Top Countries for Foreign Property Buyers: A Comprehensive Global Investment Guide

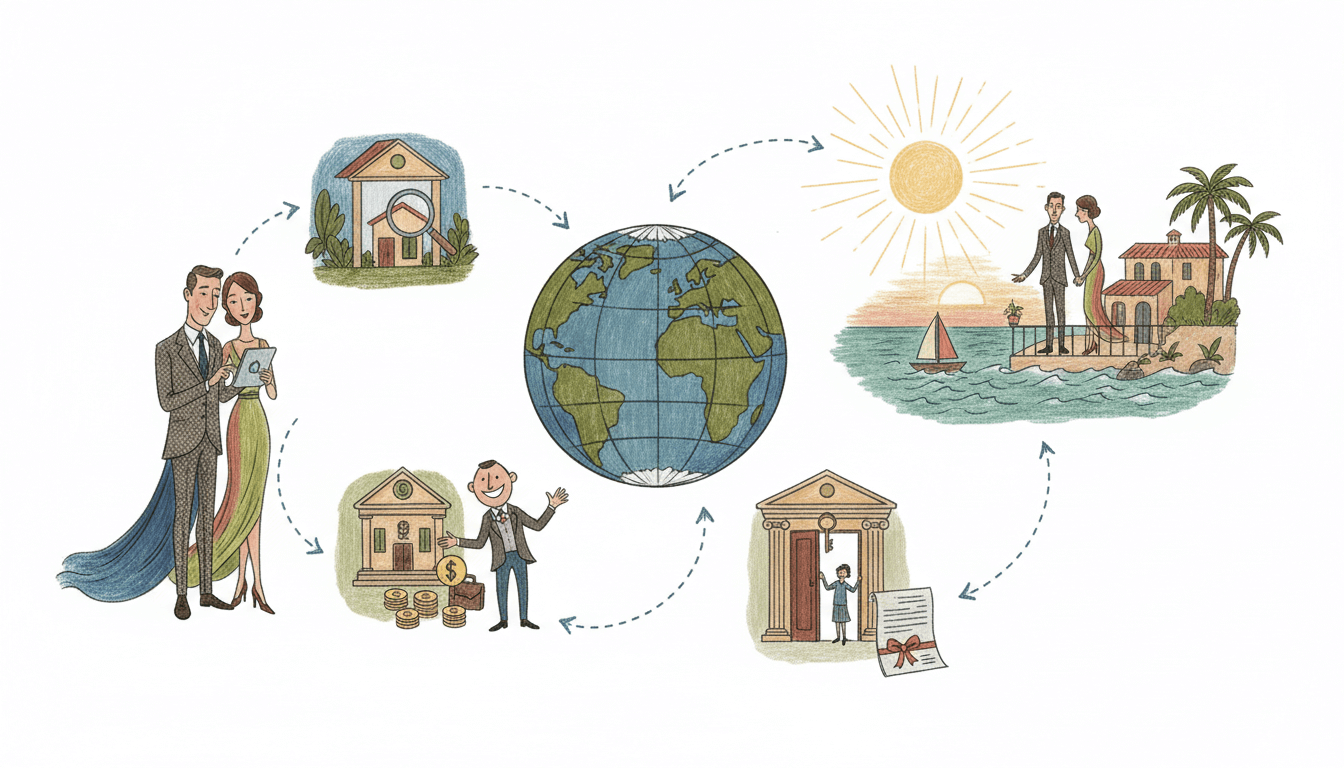

This in-depth analysis examines the most accessible and attractive countries for international real estate investors, focusing on Portugal, Spain, New Zealand, Costa Rica, and Dominican Republic. The guide details each country's unique advantages including Portugal's Golden Visa Program, Spain's transparent real estate market, New Zealand's seamless purchasing process, Costa Rica's welcoming environment for expatriates, and Dominican Republic's affordable investment opportunities. Based on the International Property Investment Report, this comprehensive overview provides specific legal frameworks, investment requirements, and practical considerations for foreign buyers seeking global property diversification.

The global real estate market presents unprecedented opportunities for foreign property buyers seeking diversification, residency benefits, and investment returns. According to the International Property Investment Report, countries like Portugal, Spain, New Zealand, Costa Rica, and Dominican Republic have emerged as premier destinations due to their favorable legal frameworks, transparent markets, and attractive residency programs. This comprehensive guide examines each country's unique advantages, including Portugal's renowned Golden Visa Program, Spain's well-regulated property market, New Zealand's streamlined purchasing process, Costa Rica's expatriate-friendly environment, and Dominican Republic's affordable investment landscape. Understanding these markets' specific requirements, legal considerations, and investment potential is crucial for making informed international property decisions.

Portugal: The Golden Visa Pioneer

Portugal stands as a premier destination for foreign property buyers, primarily due to its innovative Golden Visa Program. This residency-by-investment scheme requires a minimum investment of €500,000 in real estate (reduced to €400,000 in low-density areas) and offers numerous benefits including visa-free travel within Schengen Area, family inclusion, and a pathway to citizenship after five years. The Portuguese property market has shown consistent growth with Lisbon and Porto experiencing 7-9% annual appreciation rates. Foreign buyers benefit from clear property rights, a stable legal system, and a welcoming environment for international investors. Additional advantages include attractive tax regimes for non-habitual residents and a thriving rental market driven by tourism. The country's diverse property options range from historic city centers to coastal villas, catering to various investment strategies from luxury residences to commercial developments.

Spain: Transparent Market with Mediterranean Appeal

Spain's real estate market offers foreign buyers exceptional transparency and legal security, with established property registration systems and comprehensive consumer protection laws. The country attracts international investors through its diverse property portfolio including coastal resorts, urban apartments, and rural estates. Major markets like Barcelona, Madrid, and Costa del Sol have demonstrated resilience with 5-7% annual growth. Foreign investors benefit from straightforward purchasing processes, with non-residents typically requiring a Spanish tax identification number (NIE) and facing similar ownership rights as Spanish citizens. The market's transparency is reinforced by regulated real estate agencies, mandatory property registries, and clear title transfer procedures. Spain's appeal extends beyond investment returns to include quality of life, healthcare infrastructure, and cultural richness, making it particularly attractive for retirement and second-home buyers from Northern Europe and beyond.

New Zealand: Streamlined Process for International Buyers

New Zealand offers one of the most seamless property acquisition processes for qualified foreign buyers, despite recent regulatory changes through the Overseas Investment Act. The country's transparent legal system and English-speaking environment make it particularly accessible for international investors. Key markets in Auckland, Wellington, and Queenstown have shown strong performance with median prices exceeding NZ$1 million in premium locations. The purchasing process typically involves conditional offers, due diligence periods, and settlement within 4-6 weeks. Foreign buyers must obtain consent from the Overseas Investment Office for sensitive land or significant business assets, but residential investments meeting specific criteria can proceed efficiently. New Zealand's stable economy, political environment, and property rights protection create a secure investment landscape, while its natural beauty and lifestyle appeal continue to attract global interest despite more restrictive foreign ownership policies implemented in recent years.

Emerging Markets: Costa Rica and Dominican Republic

Costa Rica and Dominican Republic represent compelling emerging markets for foreign property investors seeking affordability and growth potential. Costa Rica's established expatriate community and stable democracy create a welcoming environment, with property values in prime Guanacaste and Central Valley locations appreciating 4-6% annually. The country's residency programs, including pensionado and rentista categories, offer accessible pathways for long-term stays. Dominican Republic provides exceptional value with beachfront properties available from $150,000 and a straightforward titling process through the National Title Office. Both countries offer favorable tax environments for foreign investors and growing tourism infrastructure supporting rental income potential. While due diligence is essential regarding local regulations and title verification, these markets present opportunities for investors seeking Caribbean lifestyle combined with investment returns in developing markets with increasing international appeal.

Key Takeaways

- Portugal's Golden Visa Program remains the most attractive residency-by-investment scheme in Europe

- Spain offers exceptional market transparency and legal security for international buyers

- New Zealand provides streamlined processes despite increased foreign investment regulations

- Emerging markets like Costa Rica and Dominican Republic offer affordable entry points with growth potential

- Comprehensive due diligence and local legal counsel are essential across all international markets

Frequently Asked Questions

What are the main benefits of Portugal's Golden Visa Program?

Portugal's Golden Visa Program offers residency rights, Schengen Area visa-free travel, family inclusion, and a pathway to citizenship after five years, with real estate investments starting at €500,000 (€400,000 in low-density areas).

Can foreign buyers obtain financing for Spanish properties?

Yes, foreign buyers can secure financing from Spanish banks typically requiring 30-40% down payment, proof of income, and comprehensive property valuation, though terms may be less favorable than for residents.

What restrictions do foreign buyers face in New Zealand?

New Zealand requires Overseas Investment Office consent for sensitive land and significant business assets, with residential purchases generally restricted to new developments or specific exemption categories under the Overseas Investment Act.

How does property ownership work in Costa Rica for foreigners?

Foreigners enjoy the same property rights as Costa Rican citizens, with condominium and corporate ownership structures available, though beachfront properties within the maritime zone have specific restrictions requiring careful legal review.

Conclusion

The global landscape for foreign property buyers continues to evolve, with Portugal, Spain, New Zealand, Costa Rica, and Dominican Republic representing diverse but equally compelling opportunities. Portugal's Golden Visa Program stands out for residency benefits, while Spain offers market maturity and transparency. New Zealand provides a streamlined process in a stable English-speaking environment, and emerging markets like Costa Rica and Dominican Republic deliver affordability and growth potential. Successful international property investment requires thorough research, understanding of local regulations, and professional legal guidance. As global mobility increases and investors seek diversification, these markets offer unique combinations of financial returns, lifestyle benefits, and long-term value appreciation for discerning international buyers.