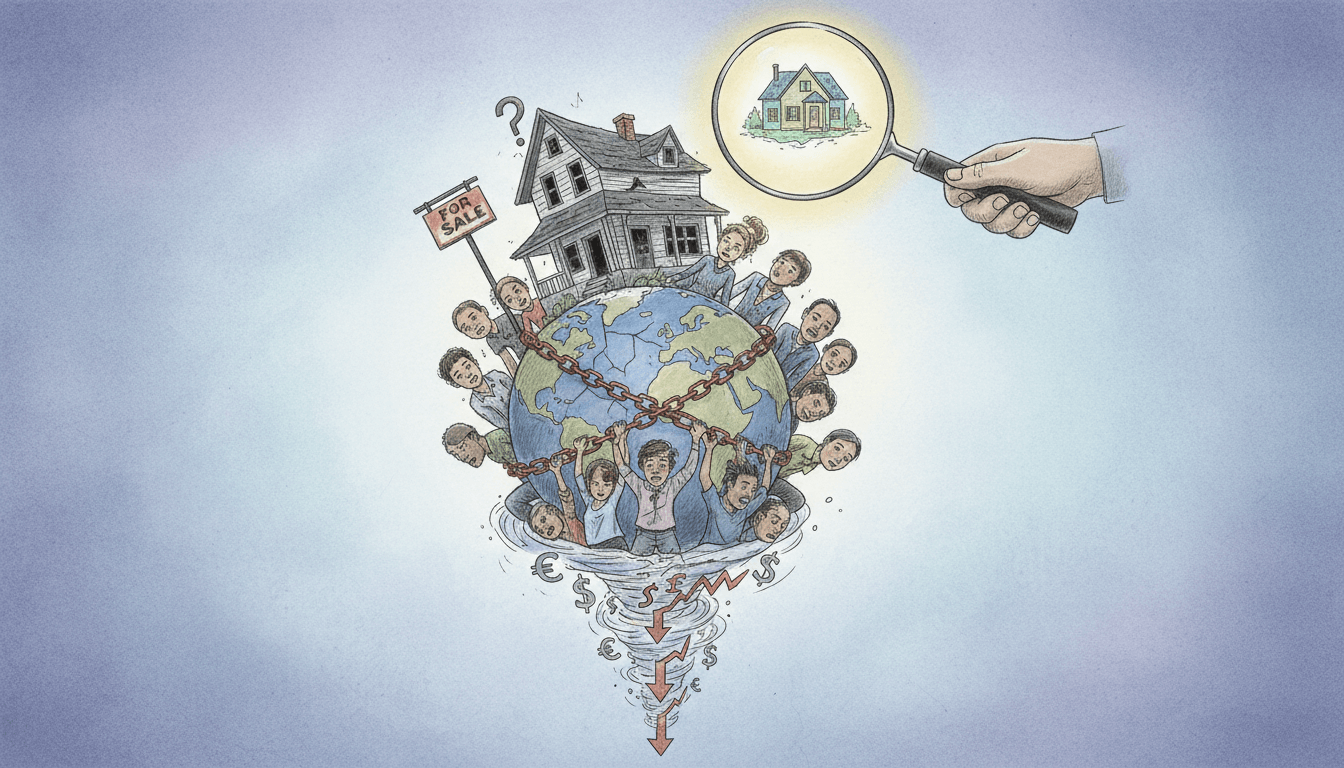

The 2024 global housing market faces an unprecedented affordability crisis, particularly impacting middle-class households. Restrictive land use policies and urban containment strategies have severely constrained housing supply, driving dramatic price increases. Markets like Hong Kong (median multiple 16.7), Vancouver (12.3), Sydney, San Jose, and Los Angeles rank as most unaffordable. The growing disparity between housing prices and incomes presents significant challenges for buyers and investors worldwide, requiring urgent policy interventions and strategic market approaches.

Pros

- Strong investment potential in affordable secondary markets

- Government initiatives emerging to address supply constraints

- Technology enabling remote work and geographic flexibility

- Long-term appreciation potential in well-located properties

- Diversification opportunities across global markets

Cons

- Hong Kong's median multiple of 16.7 indicates extreme unaffordability

- Vancouver's 12.3 median multiple prices out middle-income buyers

- Sydney's market shows severe affordability constraints

- San Jose and Los Angeles demonstrate critical California challenges

- Growing income-housing price disparity worsening annually

Our Analysis

The 2024 housing affordability crisis represents a systemic global challenge requiring comprehensive analysis. According to the Demographia International Housing Affordability Report 2024, restrictive land use policies have created artificial housing supply constraints, particularly in urban containment areas. Urban containment strategies, while intended to manage growth, have significantly contributed to price inflation by limiting developable land. The median multiple metric (house price divided by gross annual household income) reveals alarming trends, with Hong Kong leading at 16.7 times annual income, far exceeding the 3.0 times benchmark for affordability. Vancouver follows at 12.3, while Australian and Canadian markets show particularly severe conditions. The crisis disproportionately affects middle-class households, with housing costs consuming unprecedented portions of disposable income. Regional variations remain significant, with some secondary markets maintaining relative affordability while major metropolitan centers experience extreme pressure. Policy interventions must address both supply constraints and demand-side factors to achieve sustainable market balance.

Recommendation

Investors should prioritize markets with balanced regulatory environments and avoid severely unaffordable markets unless significant policy changes occur. Consider secondary cities with growth potential and diversified economic bases. Monitor government initiatives addressing housing supply constraints and support policies promoting density and mixed-use development. For homebuyers, explore alternative locations with commuting feasibility and assess long-term affordability against income projections. The current crisis requires strategic patience and careful market selection.